The deal involves private companies, but the New Hampshire Business Finance Authority will serve as an intermediary in the issuance of a $100M bond backed by cryptocurrency.

Tag: Bitcoin

Bitcoin Munari’s presale structure defines a clear price progression from the initial $0. 1 round to the $6. 00 launch benchmark, producing [.] The post Performance Analysis: Bitcoin Munari Platform Projects 5, 900% ROI for Early Participants appeared first on Coindoo.

The post El Salvador Quietly Became the 5th Largest Bitcocom. El Salvador has added $100 million worth of Bitcoin to its national reserves over the past week, purchasing 1, 098 BTC amid declining market conditions. The Central American nation now holds 7, 474 Bitcoin valued at approximately $688 million, according to the country’s Bitcoin office. President Nayib Bukele shared details of the recent acquisition on social media, reaffirming his administration’s commitment to building cryptocurrency reserves. The government has implemented a daily purchasing strategy designed to accumulate digital assets gradually while minimizing exposure to price volatility. Strategic Accumulation Through Daily Purchases El Salvador adds one Bitcoin to its reserves each day as part of its long-term investment strategy. This approach allows the government to reduce its average acquisition cost through consistent buying during market downturns. Stacy Herbert, director of El Salvador’s Bitcoin Office, explained that the initiative aims to provide citizens with greater financial autonomy. The government wants to reduce dependence on traditional banking systems and encourage cryptocurrency adoption among its population. Most Salvadorans currently use the U. S. dollar for everyday transactions. El Salvador became the first country to adopt Bitcoin as legal tender in September 2021. However, public acceptance has progressed slowly. Many citizens remain hesitant about cryptocurrency use despite government incentives and educational programs. The International Monetary Fund has expressed concern about El Salvador’s Bitcoin holdings. The organization warned about potential financial risks associated with maintaining large cryptocurrency reserves. Nevertheless, President Bukele has dismissed these warnings and continued the accumulation strategy. Government Stays Steady While Market Declines Bitcoin prices fell below $90,000 this week, dropping nearly 5% in a single trading session. The decline triggered widespread selling among retail investors who had entered the market within recent months. At the time of.

The post The Intriguing Links and Future Exploration of Bitcoin’s Architect appeared com. A prominent figure in the evolution of digital currency, Nick Szabo, remains a pivotal contributor to Bitcoin‘s conceptual foundations. Notably associated with innovations preceding Bitcoin, Szabo unfolds valuable insights into current and past cryptocurrency realms. Continue Reading: The Intriguing Links and Future Exploration of Bitcoin’s Architect Source:.

The post SEC Planned to Classify BTC and ETH as Securities, UniSwap Creator Alleges appeared com. BitcoinEthereum A heated dispute has resurfaced in the crypto world after UniSwap creator Hayden Adams disclosed what he describes as one of the most alarming regulatory ideas ever discussed in the United States: a scenario in which Bitcoin, Ethereum, and the rest of the major cryptocurrencies would have been branded securities. Key Takeaways: Hayden Adams claims former SEC leadership explored labeling even Bitcoin and Ethereum as securities. Adams says the plan could have given FTX exclusive legal control over U. S. crypto trading access. He believes the collapse of FTX prevented the model from becoming reality and preserved market competition. The claim was not tied to a theory but to a conversation Adams says he had with Sam Bankman-Fried shortly before FTX collapsed. According to his recollection, SBF suggested that the SEC under Gary Gensler at the time was preparing to expand its jurisdiction to cover the entire crypto market. The way Adams tells it, the plan would have also placed FTX at the center of the U. S. crypto trading system. A Deal That Would Have Reshaped U. S. Crypto Markets Instead of a multi-exchange environment, Adams says he understood the proposal as leading to a single licensed on-ramp for trading cryptocurrencies in the United States. One company would receive the only legal brokerage license to handle crypto assets; another, tied to FTX, would receive the only exchange license. In practice, all other platforms would lose legal access to U. S. markets. Adams says SBF never spoke the words “exclusive monopoly,” but the direction of the conversation left him with no doubt. He claims he rejected the idea on the spot, calling it contrary to the foundation of open blockchain networks. The Most Shocking Part of the Allegation What has attracted the most attention is not the licensing model but.

Key Takeaways: Saylor’s “Big Week” post sparked rumors of a new Strategy BTC buy. Strategy now holds about 641, 692 BTC [.] The post Crypto Market Watches for Possible Strategy Bitcoin Buy After Latest Saylor Update appeared first on Coindoo.

