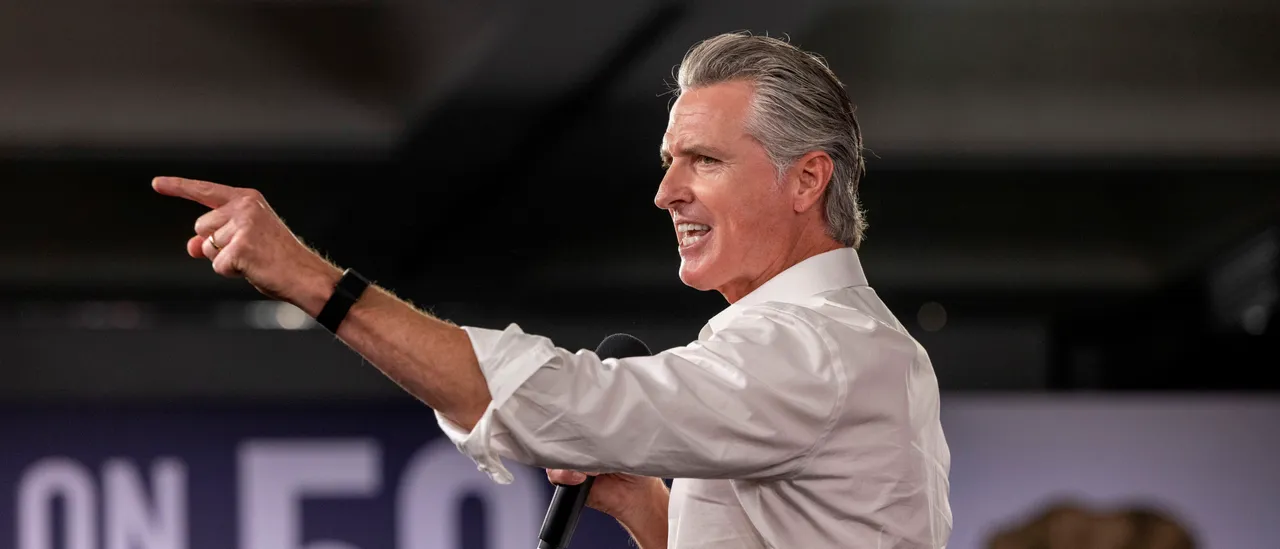

California voters handed Democratic Governor Gavin Newsom a major win on Tuesday evening by signing off on his partisan gerrymandering proposal to create more Democratic-friendly House seats ahead of the 2026 midterm elections. The Associated Press (AP) projected Proposition 50’s passage almost immediately after polls closed at 8: 00 p. m. PT. CNN also called the race [.].

Month: November 2025

Danielle Fishel and Pasha Pashkov just met the end of their Dancing With the Stars journey. The pair became the seventh couple to be eliminated from season 34 of the ABC series on the Rock and.

The mayor-elect’s rivals focused on his inexperience during the campaign. Voters appeared to put more weight on his vision.

Corsair Gaming, Inc. (CRSR) Q3 2025 Earnings Call Transcript

The Moutai Singapore Open 2025 will commence on Thursday, November 6 at Millennium & Peirce in The Singapore Island Country Club.

The post BlackRock Expands Bitcocom. Bitcoin The world’s largest asset manager is extending its crypto footprint to Australia, introducing a Bitcoin ETF that signals deepening institutional adoption of digital assets. Key Takeaways: BlackRock’s i iShares Bitcoin ETF (IBIT) is expected to debut later this month, offering local investors direct exposure to Bitcoin through a regulated framework. The new ETF comes after IBIT’s record-setting rise in the United States, where the fund accumulated over $98 billion in assets under management within two years and generated more than $240 million in annual fees. The move marks a major expansion of BlackRock’s crypto strategy, signaling confidence in Bitcoin’s role as a core institutional asset. According to Tamara Stats, who oversees institutional client business for BlackRock Australasia, the launch reflects both market maturity and investor demand. “Institutions increasingly view Bitcoin as a complementary asset within diversified portfolios,” she explained, adding that the ETF’s arrival offers a “familiar and transparent” way to gain exposure. JUST IN: $13 TRILLION ASSET GIANT BLACKROCK HAS ANNOUNCED PLANS TO LAUNCH A BITCOIN ETF IN AUSTRALIA. BTC IS TAKING OVER THE GLOBAL FINANCIAL MARKETS. 🔥 pic. twitter. com/9YjaUtin67 Defcon7 (@Defcon7_) November 4, 2025 Expanding ETF Options Beyond Crypto While the Bitcoin ETF draws the headlines, BlackRock is simultaneously broadening its traditional investment lineup in Australia. The firm recently unveiled plans for the iShares Core Global Aggregate.

The Red Sox outfielder who has been the subject of the most frequent trade speculation won’t be the one traded, an insider says,.

