JBS N.V.: A Tricky Consumer Staples Company With A Significant Upside

Category: general

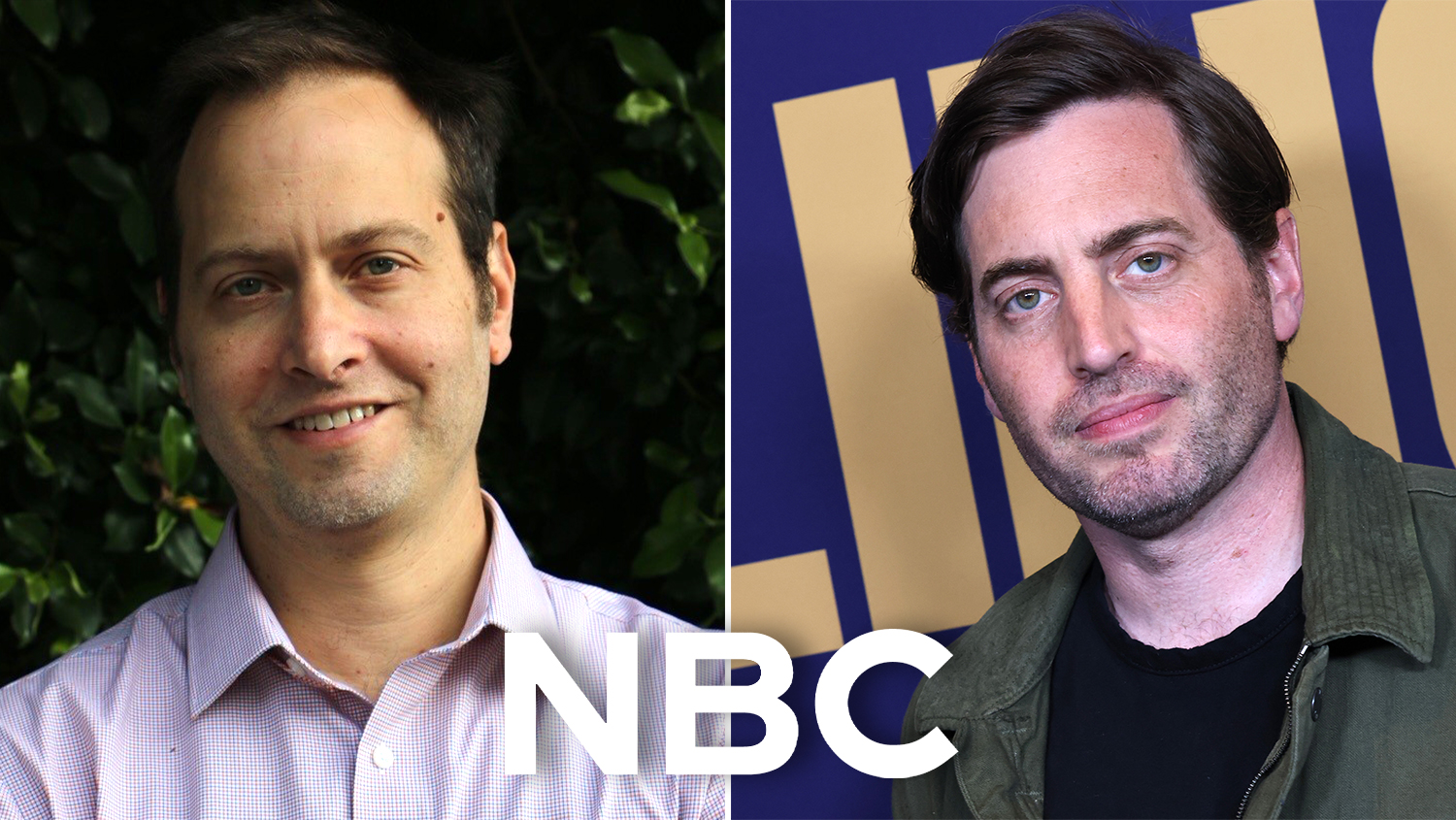

Dan Goor & Luke Del Tredici’s PI Comedy Takes Step Toward NBC Pilot Order With California Tax Credit

Already considered a sure thing for a pilot greenlight, NBC’s single-camera comedy from Brooklyn Nine-Nine co-creator/executive producer Dan Goor and executive producer Luke Del Tredici may have sealed the deal with a $1. 4M tax credit from the California Film Commission to shoot the pilot in Los Angeles. Described as one of the strongest comedy pitches [.].

