Centrism seems to have triumphed in the Netherlands after a nail-biter election between the political middle and the right-wing. Rob Jetten, leader of the centrist Democrats 66 party, declared victory on Friday after the pro-European Union faction tripled its seats and took a surprising bite out of the right-wing Party for Freedom (PVV). “We are [.].

Category: economy

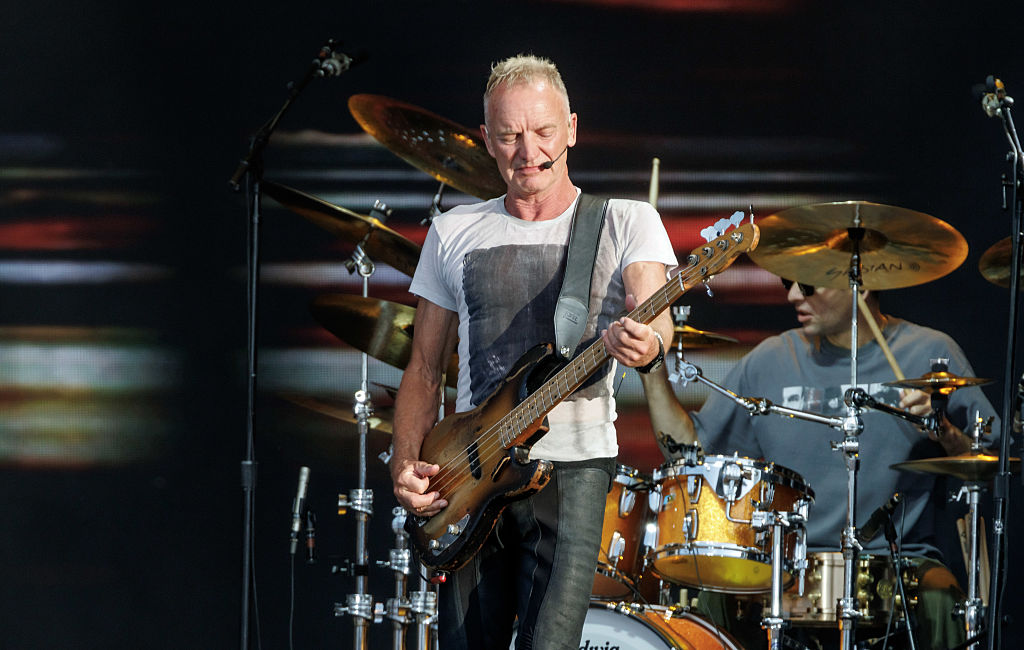

Sting will headline a Super Bowl-branded concert at the Palace of Fine Arts in San Francisco on Feb. 6, two days ahead of the Super Bowl.

Jake Paul spoke with Fox News Digital about his upcoming bout against Tank Davis, legal threats against critics, and his engagement to someone with similar athletic goals.

At least six persons died in separate rain-related incidents after heavy rains lashed different parts of Telangana due to the impact of Cyclone ‘Montha’ on October 29, police and district officials said on Friday. A husband and wife were washed away while trying to cross an overflowing stream on a two-wheeler in Siddipet district and their bodies were traced on Friday, police said. In other incidents, a man died when a road-side tree uprooted and fell on him while riding a bike in Suryapet district and an elderly woman died in a wall collapse incident in Mahabubabad district. A man in his mid 60s, who was bed-ridden, died when flood water entered his house in Warangal, officials further said. There were some more incidents wherein people went missing after getting swept away in floodwaters Heavy rains on October 29 led to waterlogging of roads and inundation of low-lying areas at several places in Warangal, Hanamakonda, Mahabubabad, Karimnagar, Khammam, Bhadradri Kothagudem,…

With the World Series pressure at its peak, individual matchups start to matter just as much as the final score, and that’s where prop bets can offer real value.

President Donald Trump’s frequent attacks on Rep. Jasmine Crockett (R-TX) reflect his growing fear of the Democratic lawmaker at least according to Crockett whose clashes with right-wing media and lawmakers have helped propel her onto the national stage.“I process [attacks from Trump and right-wing media] as they believe that I’m a threat,” Crockett told Politico. “Listen, you’re not talking about anybody who’s not relevant. That’s just the reality. No one is wasting capital on anyone that is not relevant.”While Trump is known for frequently lashing out at Democratic lawmakers, Crockett has been among the most frequent targets for his attacks. He’s called her a “lowlife,” a “very low-IQ person,” and compared her unfavorably to Rep. Alexandria Ocasio Cortez (D-NY), “only slightly dumber.”But for Crockett, Trump’s attacks are an admission that he saw her as a growing threat, and one he lashed out at frequently as a means to “thwart before they rise too much.”“I think that personally they are threatened. When you look at AOC, AOC is the highest-fundraising member in the U. S. House, period. Above Democrats, Republicans, that is number one,” Crockett said.“When you look at the crowds that she garners, when she goes out, that’s a scary thing for him, right? And a lot of the people that I believe that he wants to appeal to, AOC is one of the few people that can actually break through. I would argue that as much as I go against him, I would imagine that I get some of those folk too.”For her part, Crockett has not held back in returning jabs at Trump. After being called a “low IQ person,” Crockett fired back by noting that Trump “sure [does] have my name in your mouth a lot,” and that his attacks were proof that he was “terrified of smart, bold Black women telling the truth and holding you accountable.”.

That should be all the information you need to solve for the Be tardy crossword clue! Be sure to check more clues on our Crossword Answers. The post Be tardy Crossword Clue appeared first on Try Hard Guides.

No need to wait until Black Friday to get one of the best foldables around at a new record low price with no strings attached!.

Zach Pandl, head of research at Grayscale Investments, believes Solana exchange-traded funds (ETFs) could soon rival the success of Bitcoin and Ethereum investment products. He expects that within one to two years, about 5% of all Solana tokens could be held in regulated exchange-traded structures, a share worth over $5 billion at today’s prices. Visit Website.

In nominating Maine native Joshua Dunlap for the U. S. Court of Appeals for the First Circuit, Sen. Susan Collins has made an outstanding choice. As Josh’s former law partner, I know first-hand of his superb qualifications: his intelligence, thoughtfulness, humility and love of the law and the constitution are exceptional. He will work vigorously for the impartial [.].