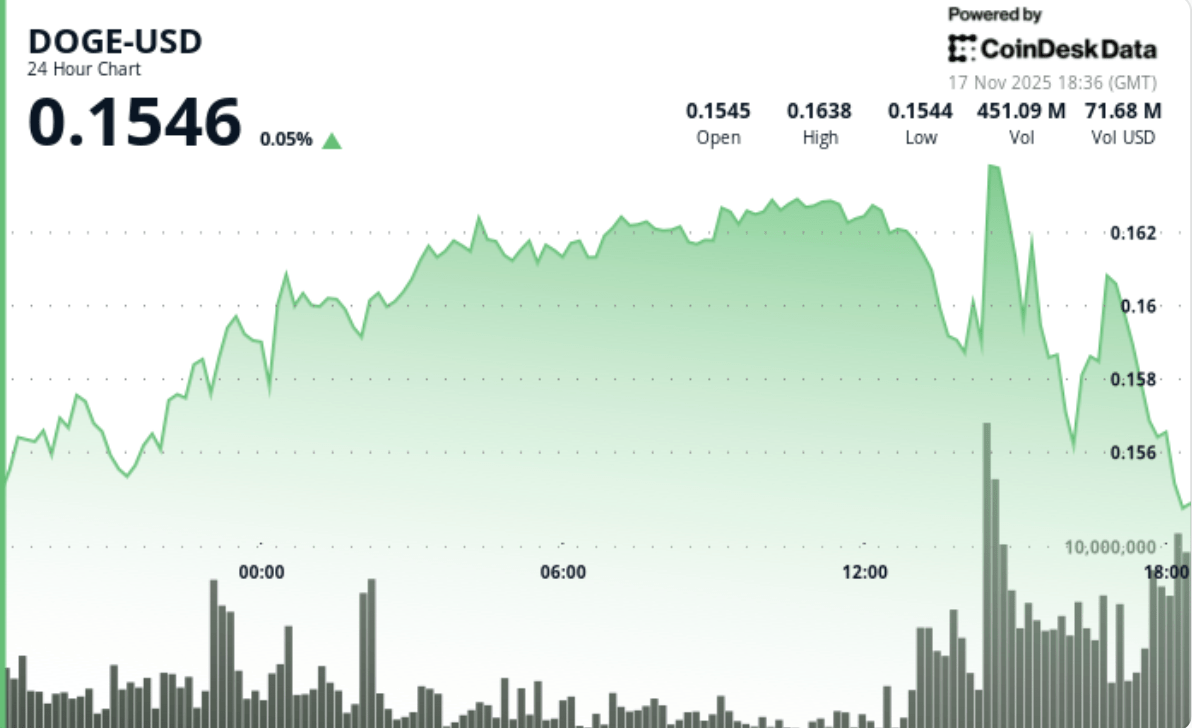

The post Bitcoin Death Cross Could Mean This for Dogecoin on the Fear & Greed Index. Analysts warn that while the Death Cross doesn’t guarantee further crashes, it tends to pressure high-beta assets like DOGE during liquidity contractions. Whale selling and accelerating spot Bitcoin ETF outflows contributed to broader risk-off contagion. Meme coin flows tightened as traders rotated into higher-liquidity majors, despite DOGE seeing intermittent whale accumulation events. Price Action Summary DOGE climbed 4. 41% to $0. 156, with volume spiking 29. 6% above weekly averages. Strong bid defense appeared at $0. 1551-$0. 1580, where buyers absorbed heavy sell pressure. DOGE broke above $0. 1640 intraday before trending lower into the close. Final-hour profit-taking triggered a 2. 57% drop, sending DOGE back toward key support. DOGE traded within a 5. 8% intraday range, tracking broader BTC-driven volatility. Technical Analysis Dogecoin opened the session with clear bullish structure, building an ascending pattern driven by strong volume at the $0. 158 support zone. The rally benefitted from broader market stabilization ahead of the BTC Death Cross event but failed to produce a decisive breakout beyond the $0. 163-$0. 165 resistance band. The afternoon volume spike 1. 26B DOGE traded confirmed aggressive defense of support and suggested institutional accumulation was present beneath market price. However, the tone shifted dramatically into the close. As BTC slid further below $94,000 and the Death Cross narrative spread across futures desks, DOGE experienced algorithmic rotational selling identical to.

https://bitcoinethereumnews.com/bitcoin/bitcoin-death-cross-could-mean-this-for-dogecoin-doge-price/

Bitcoin Death Cross Could Mean This for Dogecoin (DOGE) Price

Be First to Comment