The post XRP Tests Critical $1. 88 Support Zone Amid Market Uncertainty appeared com. Selling pressure builds up, and XRP declines to the level of $1. 88. Traders pay keen attention to price action testing macro support in a market that is losing its supply. XRP has found a turning point in its recent price direction. The digital asset fell under the support zone of $1. 93. The pressure to sell has been escalating in the market. As indicated by Skipper_XRP on X, XRP has recently gone below crucial support levels. The decision is an indication of repositioning in the market among traders. Technical factors have dominated short-term price action Source- Skipper_XRP You might also like: XRP Whales Load Up as $2. 50 Breakout Looms Where Fear Meets Opportunity The cryptocurrency is currently testing the $1. 88 mark. This is a zone of macro . 5 Fibonacci support. This is a very strong level of support, according to PrecisionTrade3 on X. It is always the scariest at support, remember, PrecisionTrade3 tweeted on X. “No need to worry or panic!” The critical line has been established at the 1. 88 mark level. Any prolonged decline below this level may precipitate additional losses. The second significant support is at 1. 85. You might also like: XRP Coiling: Expansion Phase Imminent After Accumulation? Market Dynamics Shift Dramatically Although the inflows of spot ETFs have not ceased in the past few weeks, current displacement is driven by technical positioning. Basic developments have been overshadowed by chart patterns. Traders are interested in short-term prices, as opposed to long-term stories. The market supply of XRP has significantly declined during the period of 2025. Tokens available fell by 45 per cent since January. Supply dropped to around 1. 6 billion, compared to 3. 9 billion earlier. Trading below $1. 88 persistently keeps the downside pressure. Nonetheless,.

Tag: source

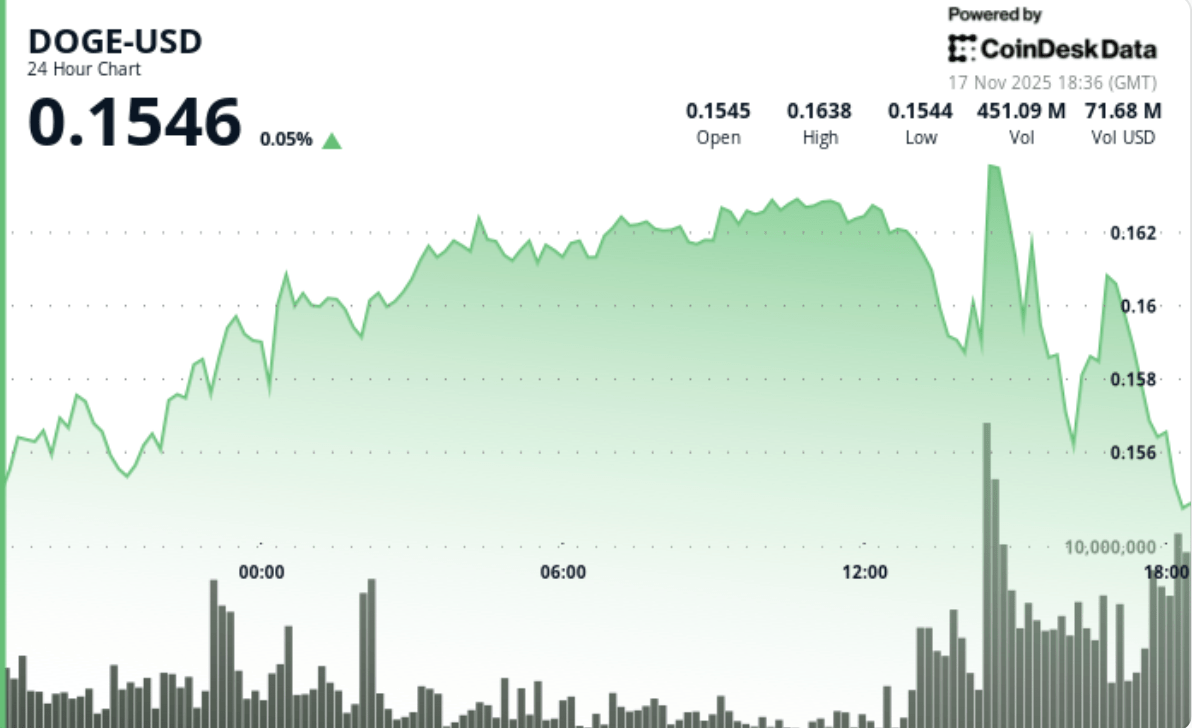

The post Bitcoin Death Cross Could Mean This for Dogecoin on the Fear & Greed Index. Analysts warn that while the Death Cross doesn’t guarantee further crashes, it tends to pressure high-beta assets like DOGE during liquidity contractions. Whale selling and accelerating spot Bitcoin ETF outflows contributed to broader risk-off contagion. Meme coin flows tightened as traders rotated into higher-liquidity majors, despite DOGE seeing intermittent whale accumulation events. Price Action Summary DOGE climbed 4. 41% to $0. 156, with volume spiking 29. 6% above weekly averages. Strong bid defense appeared at $0. 1551-$0. 1580, where buyers absorbed heavy sell pressure. DOGE broke above $0. 1640 intraday before trending lower into the close. Final-hour profit-taking triggered a 2. 57% drop, sending DOGE back toward key support. DOGE traded within a 5. 8% intraday range, tracking broader BTC-driven volatility. Technical Analysis Dogecoin opened the session with clear bullish structure, building an ascending pattern driven by strong volume at the $0. 158 support zone. The rally benefitted from broader market stabilization ahead of the BTC Death Cross event but failed to produce a decisive breakout beyond the $0. 163-$0. 165 resistance band. The afternoon volume spike 1. 26B DOGE traded confirmed aggressive defense of support and suggested institutional accumulation was present beneath market price. However, the tone shifted dramatically into the close. As BTC slid further below $94,000 and the Death Cross narrative spread across futures desks, DOGE experienced algorithmic rotational selling identical to.

