TLDR: AVAX One deployed $110M to acquire 9. 37M AVAX tokens at an average price of $11. 73 per token Company now holds over 13. 8M AVAX tokens as part of aggressive treasury accumulation strategy AVAX One maintains $35M in cash reserves for additional token purchases and share buybacks ahead Management views current market volatility as opportune timing [.] The post AVAX One Drops $110M on Avalanche Tokens, Holdings Hit 13. 8M appeared first on Blockonomi.

Tag: infrastructure

UK government will buy tech to boost AI sector in $130M growth push

From its celebrated inclusive job programs to the award-winning Craighead Forest Park, Jonesboro’s achievements tell a story of progress powered by innovation and genuine community investment. The post Jonesboro: Always Moving Forward appeared first on Arkansas Business Business News, Real Estate, Law, Construction.

Jacobs Solutions: Affordable Now, Attractive For The Next Contraction

Paramount Skydance has the inside track to acquire Warner Bros. Discovery, according to well-placed media executives and it’s all about a cable network that has a troubled relationship with Donald Trump.

The post Bitcoin’s Battle for Safe-Haven Status Intensifies appeared com. Bitcoin ETF growth shows scale, but investor trust lags behind gold’s long-term stability. Gold remains preferred in crises due to central banks and institutional allocators’ support. Bitcoin’s “digital gold” status hinges on adoption, infrastructure, and crisis performance. Bitcoin’s push toward the digital gold label continues to face strong headwinds despite its rapid ascent in global markets. The asset overtook gold ETFs in late 2024, reaching a level many considered historic. Besides, its total ETF assets now hover near $120 billion, showing lasting investor interest. However, its market character still lacks the stability and trust that define traditional safe-haven assets. This gap forms what Simon Kim, CEO of Hashed, describes as the “digital gold paradox,” a situation where scale grows fast but long-term confidence remains fragile. Why Trust Still Favors Gold Over Bitcoin Kim notes that time shapes investor trust more than any metric. Gold has survived thousands of years of crises, wars, and currency transitions. Bitcoin, meanwhile, has existed for only sixteen years, leaving investors unsure about its crisis behavior. Moreover, capital composition adds another challenge. Bitcoin ETFs attract hedge funds and trading desks that chase volatility. Consequently, the asset often reacts like a high-risk tech stock when markets move. Gold, however, benefits from long-term allocators such as central banks, pensions, and insurers. Their presence helps gold behave steadily during stress events. Correlation trends reinforce this divide. Bitcoin still trades closely with the Nasdaq, often selling off when tech stocks fall. Gold moves differently. Hence, global investors still turn to physical assets when geopolitical and macro tensions escalate. Gold’s surge to over $4,000 in 2025 and the rapid rise in gold ETF assets underline this preference. Central banks drove most of this expansion as they reduced dollar exposure and increased reserve diversification. Bitcoin’s Path to Higher Market Maturity Kim believes.

The post Securitize to Launch Institutional Assets on Plume’s Nest Protocol appeared com. The deployment aims to connect tokenized funds with Plume’s RWA investors. Plume a blockchain focused on real-world asset finance (RWAfi) with $159 million in total value locked announced Thursday that tokenization platform Securitize will deploy institutional-grade assets on its Nest staking protocol. Nest currently holds over $39. 5 million in distributed assets, down nearly 30% over the past month, according to RWAxyz. The upcoming deployment will connect Securitize’s tokenized assets with Plume’s network of roughly 280, 000 RWA investors, according to a press release viewed by The Defiant. Securitize also tokenized BlackRock’s BUIDL fund the largest RWA product with over $2. 5 billion in assets. The deployment onto Nest will start with Hamilton Lane funds and expand throughout 2026 to include additional issuers and asset classes. The fund is targeting $100 million in capital, the release noted. The move highlights how RWA and decentralized finance (DeFi) projects are increasingly exploring compliant ways to bring traditional assets on-chain for trading, staking, and other DeFi use cases. As part of the initiative, Solv Protocol, a Bitcoin finance platform with over $2. 8 billion in assets, will invest up to $10 million in Plume’s RWA vaults. Users can trade and stake these assets on Plume, which is backed by Apollo Global Management, while keeping them under Securitize’s regulated framework. “Bitcoin’s role is becoming the foundation for real, yield-bearing capital markets,” said Ryan Chow, co-founder and CEO of Solv Protocol. “As regulated on-chain markets emerge, Bitcoin will underpin a new generation of yield, credit, and liquidity infrastructure, where demand for yield-bearing Bitcoin with RWA-backed yields replaces passive treasuries as the next phase of institutional adoption.” The deployment will also utilize Bluprynt’s Know-Your-Issuer (KYI) system to verify assets and issuers. The move comes a little over a month after Plume announced it would be acquiring Dinero, the.

