Watch the November 2025 PlayStation State of Play here

Tag: approximately

Boston is predicted to be in the mix for a handful of the top free agents this offseason. The post What insiders are predicting for the Red Sox in free agency this offseason appeared first on Boston. com.

This 2000 Mercury Grand Marquis GS spent time with a single owner up until the seller’s acquisition in 2025, and it now shows 6k miles. Work under current ownership consisted of installing four tires and replacing the battery. The car is finished in Tropic Green Clearcoat Metallic over white and gray leather upholstery and is powered by a 4. 6-liter SOHC V8 paired with a four-speed automatic transmission. It is also fitted with a white vinyl coach roof, 16″ wheels with chrome-finished covers, and automatic headlights as well as air conditioning, cruise control, and a factory cassette stereo. This Grand Marquis GS is now offered with an initial purchase document, a clean Carfax report, 2025 service records, and a clean Massachusetts title in the seller’s name.

This 2006 Toyota Tundra Limited is a Double Cab 4×4 pickup that has remained registered in Texas since new and has 117k miles after the seller’s purchase in 2025. Finished in Natural White over Taupe leather, the truck is powered by a 4. 7-liter V8 linked with a five-speed automatic transmission, a dual-range transfer case, and a limited-slip rear differential. Equipment includes a power sunroof, a power-sliding rear window, a fiberglass tonneau cover, a suspension leveling kit, 17″ MKW M26 wheels, a power-adjustable driver’s seat, a JBL sound system, a DVD-based navigation system, air conditioning, and cruise control. This Tundra is offered at no reserve with a window sticker, manufacturer’s literature, a clean Carfax report, and a clean Texas title in the seller’s name.

The post What’s Driving Bitcoin’s Price Down? Is a Rise Still Possible? Analysis Firm Explains! appeared com. Bitcoin experienced a major crash, with the price falling below the psychological level of $100,000 last night. Evaluating the recent decline in Bitcoin, Singapore-based analysis firm QCP Capital examined the main reasons for the decline. At this point, QCP analysts stated that the decline in Bitcoin was due to a stronger dollar and uncertainty about the Fed’s actions, and that this decline below $100,000 also negatively affected the risk appetite. Analysts noted that this decline in risk appetite and ongoing macro pressure were also reflected in US spot Bitcoin ETFs, with ETFs recording a net outflow of approximately $1. 3 billion for four consecutive days. “This reversal in ETFs has turned one of Bitcoin’s strongest tailwinds of 2025 into a near-term headwind.” Analysts noted that weaker spot demand for Bitcoin coincided with forced deleveraging, leading to liquidations exceeding $1 billion in long positions, and that investors in the options market were also stepping up hedging activities around $100,000. Analysts stated that the data currently points to a technical decline in Bitcoin, emphasizing that uncertainty still prevails on the FEWD front. The Fed’s 25 basis point rate cut in October, coupled with rare opposition, has been met with a cautious stance that has pushed back expectations of a new rate cut in December. Currently, a 25 basis point cut in December is priced in at 72. 1% in the markets, while keeping it unchanged is priced in at 27. 9%. Despite all this uncertainty and increasing macro pressure, analysts stated that Bitcoin could rise again. According to analysts, a sustained upward rally in BTC will depend on ETF outflows giving way to inflows and renewed confidence in risky assets. *This is not investment advice. account now for exclusive news, analytics and on-chain data! Source:.

The post Humana Reports $195 Millicom. Humana Wednesday reported $195 million in third quarter profits as the health insurer’s medical cost trends were in line with the company’s earlier forecasts. In this photo is Humana signage on the floor of the New York Stock Exchange (NYSE) in New York, US, on Wednesday, July 30, 2025. Photographer: Michael Nagle/Bloomberg © 2025 Bloomberg Finance LP Humana Wednesday reported $195 million in third quarter profits as the health insurer’s medical cost trends were in line with the company’s earlier forecasts. Like most of its rivals in the health insurance industry, Humana has been seeing higher costs, particularly in its Medicare Advantage plans, which are a big share of Humana’s business. Medicare Advantage plans contract with the federal government to provide extra benefits and services to seniors, such as disease management and nurse help hotlines with some also offering vision, dental care and wellness programs. In Humana’s case, the company exited certain “unprofitable” plans and counties. “Our 3Q25 insurance segment benefit ratio of 91. 1% is in line with our guidance of ‘just above 91%’” Humana said in prepared management remarks released along with the company’s third quarter quarter earnings report. The benefit expense ratio, which is the percentage of premium revenue that goes toward medical costs, was 91. 1.% compared to 89. 9 percent in the third quarter of last year. Still, Humana’s net income fell to $195 million, or $1. 62 per share, compared to $480 million, or $3. 98 a share in the year ago quarter. Revenue rose to $32. 6 billion, compared to $29. 4 billion in the year-ago period. Given the less volatile cost trends the industry has been facing over the last year or so, Humana said it is reaffirming its full year 2025 Adjusted (earnings per share) outlook of ‘approximately $17. 00’ and insurance segment benefit ratio guidance of 90. 1% to.

