Jaylen Wells and Cedric Coward have overtaken Jaden Hicks and Jaylen Watson as the best Coug duo in pro sports. “Mr. Consistent” Mouhamed Gueye turned into “Mr. Backup” with Jalen Johnson returning to the lineup. Klay Thompson is still shooting lights out. Here is a breakdown of how all the NBA Cougs performed this week:.

Tag: significantly

Another 26 people died “without fixed abode” in OC in October, 269 for the year thus far, the lowest number since the beginning of COVID-19 era. However, in 2019, the last full year before the onset of COVID-19 the death toll was 166 at this point the year. Voice of OC is Orange County’s nonprofit newsroom. We rely on donations from people like you to sustain our news agency. Please make a contribution today:.

[PRESS RELEASE San José, Costa Rica, November 24th, 2025] Leading Non-Custodial Exchange Honored for Platform Excellence, Security, and Innovation ChangeHero, a major instant cryptocurrency exchange platform, today announced it has received three prestigious nominations from World Business Outlook in their 2025 Awards program: Best Instant Crypto Swap Platform Global 2025, Most Secure Non-Custodial Exchange [.].

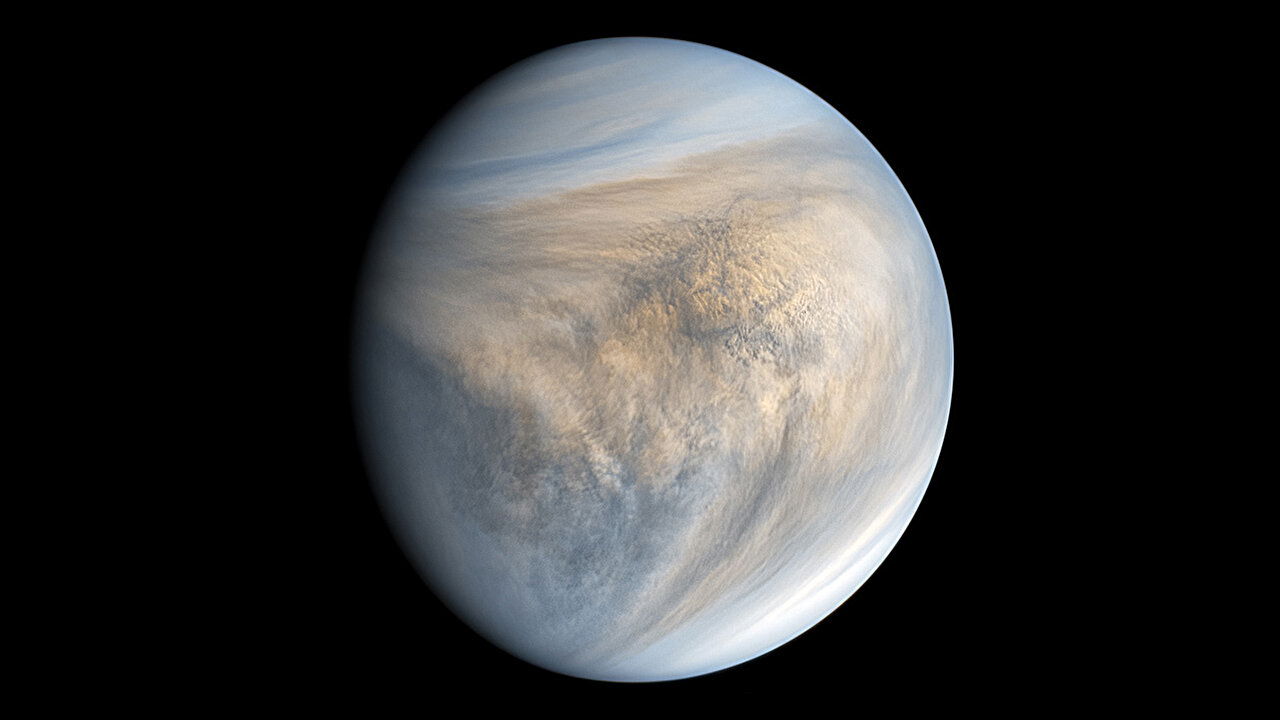

Imagine storms fiercer than the strongest hurricanes on Earth, blowing nonstop all the way around an entire planet. This is exactly what happens on Venus, where winds at the cloud tops race around the planet at speeds of more than 100 metres per second. Even more astonishing is that Venus itself rotates very slowly [.] The post Scientists discover what really powers Venus’s wild, planet-encircling winds appeared first on Knowridge Science Report.

The first booster in the new generation of Starship vehicles suffered significant damage during a Nov. 21 test, adding to doubts about the vehicle’s development schedule. The post First next-generati.

