The post XAG/USD consolidates near four-week high appeared com. Silver (XAG/USD) is seen consolidating its strong gains registered over the past four days and oscillating in a range during the Asian session on Thursday. The white metal currently trades around the $53. 35-$53. 40 region, just below a nearly four-week top touched on Wednesday, and seems poised to appreciate further. From a technical perspective, the recent goodish rebound from the vicinity of the 50-day Simple Moving Average (SMA) and the subsequent move up favor the XAG/USD bulls. Moreover, oscillators on the daily chart have been gaining positive traction and are still away from being in the overbought territory, validating the constructive outlook for the white metal. Hence, some follow-through strength beyond the overnight swing high, around the $53. 65-$53. 70 region, towards reclaiming the $54. 00 round figure, looks like a distinct possibility. A sustained strength beyond the latter would set the stage for an extension of the positive momentum towards retesting the all-time peak, around the $54. 85 zone, touched in October. On the flip side, any meaningful corrective slide below the $53. 00 mark could attract some buyers near the $52. 45 intermediate support, which should help limit the downside for the XAG/USD near the $52. 00 round figure. Failure to defend the said support levels, however, could prompt some technical selling and drag the white metal to the $51. 30-$51. 20 area. Silver daily chart Silver FAQs Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets. Silver prices.

Tag: consolidating

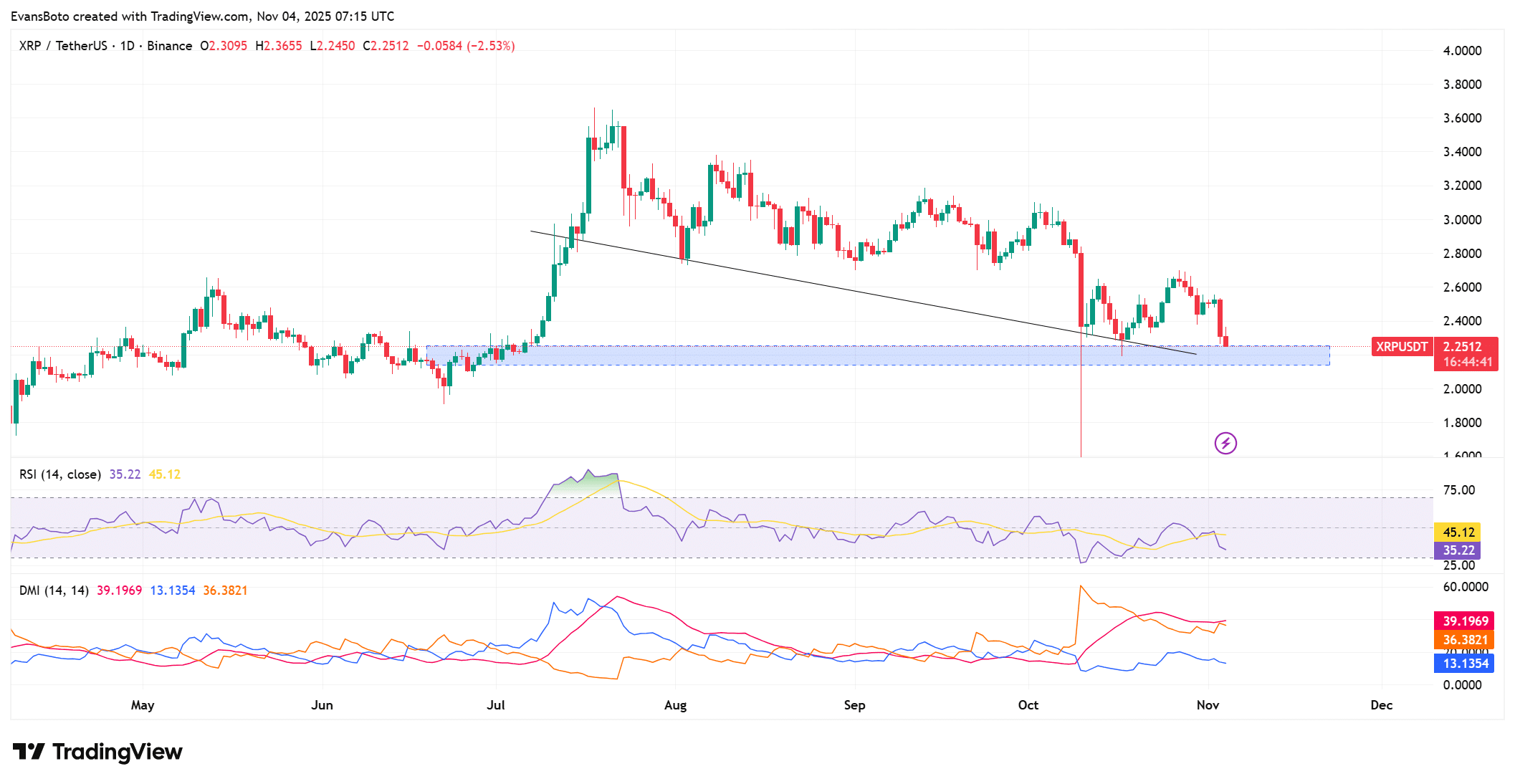

The post XRP Whale Sell-Off Signals Potential Downside Near $2. 2 Support Zone appeared com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → XRP whale investors have sold off 900, 000 tokens in five days amid falling Open Interest and bearish technicals, pushing prices toward the $2. 20-$2. 30 demand zone. This activity signals heightened caution, with potential for volatility around liquidation clusters. XRP whales offload 900, 000 tokens in five days, fueling bearish market sentiment. Open Interest drops 15. 73% to $3. 52 billion, indicating reduced leverage and risk aversion among traders. Liquidation heatmaps show dense clusters at $2. 20 and $2. 30, highlighting key volatility triggers with over $100 million in potential liquidations. XRP whale selling pressure intensifies as 900, 000 tokens are offloaded, dropping prices near $2. 20 support. Analyze technicals and Open Interest for trading insights-stay informed on crypto trends today. What is driving the recent XRP whale selling pressure? XRP whale selling pressure has emerged as a dominant force in the cryptocurrency market, with large investors offloading approximately 900, 000 XRP tokens over the past five days. This activity has coincided with weakening on-chain metrics and technical indicators, amplifying bearish sentiment and driving the price toward critical support levels between $2. 20 and $2. 30. As traders monitor these developments,.