Ariel Helwani confirms Edge will not appear in John Cena’s farewell matches, with AEW’s Tony Khan clarifying why the long-rumoured reunion was never in WWE’s plans.

Author: admin

This week marks a year of negotiations over an elusive deal. Teachers are seeking salary and health and welfare increases. But district officials say they have to balance demands with the broader stability of the district.

The Bangor area had three teams in that shined on the gridiron this fall but fell short in their state title games over the weekend.

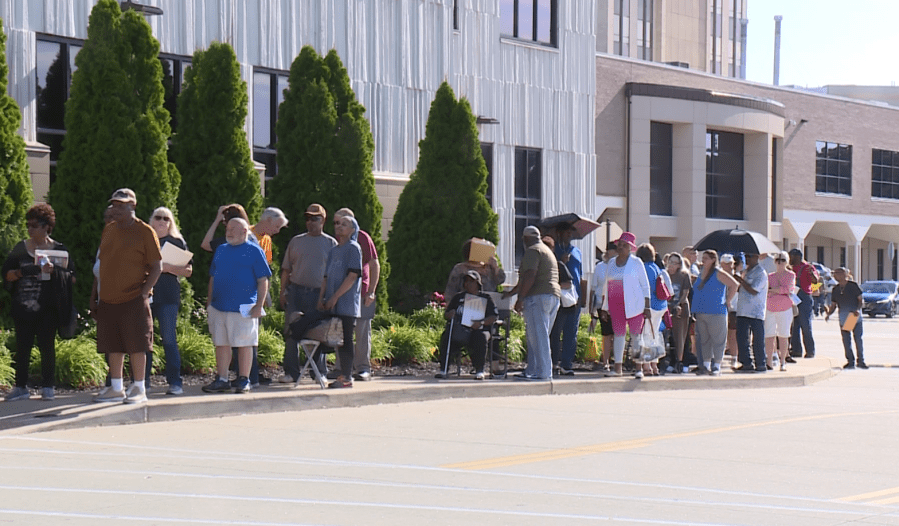

St. Louis County is considering moving its government headquarters from Downtown Clayton to a former shopping mall in St. Ann.

Google’s versatile Sans Flex font is now free to the public

Help us track trends in the home insurance market by filling out this survey.

WASHINGTON — The House voted overwhelmingly in favor of a bill Tuesday to force the Justice Department to publicly release its files on the convicted sex offender Jeffrey Epstein, a

With quarterfinal wins, the Comets and Cavaliers could meet in the state semifinal at the Monument Summit Arena no less.

Cam Skattebo made it clear on Tuesday that he won’t apologize for how he’s choosing to spend his time while recovering from a season-ending injury.

State media and the Health Ministry in Lebanon say that an Israeli airstrike on a Palestinian refugee camp in southern Lebanon has killed 11 people and wounded four. State-run National News Agency reported that the drone strike hit a car in the parking lot of a mosque in the Ein el-Hilweh refugee camp on the outskirts of Sidon. The Health Ministry said 11 people were killed and four wounded in the airstrike, without giving further details. The Israeli military said it struck a training center for Hamas, saying that the site was being used to prepare an attack against the Israeli army.