The post AAVE: Will the $50mln buyback plan repeat the 50% price surge? appeared com. Key Takeaways Why has Aave made token buyback official? The team said that the trial initiative was a “strong success” in improving AAVE value accrual. Will it lift the token above $200 again? Yes, under a positive, broader market sentiment, the deflation plan could boost AAVE in the long run. DeFi lending giant Aave [AAVE], has unanimously approved the creation of a $50 million per year buyback program. The move followed what the project called a “strong success” after a pilot test initiated in May, designed to improve the tokenomics of the AAVE token. According to the plan, the team would eye $250K-$1. 75 million in weekly AAVE purchases, based on protocol revenue and other factors. That being said, AMBCrypto evaluated the pilot test to gauge the potential impact of the latest update. AAVE buybacks and potential impact Since May, the initiative has bought over 94K AAVE tokens and spent over $22 million in the process. The team added 20. 1K AAVE in May, marking the largest monthly purchase during the trial program. From July to October, the team acquired about 10K AAVE on a monthly average. The deflation move and broader recovery lifted AAVE to $385 by August. However, Q4 headwinds dragged AAVE below $200 despite the ongoing buyback. Beyond deflation and market sentiment, AAVE’s value also has a strong positive correlation with Ethereum [ETH]. However, during pullbacks, AAVE also dumped harder. As the barometer of the broader DeFi ecosystem, ETH’s momentum also trickles down to the sector’s.