Michelle Obama is the First Lady of Complaints News Staff Thu, 11/20/2025 08: 16 Image Crouere Crouere X Jeff Crouere jcrouere@gmail again with another grievance. In an interview to promote her new book, The Look, Mrs. Obama is complaining again. When asked about running for President, Obama claimed that Americans “aren’t ready for a woman President” and have “a lot of growing up to do.” Last year, Michelle Obama campaigned for Democratic presidential nominee Kamala Harris. During a speech in Michigan, Obama called Harris “extraordinary,” and wondered “why on earth is this race even close?” She also asked whether “as a country, are we ready for this moment?” These are absurd comments since two of the last three Democratic Party presidential nominees have been women. The stage is certainly set for the right female candidate to become President. This victorious female candidate who will make history will never be Michelle Obama. There are several reasons for this prediction, but, primarily, she has refused to display any appreciation for this great country or all the many benefits she received for being married to Barack Obama. Incredibly, Michelle Obama offers a steady stream of complaints about the American people and how she has been treated in her life. As First Lady, Obama said she was under a “particularly white-hot glare,” and grumbled that her family “didn’t get the grace that I think some other families have gotten.” Of course, that complaint is ludicrous because Barack and Michelle Obama were treated as royalty in America. They received fawning media coverage from the very beginning. Those who pushed too hard and asked tough questions were labeled “racists.” Yet, Michelle Obama claimed that the “we were all too aware that as a first Black couple, we couldn’t afford any missteps.” The Barack Obama presidency was nothing but a series of “missteps,” but he not only won reelection, but he also completed his two terms without any impeachment hearings. Barack Obama could have been impeached over any number of scandals in his presidency, such as the disastrous Benghazi attack on our consulate, or the “Fast and Furious” gun running operation or the Internal Revenue Service improperly targeting Tea Party organizations. Instead of impeachment, Barack Obama received a pass from Republicans in Congress, who were too timid to push for thorough investigations and feared being called “racists.” In contrast, President Donald Trump was impeached for a “perfect” phone call to Ukrainian President Zelensky and for a speech on January 6, 2021, in which he called for his supporters to “peacefully and patriotically make your voices heard” at the U. S. Capitol. Trump was not responsible for the violence on that day. Instead, he wanted more National Guard troops for protection, and his requests were denied. The President’s wonderful wife, First Lady Melania Trump, has also been mistreated. Despite her history as a world-renowned fashion model and being internationally recognized for her beauty and accomplishments, Mrs. Trump was never invited to be photographed for the cover of Vogue magazine. However, the perpetual complainer, Michelle Obama, graced the cover of Vogue three times. Not bad for someone who whined that she did not “get the grace” that other First Ladies received. Michelle Obama has been criticizing her country for years. In February 2008, as her husband was on the path to the presidency, she said that “for the first time in my adult lifetime I am really proud of my country.” Thus, she was only proud of America because her husband was succeeding politically. In 2019, at a leadership conference for the Obama Foundation in Malaysia, she said that the United States was “still not where we need to be. when it comes to race.” Even though her husband had been elected twice as President, Michelle Obama said, “People thought electing Barack Obama would end racism. That’s four hundred years of stuff that was going to be eliminated because of eight years of this kid from Hawaii. Are you kidding me?” The “kid from Hawaii” is a particular source of Michelle Obama’s complaints on her podcast that she hosts with her brother. She is often denigrating or ridiculing her husband on the show. This seems disrespectful for no one in America would know anything about Michelle Obama if not for the “kid from Hawaii.” Even though she is ungrateful, Barack Obama has been taking care of his wife for many years. After his political stock soared in his home state, then Illinois Governor Rod Blagojevich said he was asked to make phone calls to the University of Chicago Medical Center on behalf of Michelle Obama. She eventually was hired in 2002 and served in several roles, including Vice President for Community and External Affairs. In that position, she was paid $317,000 before taking a leave of absence to campaign for her husband. Among her responsibilities was “neighborhood outreach,” remarkably similar to her husband’s famous position as “community organizer.” Michelle Obama was paid very well for “neighborhood outreach,” and, despite her many complaints, has been treated very well by the country she seems to despise. Jeff Crouere is a native New Orleanian and is a political columnist, the author of America’s Last Chance, and provides regular commentaries on the Jeff Crouere YouTube channel and at Crouere. net. For more information, email him at jcrouere@gmail. com. Editorial Columns.

Christmas tree permits for the Umatilla, Wallowa-Whitman and Malheur national forests are now available to purchase.

The Paso Robles Recreation Services Department will offer two opportunities for community members to become certified in first aid, CPR, and the use of [.].

The report was delayed by the government shutdown, which has also interfered with data gathering in October.

Reuben Johnson, National Security Journal Russia is pushing hard on two fronts, driving toward Pokrovsk in Donetsk while probing thin Ukrainian lines in the south, especially in.

Max Verstappen has shared a concerning update about his physical state, which is being affected by the current generation of F1 cars.

Troy High School presents ‘Game of Tiaras’ on Friday and Saturday

After the Galaxy S25 and the Galaxy S24 series, Samsung is now rolling out the November 2025 security patch to its non-foldable flagship smartphone lineup from 2023, the Galaxy S23 series. It is 405. 75MB in size and carries firmware version S91xB0XM8EYK2. [.] The post Galaxy S23 gets the November 2025 security update appeared first on SamMobile.