Parenting is not a collaborative effort in which moms and dads give gentle guidance and suggestions while offering the child an opportunity to haggle over each.

Category: general

Our tips and tricks for Arc Raiders will help players handle players and drones alike

The new artificial intelligence model is the second the company has released this year. OpenAI and Anthropic made similar updates a few months ago.

The post Coinbase (COIN) Stock Price Prediction: 2025, 2026, 2030 by Rachel Lucio appeared first on Benzinga. Visit Benzinga to get more great content like this. Analysts are saying that Coinbase could hit $177 by 2030. Bullish on COIN? Invest in Coinbase on SoFi with no commissions. If it’s your first time signing up for SoFi, you’ll receive up to $1,000 in stock when you first fund your account. Plus, get a 1% bonus if you transfer your investments and keep . Continued The post Coinbase (COIN) Stock Price Prediction: 2025, 2026, 2030 by Rachel Lucio appeared first on Benzinga. Visit Benzinga to get more great content like this.

Tuesday could be the day America finally gets to see what the Epstein files reveal, and the anticipation is thick enough to cut with a knife. The House is scheduled to vote on the release, and the outcome is basically a foregone conclusion. Not only does Donald Trump back it, but the votes were already there before he chimed in. It’s only a matter of time.

Retailers are preparing for a holiday season clouded by tariffs, inflation and economic uncertainty.

HACK? (Main headline, 4th story, link) Related stories:INTERNET SUFFERS ANOTHER MASS OUTAGECLOUDFLARE DOWN’UNUSUAL’ SPIKE IN TRAFFIC

Another billion-dollar liquidation wave has hit crypto, driven by high leverage and shrinking liquidity. As cascading sell-offs become routine, traders face a market increasingly prone to violent swings. The post Crypto’s New Normal: Another $1 Billion Liquidation Day Shakes…

The post Mastercard Partners With Polygon to Expand Crypto Credential to Self-Custody Wallets appeared first on Coinpedia Fintech News Crypto payments with Mastercard are set for a major leap forward. The company has partnered with Mercuryo and Polygon Labs to bring the Mastercard Crypto Credential system to self-custody wallets. The goal is to simplify crypto transfers and make them more accessible, secure, and scalable for users. Read on to see how it works. Simplifying …

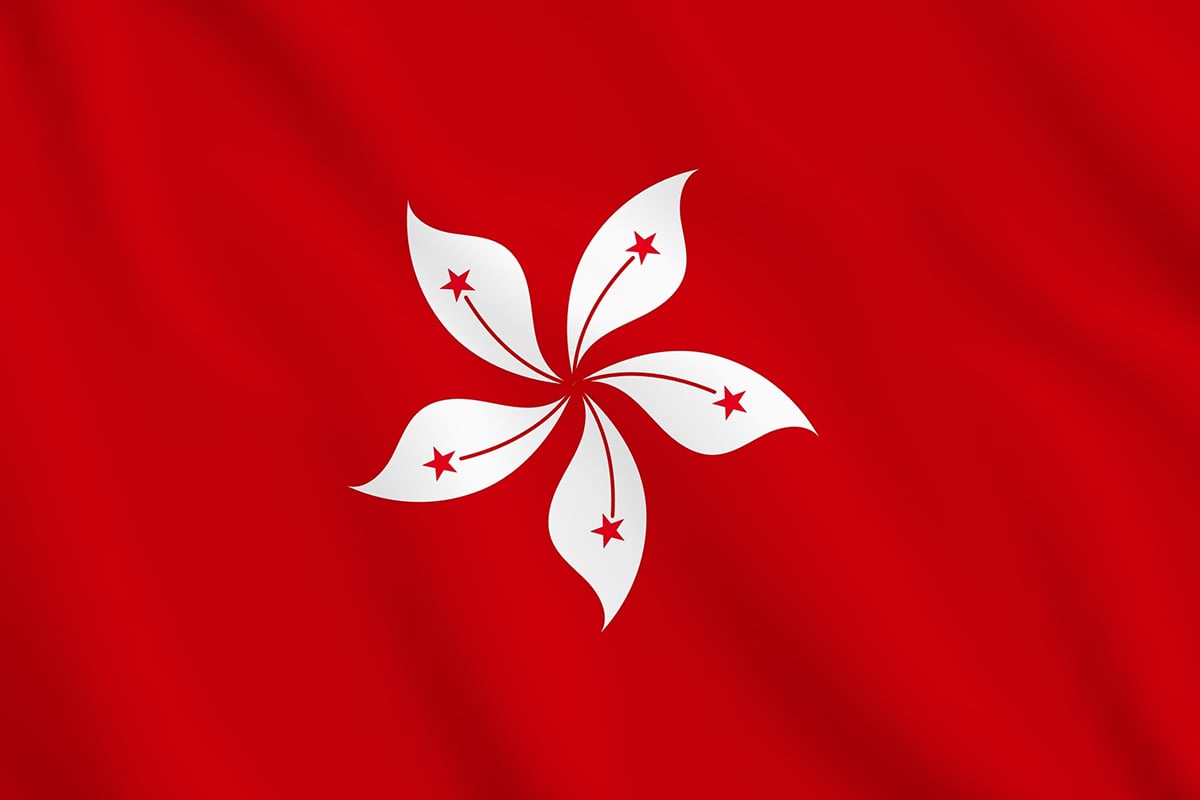

TLDR: AMINA HK gets SFC Type 1 license, leading crypto services in Hong Kong. AMINA offers 24/7 crypto trading and custody for professional clients in Hong Kong. AMINA’s crypto services set to meet growing demand in Hong Kong’s market. AMINA leads in Hong Kong with secure, regulated digital asset solutions. Hong Kong sees 233% crypto [.] The post AMINA Becomes First International Bank in Hong Kong to Offer Full Crypto Trading & Custody Services appeared first on CoinCentral.