Cricket legend and former Deccan Chargers keeper-batter Adam Gilchrist caught up with Rohit Sharma before the second ODI between India and Australia at the Adelaide Oval.

Category: international

Republican senators hope that President Trump can step in and help end the 22-day government shutdown by beginning talks with Democrats on enhanced health insurance premiums, which would give Democrats confidence about having a path to an eventual deal. Several Republican senators say it would be helpful if Trump were to become more involved in…

On Wednesday, October 22, the BCCI announced India A’s squad for the upcoming red-ball games against South Africa A. The A tour matches will be played ahead of the Proteas’ Test tour of India.

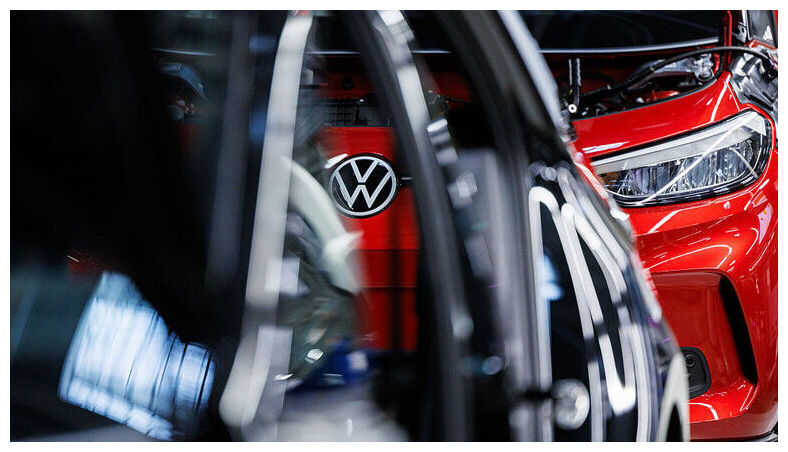

The German automaker reportedly lacks €11 billion needed to fund next year’s operations and investments. Germany’s largest carmaker, Volkswagen Group, is facing a potential financial crisis, with a multi-billion-euro cash-flow gap expected in 2026, Bild has reported, citing internal company figures. The German auto giant will be about €11 billion short next year, leaving it unable to fund planned spending and investments, according to the newspaper. Volkswagen’s half-year report for 2025 showed operating profit down 33% from a year earlier and a negative cash flow of €1.4 billion. A slump in profits, weak business in China and competition from Chinese brands, as well as the tariffs imposed by US President Donald Trump have been blamed for the company’s financial woes.

U. S. President Donald Trump’s declaration of 100% tariffs on Chinese imports sent shockwaves through global markets, and crypto was no [.] The post Crypto Market Proves Its Strength After Major Selloff, Analysts Say appeared first on Coindoo.

TLDRs: Nexperia China tells staff to prioritize local management over Dutch HQ orders amid tension. Dutch emergency law seizure targets only the parent company, not China-based subsidiaries. China’s export restrictions block Dutch oversight, keeping Dongguan operations largely independent. Rivals may exploit supply concerns, targeting Nexperia’s high-volume automotive chip production. Nexperia China has instructed its employees [.] The post Dutch Seizure of Nexperia Sparks Corporate Stand-Off in China appeared first on CoinCentral.

Kalmar julkaisee tammi-syyskuun 2025 osavuosikatsauksen perjantaina 31.10.2025

TLDR Tether invested 10. 7% in Juventus earlier this year and seeks board control. Tether nominates Zachary Lyons and Francesco Garino to Juventus’ board. Tether pushes for better governance and minority representation at Juventus. Juventus faces leadership changes after a financial fraud scandal in 2022. Tether, the issuer behind the stablecoin USDT, is looking to expand [.] The post Tether Nominates Executives to Juventus Board After Investment in Club appeared first on CoinCentral.