The ‘Church on the Hill’ still stands in Brunswick today

Category: general

Could Purdy and Pearsall return to the field in Week 11? The post 49ers’ Kyle Shanahan Gives Latest Update on Brock Purdy & Ricky Pearsall Injuries appeared first on Heavy Sports.

General Hospital (GH) recap for Wednesday, November 12, reveals that Professor Henry “Hank” Dalton (Daniel Goddard) busted Rocco Falconeri (Finn Carr) in the lab as Danny Morgan (Asher Antonyzyn) and Charlotte Cassadine’s (Bluesy Burke) panicked. After Brook Lynn Quartermaine (Amanda Setton) showed up with Harrison Chase (Josh Swickard) and Jason Morgan (Steve Burton), she wanted to know if Ned Quartermaine . Keep Reading.

“Batgirl” and “Orange Is the New Black” actor Ruby Rose has taken to Threads to slam Sydney Sweeney as a “cretin” following the release of “Christy,” Sweeney’s biopic on the wrestler Christy Martin that disappointed in its box office debut with just $1. 3 million. The drama opened in more than 2, 000 theaters in North America [.].

One of fiercest rivalries in MLB, the LA Dodgers and San Diego Padres compete for supremacy in the NL West every season.

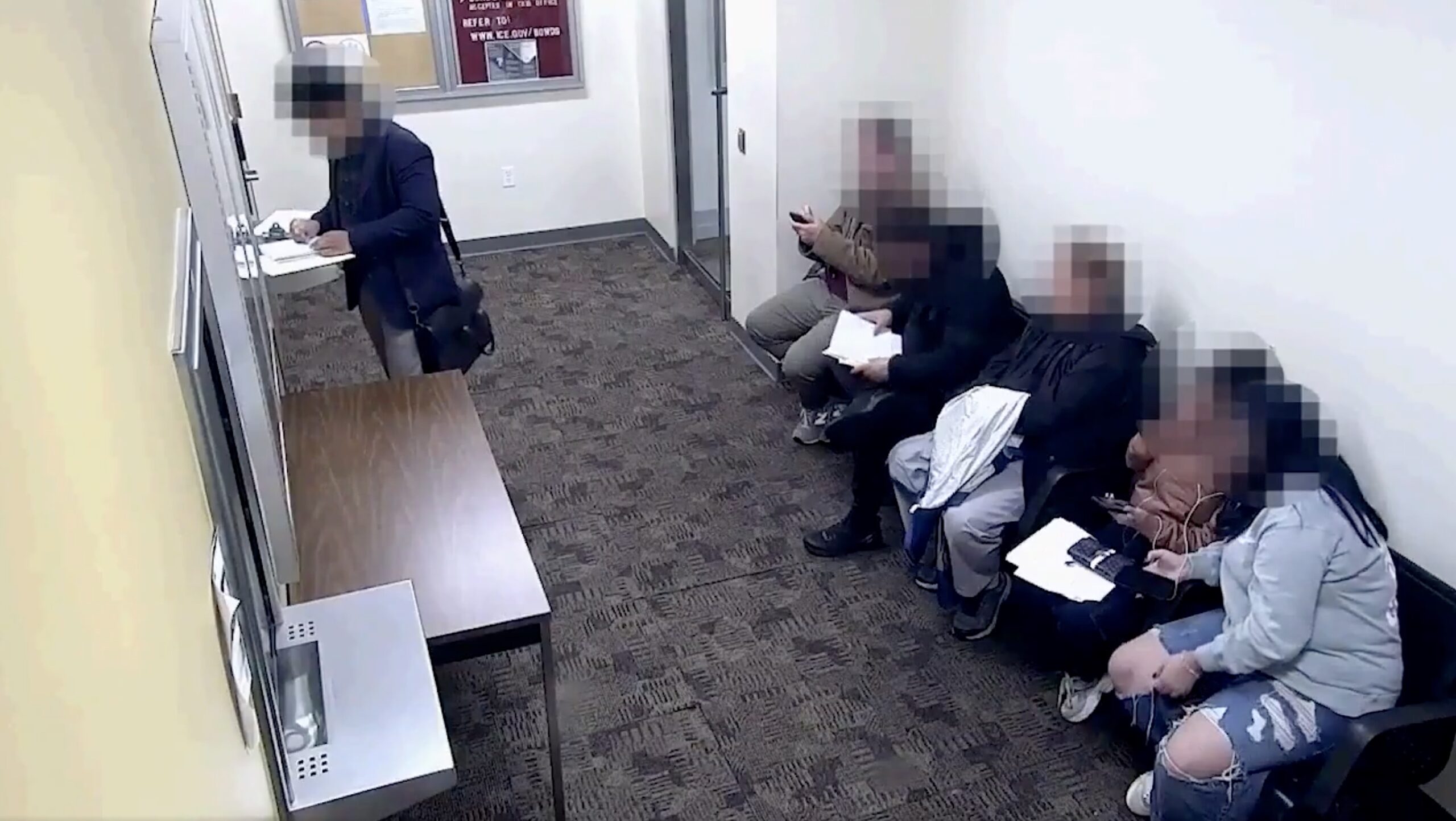

Louis, Illinois. The Department of Homeland Security is demanding answers after Duckworth’s staffer, Edward York, misrepresented himself to federal agents as legal counsel for Jose Ismeal Ayuzo Sandoval, a four-time deported illegal alien with a prior DUI conviction. According to a letter from the DHS, York entered the ICE facility.

Torn Light Records moved from Cincinnati to Chicago’s Bucktown neighborhood in June 2024 and quickly established itself as one of our city’s premier record stores. But in early October, broken plumbing in the unit above Torn Light flooded the shop four times in a 48-hour period, forcing owners Alex York and Dan Buckley to temporarily [.] The post Torn Light Records reopens after a month of mopping up appeared first on Chicago Reader.

The post Skims hits $5 billion valuation after funding round led by Goldman appeared com. Skims underwear is displayed on a shelf at a Nordstrom store on March 25, 2025 in Corte Madera, California. Justin Sullivan | Getty Images Kim Kardashian’s Skims brand has raised $225 million in new funding led by Goldman Sachs Alternatives, valuing the shapewear and apparel company at $5 billion up from roughly $4 billion after its 2023 round. The deal comes as Skims nears $1 billion in annual net sales, six years after its 2019 launch, and marks one of the largest private raises for a U. S. consumer brand this year. BDT & MSD Partners’ affiliated funds also joined the round, Skims said Wednesday. Skims plans to use the new capital to accelerate brick-and-mortar and international expansion, as well as product innovation and category diversification. The company has 18 stores across the U. S. in cities including New York, Los Angeles, Austin and Atlanta and one in Mexico, with plans to open additional stores overseas in 2026. Skims said it’s laying the groundwork to become a “predominantly physical business” in the coming years, a pivot for a company that built its reputation as a digital-first direct-to-consumer brand. “This milestone reflects continued confidence in our long-term vision and coupled with disciplined execution, positions Skims to unlock its next phase of growth,” CEO and co-founder Jens Grede said in a statement. The new funding follows the debut of NikeSkims, a partnership with Nike that launched earlier this year and sold out within hours. The collaboration signals Skims’ ambitions to scale beyond its core shapewear products and into activewear, apparel and performance categories, pushing the brand further into the mainstream athleticwear market dominated by Lululemon, a handful of upstarts and Nike itself. The new capital infusion could further delay an IPO from Skims. The company has been eyeing a public debut since at.