Source: Bloomberg, 6:19

Month: November 2025

The post USD/JPY consolidates around 153. 60 amid divergence BBH appeared com. USD/JPY remains around 153. 60 as Japan’s on-hold policy stance keeps the pair elevated despite yield-based valuation concerns, BBH FX analysts report. Japan official flags overstretched Yen vs. US yields “USD/JPY is directionless around 153. 60. Japan Vice Finance Minister for International Affairs, Atsushi Mimura, highlighted that USD/JPY is trading above the level implied by US-Japan bond yield differentials. We agree.” “However, the Bank of Japan’s on-hold policy stance means this divergence is unlikely to close anytime soon. The swaps market continues to see 50% odds of a December 25bps rate hike to 0. 75%, with a full 25bps move priced for January/March.” Source:.

The post Crypto recovery remains slow despite global liquidity boost: Wintermute appeared com. Global liquidity is rising, stocks are soaring, and interest rates are falling but crypto markets are not bouncing back. Wintermute says why. Summary Wintermute reports that crypto is underperforming despite global liquidity expansion and rate cuts. The report says liquidity is flowing into equities, AI, and prediction markets, not crypto. Wintermute says the four-year Bitcoin halving cycle no longer explains price movements. Recovery depends on renewed ETF inflows and institutional activity in DAT markets. Despite a favorable macroeconomic environment, the cryptocurrency market continues to underperform other risk assets, according to Wintermute’s latest market update dated Nov. 3. The report highlights that although global liquidity is expanding with central banks cutting interest rates, ending quantitative tightening (QT), and stock markets sitting near all-time highs, capital is not flowing into crypto markets at the same pace. Wintermute attributes this underperformance to a redirection of liquidity. While financial conditions have improved globally, the inflows are primarily targeting equities, artificial intelligence (AI) sectors, and prediction markets. In contrast, ETF inflows and Digital Asset Treasury (DAT) activity, which were key drivers of crypto growth earlier in the year, have largely stalled. “The tap isn’t off, it’s just pointed somewhere else,” the report noted. Stablecoin supply remains the only inflow metric showing growth, with over $100 billion added year-to-date. Meanwhile, Bitcoin ETF assets under management have stagnated around $150 billion, and secondary DAT volumes have plummeted. Market data reinforces this slowdown. BTC (BTC) and ETH (ETH) have both been range-bound, with Bitcoin hovering near $101,000 and Ethereum around $3,300. The broader market also suffered heavy losses last week gaming, layer-2s, and meme coins recording double-digit drops. Wintermute says four-year Bitcoin cycle is dead Wintermute also argues that the traditional four-year Bitcoin cycle theory is no longer relevant. The firm believes that price performance in mature markets.