The post Singapore Pioneers Tokenized Government Bonds With CBDC Settlement appeared com. Revolutionary: Singapore Pioneers Tokenized Government Bonds With CBDC Settlement Skip to content Home Crypto News Revolutionary: Singapore Pioneers Tokenized Government Bonds with CBDC Settlement Source:.

The post XRP Price Today: XRP Forms Bullish ‘W’ Pattern as Traders Eye Breakout Above $2. 53 appeared com. XRP is showing renewed signs of bullish momentum as technical indicators flash a potential breakout signal, with traders closely watching the emerging ‘W’ pattern that could ignite a rally toward $3. 25. After several days of consolidation, the XRP price is building strength near a critical resistance zone, sparking optimism among market participants. However, growing whale activity and profit-taking suggest that traders remain cautious, waiting for stronger confirmation before committing to the next leg up. XRP Price Holds Steady Amid Profit-Taking and Rising Volume As of November 11, 2025, XRP trades at $2. 45, marking a modest 1. 16% daily decline from $2. 48. Despite the dip, trading volume surged by more than 34%, reaching $6. 14 billion in the last 24 hours. Such an increase in volume during a pullback often signals repositioning among traders rather than panic selling, indicating potential accumulation ahead of XRP’s next move. XRP was trading at around $2. 45, down 3. 15% in the last 24 hours at press time. 75%, pushing its total market capitalization to roughly $147. 5 billion. The trend suggests that while short-term selling persists, the broader structure remains bullish as long as prices hold above the $2. 15-$2. 20 demand zone. Analysts Spot Bullish ‘W’ Formation Technical analysts are paying close attention to a bullish “W” pattern forming on the 12-hour XRP/USDT chart, a classic double-bottom structure signaling reversal potential. According to crypto trader Steph_iscrypto, “support around $2. 00 remains firm, with a possible breakout above $2. 53 that could propel XRP toward $3. 25 if volume confirms the move.” The analysis highlights a bullish “W” pattern on the 12-hour XRP/USDT chart, indicating strong support at $2. 00 and a possible breakout above $2. 53 toward $3. 25.

The post How Base Transforms Institutional Payments appeared com. Revolutionary JPM Coin Expansion: How Base Transforms Institutional Payments Skip to content Home Crypto News Revolutionary JPM Coin Expansion: How Base Transforms Institutional Payments Source:.

The post Bullish $115K Target Withcom. Bitcoin Price Prediction: Bullish $115K Target Within Reach If This Key Metric Holds Strong Skip to content Home Crypto News Bitcoin Price Prediction: Bullish $115K Target Within Reach If This Key Metric Holds Strong Source:.

The post From Stable Trading To Wild Speculation appeared com. Ethereum Market Shifts Dramatically: From Stable Trading To Wild Speculation Skip to content Home Crypto News Ethereum Market Shifts Dramatically: From Stable Trading to Wild Speculation Source:.

The post Amazing Pyramiding ZEC Longs Strategy Nets Trader $5. 65 Millicom. Amazing Pyramiding ZEC Longs Strategy Nets Trader $5. 65 Milli65 Million Unrealized Profit Source:.

The post Crypto Leaders React to Mamdani’s Win: Will New York’s Blockchain Adoption Come to a Halt? appeared com. Crypto Leaders React to Mamdani’s Win: Will New York’s Blockchain Adoption Come to a Halt? | Bitcoinist. com Sign Up for Our Newsletter! For updates and exclusive offers enter your email. This website uses cookies. By continuing to use this website you are giving consent to cookies being used. Visit our Privacy Center or Cookie Policy. I Agree Source:.

The post HBAR Price Climbs as ETF Adds 380 Millicom. The Canary HBAR ETF now holds over 380 million Hedera tokens worth $66 million, signaling growing institutional confidence. Despite short-term consolidation, analysts expect renewed strength as ETF inflows and enterprise adoption rise. With the asset trading at $0. 17 and showing bullish momentum, investors anticipate potential upside amid expanding network activity and market stability. Canary HBAR ETF Expands Holdings Above 380 Million Tokens New portfolio data released on November 5, 2025, shows that the Canary ETF (HBR) has increased its exposure to Hedera Hashgraph, now holding over 380 million tokens. According to market data analyzed by ALLINCRYPTO, the fund’s total holdings are currently valued at around $66 million, reflecting the latest market price. This accumulation marks one of the largest institutional positions in Hedera to date, indicating growing investor participation in the token’s ecosystem. This suggests near-complete allocation toward the asset, indicating a focused investment strategy on assets backed by enterprise adoption and blockchain utility. With this expansion, the fund now represents a key institutional vehicle for gaining exposure to its token economy, which continues to attract attention for its scalability and energy-efficient network design. Institutional Confidence Builds Around Hedera’s Growth Outlook The ETF’s accumulation aligns with broader developments across the ecosystem. Over recent months, the token has seen an increase in tokenized asset projects, enterprise partnerships, and decentralized applications. These trends have strengthened institutional engagement, positioning it as a growing component of blockchain-based portfolios. The move by Canary ETF also reflects interest in assets with practical use cases in real-world applications such as payments, supply chain tracking, and decentralized identity management. Market observers note that funds of this scale often influence liquidity depth and overall market visibility for the underlying asset. Should.