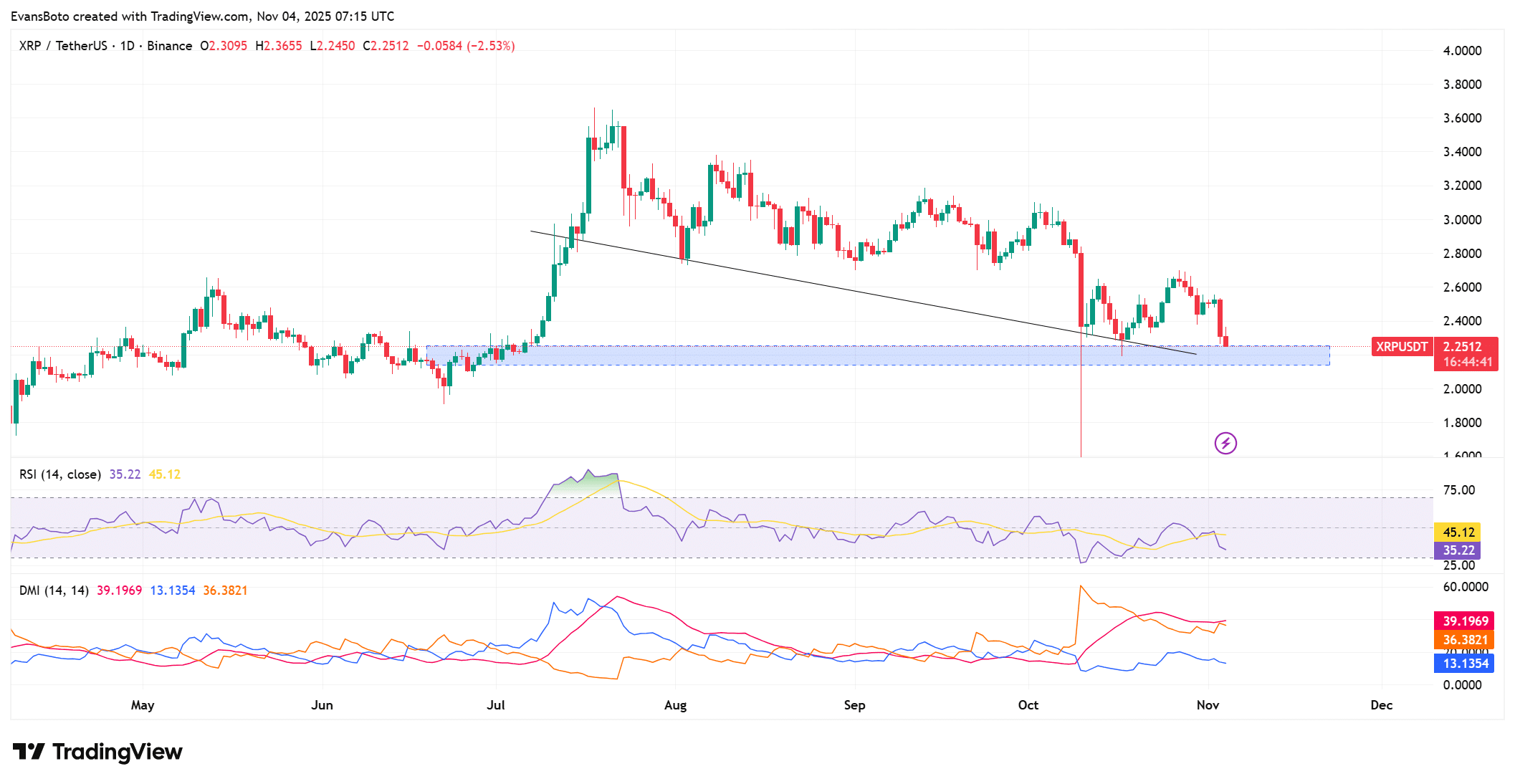

The post XRP Whale Sell-Off Signals Potential Downside Near $2. 2 Support Zone appeared com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → XRP whale investors have sold off 900, 000 tokens in five days amid falling Open Interest and bearish technicals, pushing prices toward the $2. 20-$2. 30 demand zone. This activity signals heightened caution, with potential for volatility around liquidation clusters. XRP whales offload 900, 000 tokens in five days, fueling bearish market sentiment. Open Interest drops 15. 73% to $3. 52 billion, indicating reduced leverage and risk aversion among traders. Liquidation heatmaps show dense clusters at $2. 20 and $2. 30, highlighting key volatility triggers with over $100 million in potential liquidations. XRP whale selling pressure intensifies as 900, 000 tokens are offloaded, dropping prices near $2. 20 support. Analyze technicals and Open Interest for trading insights-stay informed on crypto trends today. What is driving the recent XRP whale selling pressure? XRP whale selling pressure has emerged as a dominant force in the cryptocurrency market, with large investors offloading approximately 900, 000 XRP tokens over the past five days. This activity has coincided with weakening on-chain metrics and technical indicators, amplifying bearish sentiment and driving the price toward critical support levels between $2. 20 and $2. 30. As traders monitor these developments,.