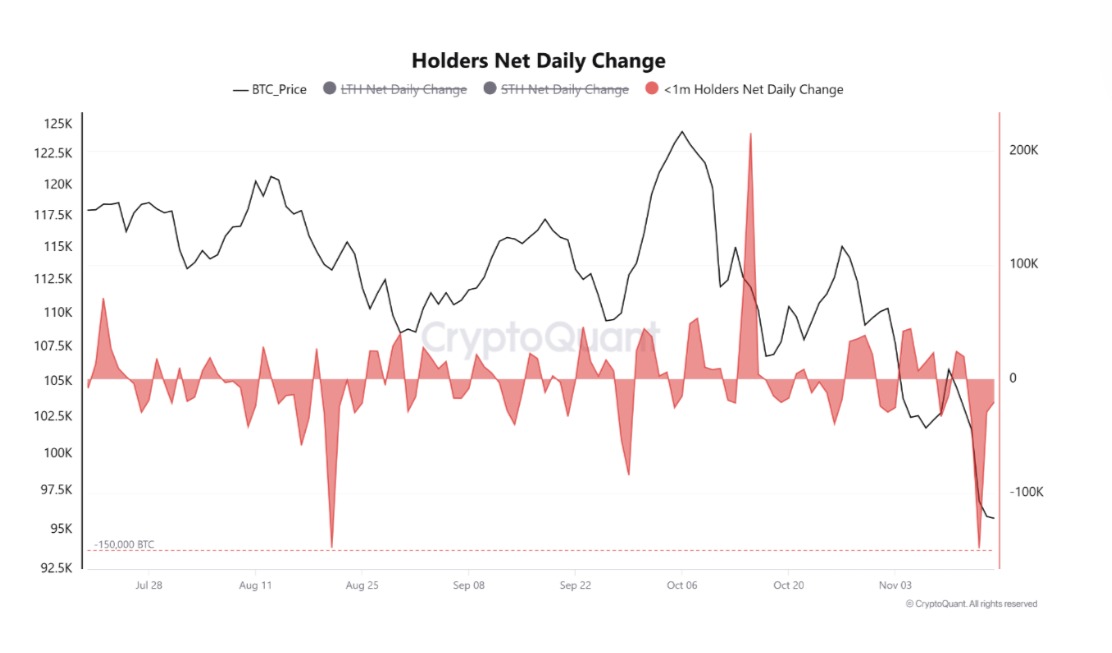

The post Bitcoin Risks Further Decline to $94K Amid STH Selling Pressure appeared com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → Bitcoin short-term holder losses have surged to an 8-month high, reaching 4. 9 million BTC in supply underwater, driven by recent price drops below key cost bases. Short-term holders dumped 148, 000 BTC over 48 hours, intensifying sell pressure as the market capitulates amid declining confidence. Short-term holders face mounting losses as BTC falls to $96,041, marking an 8. 7% weekly decline. Realized losses hit levels not seen since April, signaling panic selling from recent buyers. Over 148, 000 BTC sold by short-term holders in 48 hours, with shark and fish cohorts adding 70, 100 BTC to the sell-off. Discover why Bitcoin short-term holder losses are accelerating in 2025, with STHs dumping 148k BTC amid price weakness. Stay informed on BTC trends and trading strategies for potential rebounds. Read now for key insights. What Are Bitcoin Short-Term Holder Losses and Why Do They Matter? Bitcoin short-term holder losses refer to the unrealized and realized financial setbacks experienced by investors who have held BTC for less than 155 days, particularly when prices drop below their purchase points. These losses matter because they often trigger widespread.

