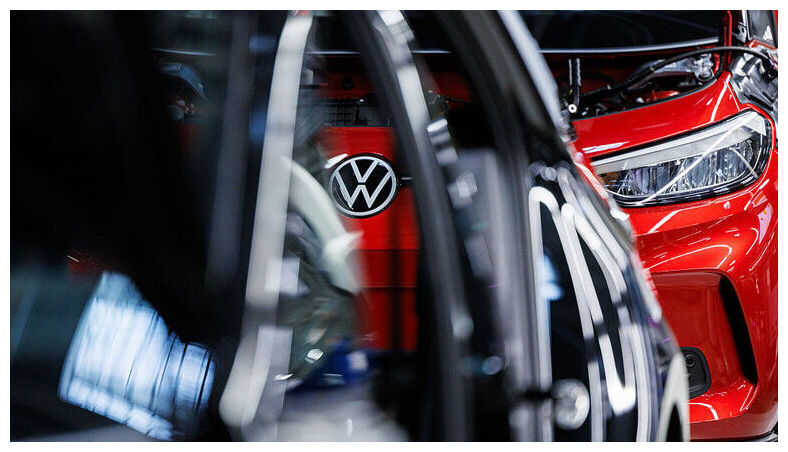

The German automaker reportedly lacks €11 billion needed to fund next year’s operations and investments. Germany’s largest carmaker, Volkswagen Group, is facing a potential financial crisis, with a multi-billion-euro cash-flow gap expected in 2026, Bild has reported, citing internal company figures. The German auto giant will be about €11 billion short next year, leaving it unable to fund planned spending and investments, according to the newspaper. Volkswagen’s half-year report for 2025 showed operating profit down 33% from a year earlier and a negative cash flow of €1.4 billion. A slump in profits, weak business in China and competition from Chinese brands, as well as the tariffs imposed by US President Donald Trump have been blamed for the company’s financial woes.

Category: economy

U. S. President Donald Trump’s declaration of 100% tariffs on Chinese imports sent shockwaves through global markets, and crypto was no [.] The post Crypto Market Proves Its Strength After Major Selloff, Analysts Say appeared first on Coindoo.

Key Takeaways Are institutions still bullish on Bitcoin’s future? Nearly 67% expect BTC prices to rise through 2026. Is Bitcoin still in an accumulation phase? Whales and long-term holders conThe post Big money backs Bitcoin through 2026 but the market is split today appeared first on AMBCrypto.

Charter Communications, Inc. (NASDAQ: CHTR) is one of the 11 Dirt Cheap Stocks to Buy According to Analysts. On October 3, KeyBanc Capital Markets lowered its price target on Charter Communications, Inc. (NASDAQ: CHTR) from $500 to $430 and kept an Overweight rating. KeyBanc expects Charter Communications, Inc. (NASDAQ: CHTR) to have weaker broadband subscriber numbers in Q3 [.].

CoreCivic, Inc. (NYSE: CXW) is one of the best small cap stocks with the highest upside. CoreCivic, Inc. (NYSE: CXW) reported on October 2 that it will announce its fiscal Q3 2025 results on November 5, after the market closes. Ahead of earnings, Noble Financial analyst Joe Gomes reiterated a bullish stance on CoreCivic, Inc. (NYSE: CXW) on [.].

The nation’s mom-and-pop investors are piling into risky assets as they try to build enough wealth to buy a home.

TLDRs: Nexperia China tells staff to prioritize local management over Dutch HQ orders amid tension. Dutch emergency law seizure targets only the parent company, not China-based subsidiaries. China’s export restrictions block Dutch oversight, keeping Dongguan operations largely independent. Rivals may exploit supply concerns, targeting Nexperia’s high-volume automotive chip production. Nexperia China has instructed its employees [.] The post Dutch Seizure of Nexperia Sparks Corporate Stand-Off in China appeared first on CoinCentral.

Certain rate environments can make annuities more rewarding, but the timing isn’t the only factor to weigh.

Kalmar julkaisee tammi-syyskuun 2025 osavuosikatsauksen perjantaina 31.10.2025