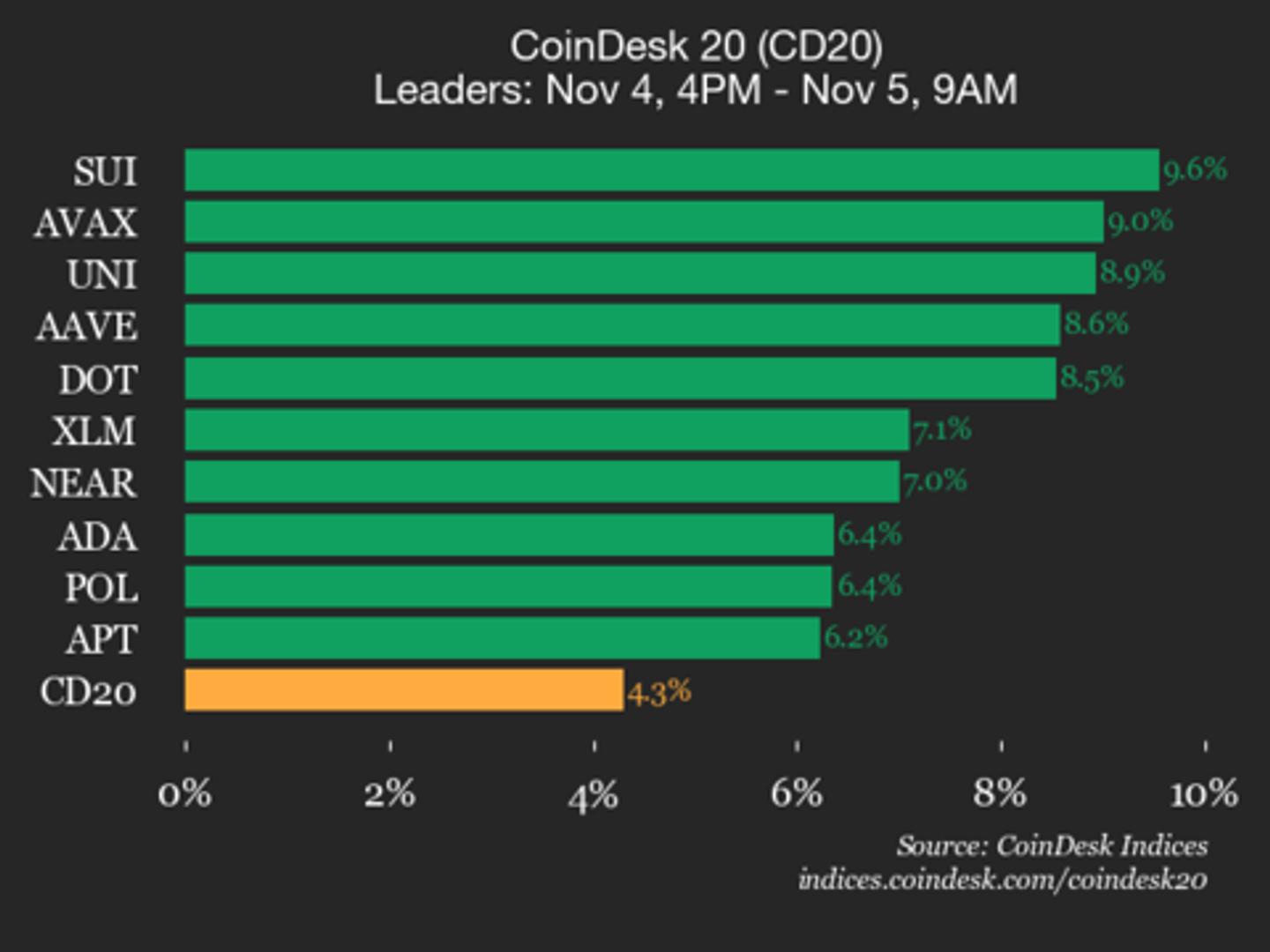

CoinDesk 20 Performance Update: SUI Gains 9.6%, Leading Index Higher

The post Humana Reports $195 Millicom. Humana Wednesday reported $195 million in third quarter profits as the health insurer’s medical cost trends were in line with the company’s earlier forecasts. In this photo is Humana signage on the floor of the New York Stock Exchange (NYSE) in New York, US, on Wednesday, July 30, 2025. Photographer: Michael Nagle/Bloomberg © 2025 Bloomberg Finance LP Humana Wednesday reported $195 million in third quarter profits as the health insurer’s medical cost trends were in line with the company’s earlier forecasts. Like most of its rivals in the health insurance industry, Humana has been seeing higher costs, particularly in its Medicare Advantage plans, which are a big share of Humana’s business. Medicare Advantage plans contract with the federal government to provide extra benefits and services to seniors, such as disease management and nurse help hotlines with some also offering vision, dental care and wellness programs. In Humana’s case, the company exited certain “unprofitable” plans and counties. “Our 3Q25 insurance segment benefit ratio of 91. 1% is in line with our guidance of ‘just above 91%’” Humana said in prepared management remarks released along with the company’s third quarter quarter earnings report. The benefit expense ratio, which is the percentage of premium revenue that goes toward medical costs, was 91. 1.% compared to 89. 9 percent in the third quarter of last year. Still, Humana’s net income fell to $195 million, or $1. 62 per share, compared to $480 million, or $3. 98 a share in the year ago quarter. Revenue rose to $32. 6 billion, compared to $29. 4 billion in the year-ago period. Given the less volatile cost trends the industry has been facing over the last year or so, Humana said it is reaffirming its full year 2025 Adjusted (earnings per share) outlook of ‘approximately $17. 00’ and insurance segment benefit ratio guidance of 90. 1% to.