The post Bybit Opens ‘Vault of Legends’ With 500, 000 USDT com. Dubai, UAE, November 18th, 2025, Chainwire Bybit, the world’s second-largest cryptocurrency exchange by trading volume, is thrilled to announce its final and most prestigious event of the year, the Vault of Legends, offering 500, 000 USDT in rewards for elite traders. The event, which runs from Nov. 18, 2025, at 10 a. m. UTC to Dec. 26, 2025, at 10 a. m. UTC, invites top-performing users to earn and redeem points for premium rewards through Bybit’s VIP program. Points can be redeemed until Dec. 31, 2025, at 11: 59 p. m. UTC. Paths to Prestige Participants can choose between two trading paths, each designed to reflect distinct trading styles. The Path of Precision caters to strategic spot traders who prioritize consistency and measured decision-making, while the Path of Momentum rewards derivatives traders who thrive on volatility and quick execution. Each trade contributes to a participant’s point total, allowing users to progress toward the event’s exclusive rewards. Legendary Rewards The Vault of Legends contains four categories of rewards curated specifically for VIP participants: Solid Gold (USDT Airdrops) Symbolizing stability and consistent performance. Everbright Crystal (MNT Airdrops) Representing shared growth within the Bybit ecosystem. Rare Relic (Bybit Mystery Boxes) Collectible items available only to exceptional traders. Golden Compass (Nansen Pro Subscriptions) Advanced analytical tools designed to enhance trading decisions. Each reward highlights an aspect of trading excellence, from reliability and insight to rarity and growth potential. Traders accumulate points through market activity and can redeem them directly within the vault. Points may also be used for Vault Scratch Cards, offering additional opportunities to win during the event period. The more consistent a trader’s engagement, the greater their share of the 500, 000 USDT prize pool. The Vault of Legends marks Bybit’s closing chapter of 2025’s VIP campaigns, underscoring its focus on rewarding consistent performance,.

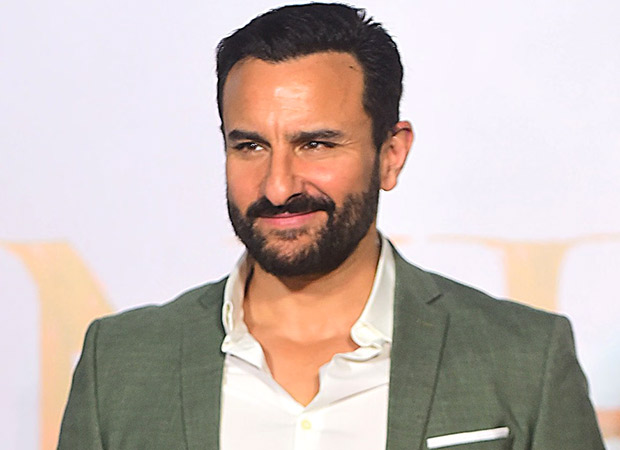

Bollywood actor Saif Ali Khan has added yet another prime asset to his real estate portfolio, this time in Mumbai’s thriving commercial district of Andheri East. According to property registration documents, the actor has purchased two office units in the Kanakia Wallstreet building for a total consideration of Rs. 30. 75 crore. The combined area of the newly acquired offices measures 5, 681 sq ft and includes six dedicated parking spaces. The seller of the property is Apiore Pharmaceutical, a US-based pharma company, as reflected in the registration filings. The deal was arranged by Volney, a real estate advisory and investor network firm. The transaction was officially registered on November 18, 2025, with a stamp duty of Rs. 1. 84 crore and a registration fee of Rs. 60, 000. Industry experts note that Andheri East has rapidly emerged as one of Mumbai’s busiest commercial corridors, attracting corporates, global enterprises, and creative firms due to its improved connectivity and infrastructure. Volney’s founder, Rohan Sheth, described the area as a market that combines accessibility with strong rental prospects, adding that it continues to draw long-term investors. Saif’s new commercial investment also places him among several high-profile names who have recently secured space in the vicinity. Elon Musk’s satellite internet company, Starlink Satellite Communications Private Limited, recently leased a 1, 294 sq. ft. office in the nearby Chandivali area for a five-year period, with total rent valued at Rs. 2. 33 crore. Additionally, the same building previously housed leased offices where Hrithik Roshan and Rakesh Roshan acquired three commercial units earlier this year for about Rs. 31 crores through HRX Digitech LLP. Beyond his latest acquisition, Saif Ali Khan is already known for his premium residential and commercial holdings across Mumbai. He currently resides in a high-end apartment in Bandra West, a property he purchased nearly a decade ago for Rs. 24 crores. Records also show that he bought a sprawling 6, 500 sq. ft. apartment in April 2012 for Rs. 23. 50 crore from Satguru Builders, further cementing his presence in the city’s luxury real estate landscape. With his latest investment, the actor continues to strengthen his position not just in cinema but also in Mumbai’s top-tier property market. Also Read: Dining with the Kapoors Trailer: Netflix brings together Bollywood’s first family for a grand tribute to Raj Kapoor.