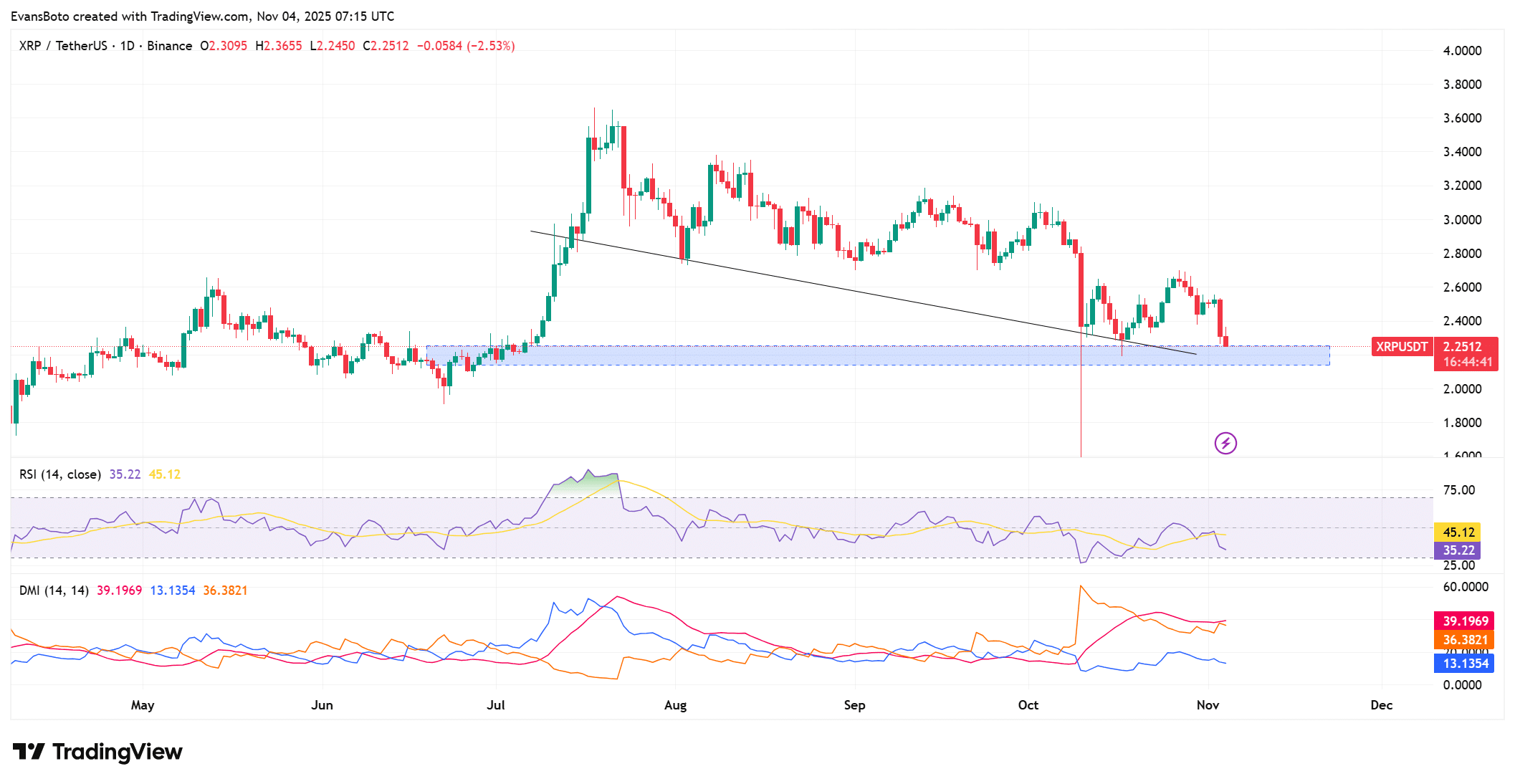

The post XRP Whale Sell-Off Signals Potential Downside Near $2. 2 Support Zone appeared com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → XRP whale investors have sold off 900, 000 tokens in five days amid falling Open Interest and bearish technicals, pushing prices toward the $2. 20-$2. 30 demand zone. This activity signals heightened caution, with potential for volatility around liquidation clusters. XRP whales offload 900, 000 tokens in five days, fueling bearish market sentiment. Open Interest drops 15. 73% to $3. 52 billion, indicating reduced leverage and risk aversion among traders. Liquidation heatmaps show dense clusters at $2. 20 and $2. 30, highlighting key volatility triggers with over $100 million in potential liquidations. XRP whale selling pressure intensifies as 900, 000 tokens are offloaded, dropping prices near $2. 20 support. Analyze technicals and Open Interest for trading insights-stay informed on crypto trends today. What is driving the recent XRP whale selling pressure? XRP whale selling pressure has emerged as a dominant force in the cryptocurrency market, with large investors offloading approximately 900, 000 XRP tokens over the past five days. This activity has coincided with weakening on-chain metrics and technical indicators, amplifying bearish sentiment and driving the price toward critical support levels between $2. 20 and $2. 30. As traders monitor these developments,.

TLDR DTCC now lists nine XRP ETFs on its platform Products include both futures-based and spot-based strategies Four futures XRP ETFs are already trading in the market Five-spot XRP ETFs are still awaiting final SEC approval November 13 set as potential launch date for spot products The Depository Trust & Clearing Corporation has listed nine [.] The post DTCC Lists Nine XRP ETFs as Countdown to Potential Launch Begins appeared first on CoinCentral.

The post U. S. Treasury cuts Q4 borrowing estimate to $569B appeared com. The Federal borrowing estimate for the U. S. Treasury Department for the final three months of the year was reduced to $569 billion, thanks to a stronger cash position and improved revenue collection. The three months, which ended on Wednesday, saw $21 billion in short-term borrowing, down from the $590 billion forecast issued in July, indicating a decrease in short-term borrowing. Officials attribute most of the changes to more cash than expected at the beginning of the quarter. The data available suggests that in early October, the Treasury had approximately $891 in cash, which was above the $850 in summer gross cash. Using a substantial portion of the trove allowed the department to slow its rate of wealth increase for spending and debt repayment while still meeting all obligations. Treasury leverages a strong cash buffer The Treasury’s cut results from careful cash management, given there were months of heavy issuance to rebuild reserves following the suspension of the debt ceiling at the start of the calendar year. In previous quarters, the Treasury had increased sales of short-term bills to replenish its coffers. But strong tax inflows and cautious outlays have left it with a much larger cushion than expected. According to analysts, this could ease some of the tension in the bond markets, which have been pressured by the rapid pace of supply and an increase in longer-term interest rates. A borrowing reduction was a strong move to get the Treasury stabilizer working again, according to analysts quoted by the Financial Times. In addition, reductions in the borrowing requirement may help steady Treasury yields, making it easier for investors to anticipate interest rate hikes by the Federal Reserve. Nonetheless, economists claim that the reduction is not an indication of general fiscal moderation. Spending at the federal level remains unchanged, and borrowing.