Pastel colors can provide softness and neutrality to nearly any room of the home. From living spaces to dining areas and bedrooms, these soothing colors can also bring a sense of lightness and serenity. Looking for ways to infuse pastels into your home? Here are some top tips. 1. Balance with neutrals. Pair pastel colors with neutral colors such as white, cream or gray for a fresh, modern.

Category: general

The post Strategy’s Bitcoin Buying Slows, Analysts See Potential for Renewed Momentum appeared com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → MicroStrategy’s Bitcoin accumulation has slowed after two years of aggressive buying, with its market premium thinning to 1. 2x amid BTC consolidation at $110,000. However, analysts view this as a temporary pause, not a halt, emphasizing the company’s robust model for converting capital into Bitcoin exposure and projecting yields up to 30%. MicroStrategy holds over 640, 000 BTC, representing about 3% of global supply, supporting sustained growth potential. The slowdown reflects market timing rather than flaws in the firm’s Bitcoin strategy, with shares rising 5% recently on recovery optimism. A new B- rating from S&P opens access to a $4. 9 trillion credit pool, potentially tripling funding for further Bitcoin acquisitions, per TD Cowen analysis. Explore how MicroStrategy’s Bitcoin engine slows but remains primed for growth. Analysts bullish on yields and credit access amid BTC at $110,000-discover key insights and projections for 2025 investors now. What is MicroStrategy’s Current Bitcoin Accumulation Pace? MicroStrategy’s Bitcoin accumulation has notably decelerated following two years of steady increases, with recent quarterly data showing a reduced pace of purchases. The company’s market premium to net asset value.

The post Bitwise’s NYSE Listing Update Hints XRP ETF Approval Could Arrive Within 20 Days appeared first from Bitwise could soon become a reality. Bitwise, the $15 billion asset management giant, has just submitted Amendment No. 4 to its XRP ETF filing with the U. S. Securities and Exchange Commission (SEC), revealing two crucial details. Experts believe such updates usually signal the final step before approval. If cleared.

The post Virtuals Protocol Price Surges Past $1. 79 As Traders Eye $1. 90 Breakout appeared first The price soared 35. 8% in the past 24 hours, zooming past short-term resistance and adding to a week of powerful gains. Traders and investors are buzzing on social media, urged by news of x402 protocol integration with Coinbase’s AI payment standards.

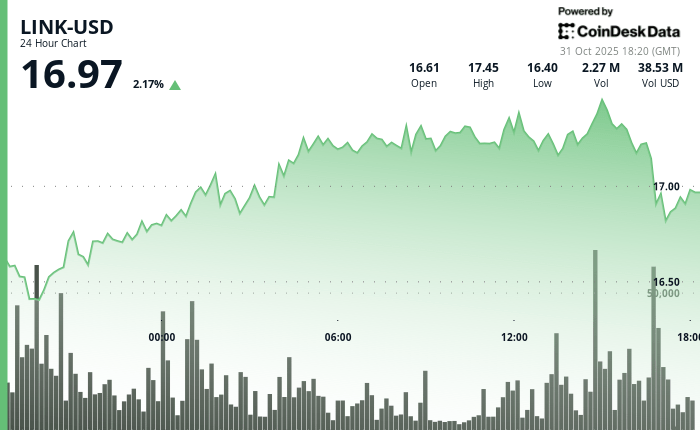

The post Modest Bounce as Stellar Integraticom. The native token of oracle network Chainlink LINK$17. 15 bounced 3. 6% on Friday, reversing some of Thursday’s losses as traders stepped in around key support level. LINK briefly cleared the $17 level with a surge in trading volume some 3 million tokens changed hands during a morning breakout up -, pointing to renewed accumulation, CoinDesk Research’s market insight tool suggested. However, weakness during the U. S. trading hours drove LINK back below $17. Recently, the token traded at $16. 96. On the news front, payments-focused Stellar (XLM) announced to integrate Chainlink’s Cross-Chain Interoperability Protocol (CCIP), Data Feeds, and Data Streams. The move enables developers and institutions building on Stellar to access real-time data and trusted cross-chain infrastructure for tokenized assets. With over $5. 4 billion in quarterly RWA volume and a fast-growing DeFi footprint, Stellar’s adoption of Chainlink tooling signals expanding demand for secure, interoperable financial infrastructure. Key technical levels to watch: LINK now holds near-term support at $16. 37 with upside targets at $17. 46 and $18. 00. Whether the token can build on Friday’s rebound may depend on broader market flows and follow-through from dip-buying. Support/Resistance: Solid support holds at $16. 37 after multiple successful tests, while $17. 46 resistance shows repeated rejection patterns. Volume Analysis: 78% volume surge during breakout attempt confirms institutional interest, explosive selling volume indicates position rebalancing. Chart Patterns: Late-session flush-out pattern creates classic oversold setup for accumulation strategies. Targets & Risk/Reward: Holding above $16. 89 targets $17. 46 retest with upside to $18. 00, downside risk limited to $16. 37 support. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. Source:.

Deadbeat dad admits to stealing $10K from 4-year-old’s savings to fund luxury trips: ‘He won’t know’

Deadbeat dad admits to stealing $10K from 4-year-old’s savings to fund luxury trips: ‘He won’t know’

Falsehoods 7 Little Words Answer is. We hope this helped you to finish today’s 7 Little Words puzzle. You can find all of the answers for each day’s set of clues in the 7 Little Words section of our website. The post Falsehoods 7 Little Words Answer appeared first on Try Hard Guides.

Los Angeles Dodgers vencieron en el sexto juego de la Serie Mundial, gracias a otra gran salida del japonés Yoshinobu Yamamoto.

Charles Milton McPeters passed away on October 25, 2025, in St. Peters, Missouri. He is survived by his daughter Debra Meiners, son Jerry, son-in-law Mark Meiners, and grandchild Mason Meiners. Visitation will be held November 7 from 4: 00 p. m. to.