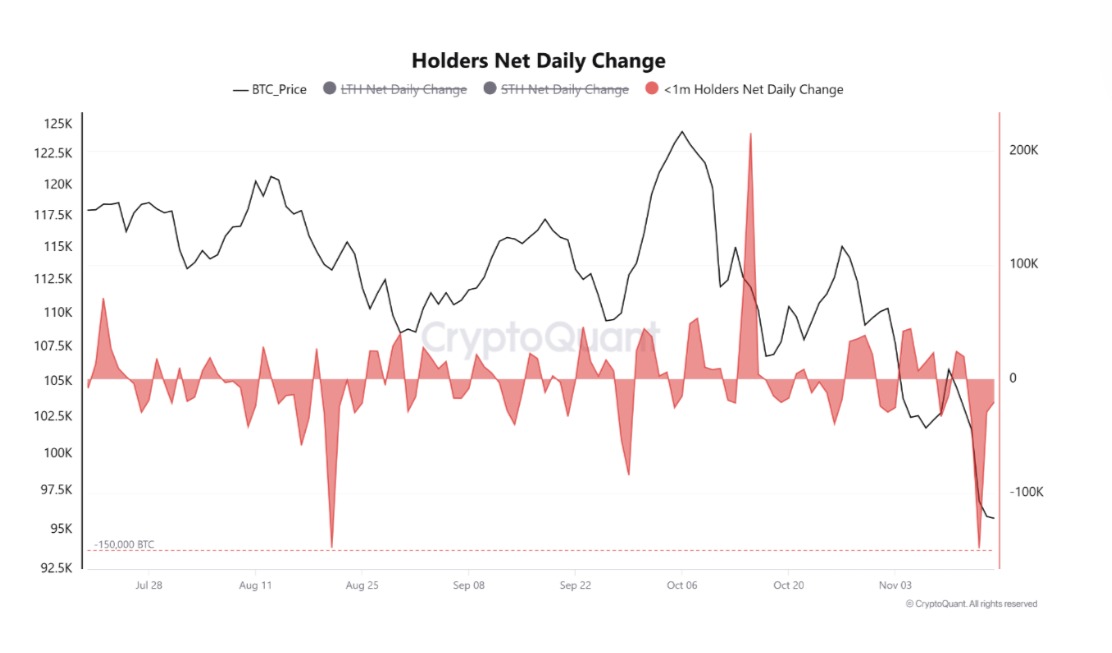

The post Bitcoin Risks Further Decline to $94K Amid STH Selling Pressure appeared com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → Bitcoin short-term holder losses have surged to an 8-month high, reaching 4. 9 million BTC in supply underwater, driven by recent price drops below key cost bases. Short-term holders dumped 148, 000 BTC over 48 hours, intensifying sell pressure as the market capitulates amid declining confidence. Short-term holders face mounting losses as BTC falls to $96,041, marking an 8. 7% weekly decline. Realized losses hit levels not seen since April, signaling panic selling from recent buyers. Over 148, 000 BTC sold by short-term holders in 48 hours, with shark and fish cohorts adding 70, 100 BTC to the sell-off. Discover why Bitcoin short-term holder losses are accelerating in 2025, with STHs dumping 148k BTC amid price weakness. Stay informed on BTC trends and trading strategies for potential rebounds. Read now for key insights. What Are Bitcoin Short-Term Holder Losses and Why Do They Matter? Bitcoin short-term holder losses refer to the unrealized and realized financial setbacks experienced by investors who have held BTC for less than 155 days, particularly when prices drop below their purchase points. These losses matter because they often trigger widespread.