The post Best Meme Coins to Buy For Big Gains in 2026 Bull Run: DeepSnitch AI Leads With 100X Potential appeared com. The altcoin season is closing in, with many meme coins already gearing up for the 2026 bull run, as they start to show small upticks. PEPE appreciated around 5% in the second week of November after an 18% downturn in the last month. TRUMP also surged 22% over the previous month. But it was a fairly new AI-powered meme coin, DeepSnitch AI (DSNT), that surged about 50% to $0. 02289. Though the coin is still in its presale, the momentum building around it is worth noticing. Early investors have already filled their wallets with over $520K in DSNT tokens in the second phase alone. So if you’re hunting for the best meme coins to buy and hold for the 2026 bull run, here is what you need to know. Will a bull run come in 2026, and how long could it last? According to Bitwise Chief Investment Officer Matt Hougan, 2026 is definitely going to be the actual bull run for the market. He suggests that, based on 2025 not showing the projected bullish trend post Bitcoin halving. He points out that after every halving, Bitcoin has entered a bull run, marking the end of a four-year cycle. But the cycle has shifted this year, with 2025 not looking like a bull year as many analysts had expected. Had it been one, 2026 would have marked the start of a bear cycle. But clearly, the bull run is delayed by a year this time. Hougan further told Cointelegraph at the Bridge conference in New York that the recent governance proposal by the Uniswap protocol could also bring many DeFi protocols back to life. Uniswap has also pumped by more than 40% in November following its proposal to burn $100 million in UNI tokens and reward its holders with the ecosystem fees.

The post Best Crypto to Buy Now: Tapzi & Jasmy Shine as Michael Saylor Ends Bitcocom. The crypto market faced heightened volatility this week as conflicting reports triggered confusion among traders, investors, and analysts. Concerns first rose after significant Bitcoin wallet movements created speculation that Strategy, one of the largest corporate Bitcoin holders, had started selling its treasury stack during a sharp market downturn. The rumor spread quickly and fueled broader fear because many investors view the firm as a long-term anchor for Bitcoin stability. Besides, this tension added pressure to an already fragile market environment. However, a fast response from Strategy leadership helped calm the situation. The denial restored confidence and shifted attention back to emerging opportunities across the market. Consequently, investors began focusing again on trending best crypto to buy now, such as Tapzi and Jasmy, both showing rising momentum despite ongoing volatility. Tapzi Strengthens Position as Web3 Gaming Expands Rapidly Tapzi continues to capture interest with its best crypto presale of the year due to its focus on decentralized skill-based gaming. The platform runs on BNB Smart Chain and aims to reshape traditional GameFi through a fair and skill-driven model. This structure removes luck-based mechanics and eliminates bots. Hence, players compete directly using skill rather than random outcomes. Tapzi encourages staked matches where players enter games with APZI tokens. Winners receive rewards funded by match stakes. This keeps the economy sustainable and transparent, making Tapzi one of the best altcoins to buy for long-term holding due to its ecosystem’s stickiness. Tapzi also supports developers through a launchpad system. Builders gain access to SDKs, staking modules, and community exposure. Moreover, the onboarding experience remains simple. Users play through the web or mobile without downloads or complex blockchain steps. Tapzi removes gas fees during gameplay, which helps attract mainstream players. Additionally, a Free Mode gives curious users a chance to explore before staking, which increases.

The post Bitcoin Black Friday: Tether CEO Reacts to BTC’s Surprising Crash Below $100,000 appeared com. Bitcoin fell below $95,000 for the first time in about six months as a wave of risk aversion swept across markets, with investors pulling nearly $900 million from exchange traded funds. Bitcoin fell to a low of $94,455 on Friday, extending its drop from the Nov. 11 high of $107,482 into the fourth day. With the current sell-off, Bitcoin is on the verge of wiping out its gains for the year, dropping as much as 7% in the last 24 hours. Bitcoin traded at a record high of $126,251 in early October and ended the past year, 2024, at $93,714. “Bitcoin black friday,” Tether CEO Paolo Ardoino posted in a tweet in apparent reaction to Bitcoin’s surprising price drop. The sell-off across the crypto market has prompted more than $1. 38 billion in liquidations, about half of which occurred on Bitcoin trading pairs, according to CoinGlass. Bitcoin accounted for $676 million out of this total figure; the largest single wipeout on the market was a $44 million BTC long on HTX. Crypto market under strain The crypto market remains under strain after $19 billion in liquidations on Oct. 10, which in turn erased over $1 trillion from the total market value of all cryptocurrencies. According to CoinGlass data, the recent liquidation event impacted mostly longs, which accounted for $1. 21 billion, while shorts came in at $157. 36 million. A total of 278, 152 traders were affected in the last market downturn. Economic data from China and fading hopes for a Federal Reserve rate cut contributed to the downturn on the crypto and equity markets. Meanwhile, Tether’s dominance rate has reached its highest level since April. This remains significant as, oftentimes, a surge in USDT dominance has been highlighted as a key feature of Bitcoin bear markets. According to CryptoQuant CEO Ki Young Ju,.