The post Japan economy sees 1. 8% GDP drop in Q3 appeared com. Japan’s economy shrank 1. 8% on an annualized basis in the July-September quarter, marking its first decline in six quarters. The slowdown arose from softer exports, weak consumer spending, and regulatory pressures. The contraction, slightly below economists’ expectations, highlights the ongoing fragility of Japan’s economic recovery. Exports weighed heavily on growth, as trade tensions-especially tariffs on shipments to the United States-reduced output. Net external demand is subtracted from the overall quarterly growth. Private consumption, which makes up more than half of Japan’s GDP, has grown by only 0. 1%. High living expenses and stagnant wages have led households to be cautious, with limited discretionary spending on goods and services. Meanwhile, housing investment suffered too on the back of changes in building regulations, as well as tighter financing, with residential expenditure plunging. On the bright side, businesses also increased capital spending by about 1%, driven by strong business sentiment and targeted investments in equipment and factories. Government rolls out major stimulus amid rising inflation Inflation remains high, with core consumer prices rising significantly above the Bank of Japan’s target of 2%. Soaring prices for staples such as energy and food continue to put pressure on households. Meanwhile, Prime Minister Sanae Takaichi is preparing an ambitious economic stimulus package, valued at over ¥17 trillion (around US$110 billion). Measures are expected to include subsidies on electricity and gas bills, cuts to gasoline taxes, targeted tax breaks, and strategic investment in growth industries such as AI and semiconductors. The government plans to fund the package through a large supplementary budget, likely exceeding last year’s additional spending of ¥13. 9 trillion. Policymakers struggle to ensure that they are providing strong fiscal support while being responsible for its fiscal implications. Monday’s GDP numbers boost political support for aggressive fiscal spending. But Japan’s already elevated public debt raises concerns about.

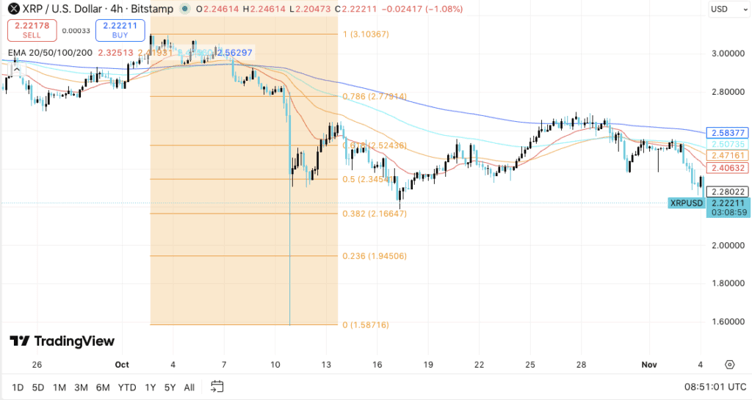

The post Ripple Whales Are Loading Up on Mutuum Finance investors, as the price has tumbled by over 10% due to a loss of bullish momentum. According to whale on-chain movement, XRP whales are not leaving the market, they are actually investing in a new crypto coin called Mutuum Finance (MUTM). With a price of only $0. 035, Mutuum Finance is one of the most popular new coins currently circulating within the crypto market because of its DeFi lending mechanism and real yield system and growth rate for the new crypto coin. With Stage 6 of its presale already being 85% sold, Mutuum Finance is one of the top candidates for next crypto to explode for Q4 of this year and into 2026 because demand is escalating at a rate that defies estimates and predictions currently available on market research platforms available online today. XRP Price Pressure Intensifies XRP has had a tough week, falling more than 10% as it maintains its tight range between $2. 16 and $2. 52, exactly on the Fibonacci support level of 0. 382. While efforts are being made by bulls to protect this region, presently, however, XRP is finding it tough to move past its EMA resistance levels, thereby preventing it from moving up significantly. To get its momentum back, XRP would need to get past its present resistance of $2. 52, potentially opening up a way towards $2. 77-$3. 10. But if this resistance is not negated, then forecasts point towards a possible fall towards $1. 94. However, one thing that is keeping market participants up is that open interest is increasing, thereby foretelling that soon a huge volatility is due, though whether it would be up or down is still unclear. It is this kind of uncertainty that has made many investors, who would have liked more predictable.

The post Can ETH Flip Key Resistance? Whales Move From Solana to AP Amid 50X Growth Forecasts appeared com. The crypto market is showing signs of life after the Ethereum price regained a key level. But can it revisit its 30-day high? Meanwhile, an interesting trend has emerged during the recent market pullback: Solana coin whales are doubling down on Digitap (AP), hailed as the best crypto to buy now. At the forefront of the PayFi and banking revolution, Digitap is arguably the most promising crypto to buy now. Interestingly, it is in its early stages, priced at $0. 0268. Significantly undervalued and with bold forecasts flying-a 50x surge-it may be the best crypto presale of 2025. Can the Ethereum Price Break Past $4,000? After dropping to $3,000 this week, the Ethereum price is slowly reclaiming lost levels. Bulls have managed to push the altcoin price above $3,300, which may be the start of a strong rebound. A key level to watch is $4,000, which will not only boost investors’ confidence. The Ethereum price flipping its monthly resistance of $4,755 into support could push the altcoin into price discovery mode. Finally, a new ETH high will be a relief, as it signals the start of altseason. Inflows into ETH ETFs will also contribute to the Ethereum price rally. With a reversal unfolding, ETH might be a good crypto to buy now. Solana Coin Underwhelms Despite Bullish Catalysts SOL ETFs going live on Wall Street was supposed to be a bullish catalyst-many analysts saw it as the “best crypto to buy now” then. However, reality has been different. Despite inflows into this exchange-traded fund, the Solana coin price is in a downtrend. On its weekly chart, the altcoin is down nearly 20%. Even more concerning is the 30% downtrend on its monthly chart, giving a bearish outlook. Currently, the Solana coin hovers around $160, trading below its 30-day high of $235. Meanwhile,.

Bill Belichick bests Frank Reich in NFL reunion game