The post Don’t panic over tech, AI stocks selloff, analysts dismiss fears appeared com. There was a clear change in mood across world markets on Wednesday as tech stocks experienced sharp declines from record highs, and some stretched valuations. Until this week, traders had been happy to overlook warnings, rising prices and doubts about whether the most popular companies had justified the surge in their share prices. Now, the drop has forced investors to reflect on whether the gains had gone too far and too fast. However, even with some large names losing billions in value in a matter of hours, most heavyweight fund managers insisted this was not a full-blown crisis moment, but more of a short wobble after a long winning streak. Experts still favor AI and tech stocks Shares across Asia were sold down for the second day in a row and indices in Seoul and Tokyo were roughly 5% below earlier highs logged only on Tuesday morning. Nasdaq futures were also weaker, even after the US benchmark had already fallen 2% the day before. The names taking the biggest hit were the same stocks that had ridden the boom on the way up. Nvidia, which only a year or two ago was little known outside specialist circles, has since become the most valuable company on the planet due to the AI rush. The company slid nearly 4% on Tuesday, and was around 7% below last month’s top. Palantir, another strong favourite during the boom, fell almost 8% on the day and then slipped a further 3% in after-hours trade. Some managers blamed timing, with the year-end window in sight, there is little incentive to let paper gains reverse if the market begins to swing the wrong way. One investor in Hong Kong said this was more about locking in profits than abandoning AI. Another in Sydney said he was.

The Los Angeles Dodgers celebrated their back-to-back World Series victory in style with fans flocking the streets of downtown LA for the official parade on Monday.

Harshvardhan Rane, who is currently basking in the success of his recent action romance Ek Deewane Ki Deewaniyat, has officially joined the cast of one of Bollywood’s most popular action franchises Force. The announcement has generated massive buzz, as the actor revealed his association with Force 3 through a heartfelt post on social media. Taking to his Instagram story, Harshvardhan shared a photo of himself at the revered Trimbakeshwar Temple in Maharashtra, dressed in a traditional dhoti and performing prayers. Alongside the image, the actor made the exciting revelation, writing, “John Abraham locks Harshvardhan Rane for taking FORCE franchise forward, under him.”Expressing his gratitude towards John Abraham, who headlined the first two installments, Harshvardhan added, “all i can do at this moment is thank this angel of a man called John Sir, while i look upwards and thank who ever is doing this from up there, cant wait to begin shoot in March 2026. (No other details till i begin the shoot.)”The Force franchise, known for its high-octane action and emotional depth, first hit theatres in 2011 under the direction of Nishikant Kamat. The film, starring John Abraham and Genelia D’Souza, became a fan favourite for its gripping storyline and powerful action sequences. It was followed by Force 2 in 2016, directed by Abhinay Deo, with Sonakshi Sinha joining John in an espionage-driven narrative that expanded the series’ universe. With Force 3, the franchise now enters a new chapter as Harshvardhan Rane steps in to carry forward its legacy. While plot details remain under wraps, the actor’s inclusion has already sparked speculation about a fresh storyline and a new wave of stylized action. Harshvardhan, who rose to renewed fame earlier this year following the re-release of his romantic drama Sanam Teri Kasam, has been on a strong career trajectory. His recent hit Ek Deewane Ki Deewaniyat continues to perform well at the box office, and he also has Silaa, a fantasy romance action drama co-starring Sadia Khateeb and Karan Veer Mehra, in the pipeline. With Force 3 expected to begin filming in March 2026, fans can look forward to seeing Harshvardhan Rane bring his signature intensity to one of Bollywood’s most adrenaline-fueled franchises. Also Read: EXCLUSIVE: ECSTATIC Harshvardhan Rane talks about Ek Deewane Ki Deewaniyat’s roadshows and being mobbed by fans like never before: “Har sheher mein fans ke nakhuno se mera thoda sa khoon nikla hai. Lekin mera khoon ab mera nahi, unka hai”.

Coeur Mining Acquires New Gold: When 2 Buys Create A Strong Buy