The post Bitwise Chainlink ETF Gains DTCC Eligibility as LINK Price Holds Above $15 appeared com. TLDR: Bitwise Chainlink ETF added to DTCC list, marking procedural progress. DTCC eligibility does not signal SEC approval or trading start. LINK trades near $15. 38 after a volatile rebound week. Institutional focus grows as traders eye $16-$17 resistance zone The Bitwise Chainlink ETF (ticker: CLNK) has been added to the Depository Trust & Clearing Corporation (DTCC) eligibility list. This marks an early procedural step in preparing the fund for potential market settlement. The listing does not represent approval from the Securities and Exchange Commission (SEC) or any other regulatory body. However, it has attracted attention from traders tracking institutional engagement with Chainlink’s growing ecosystem. Bitwise Chainlink ETF Joins DTCC Eligibility List According to data shared by Wu Blockchain, the listing represents part of the standard clearing and settlement process for new ETFs. The DTCC designation allows the Bitwise Chainlink ETF to move through technical systems once all required approvals are completed. It is not a sign that trading will begin soon, but it does suggest readiness for operational setup. The Bitwise Chainlink ETF (ticker: CLNK) has been added to the DTCC eligibility list. Such listing is part of the standard clearing and settlement preparation process and does not indicate that the ETF has received regulatory approval or completed any other required approvals.- Wu Blockchain (@WuBlockchain) November 11, 2025 The update is as a typical yet necessary step before any ETF launch in the U. S. The DTCC’s role ensures that securities can settle efficiently once regulators provide clearance. For Chainlink, this procedural milestone added fresh momentum to discussions about the network’s expanding role in traditional finance. The move also aligns with broader efforts by asset managers to introduce blockchain-linked investment products with institutional backing. Bitwise’s ETF proposal aims to connect decentralized data infrastructure with regulated financial frameworks. Although no official.

Tag: chainlink

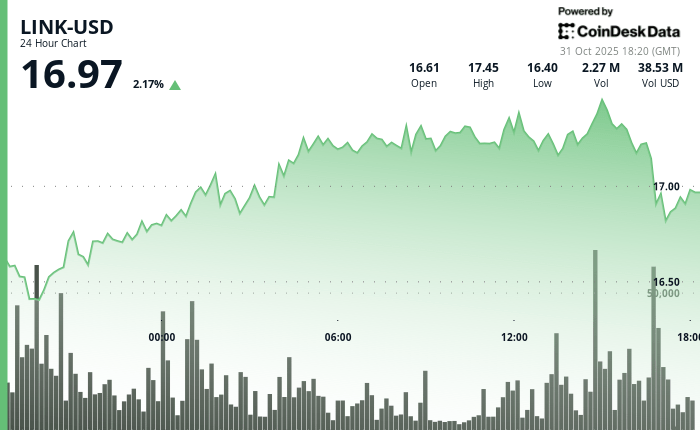

The post Modest Bounce as Stellar Integraticom. The native token of oracle network Chainlink LINK$17. 15 bounced 3. 6% on Friday, reversing some of Thursday’s losses as traders stepped in around key support level. LINK briefly cleared the $17 level with a surge in trading volume some 3 million tokens changed hands during a morning breakout up -, pointing to renewed accumulation, CoinDesk Research’s market insight tool suggested. However, weakness during the U. S. trading hours drove LINK back below $17. Recently, the token traded at $16. 96. On the news front, payments-focused Stellar (XLM) announced to integrate Chainlink’s Cross-Chain Interoperability Protocol (CCIP), Data Feeds, and Data Streams. The move enables developers and institutions building on Stellar to access real-time data and trusted cross-chain infrastructure for tokenized assets. With over $5. 4 billion in quarterly RWA volume and a fast-growing DeFi footprint, Stellar’s adoption of Chainlink tooling signals expanding demand for secure, interoperable financial infrastructure. Key technical levels to watch: LINK now holds near-term support at $16. 37 with upside targets at $17. 46 and $18. 00. Whether the token can build on Friday’s rebound may depend on broader market flows and follow-through from dip-buying. Support/Resistance: Solid support holds at $16. 37 after multiple successful tests, while $17. 46 resistance shows repeated rejection patterns. Volume Analysis: 78% volume surge during breakout attempt confirms institutional interest, explosive selling volume indicates position rebalancing. Chart Patterns: Late-session flush-out pattern creates classic oversold setup for accumulation strategies. Targets & Risk/Reward: Holding above $16. 89 targets $17. 46 retest with upside to $18. 00, downside risk limited to $16. 37 support. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. Source:.

Crypto markets continue to show cautious optimism this week. Solana (SOL) remains one of the most traded large-cap coins, maintaining […]

The post Solana Holds Strong, Chainlink Pauses, as BlockDAG’s Kraken–Coinbase Leak Ignites Market Excitement Ahead of 2025 appeared first on Coindoo.