Suspects face charges in 5-year-old Idaho boy’s 2021 disappearance

Category: general

Alabama Police Get Revenge Using ‘Old School Rules’ After High School Seniors Cover HQ With Toilet Paper

Catholic priest who said he wanted to bomb mosques avoids jail

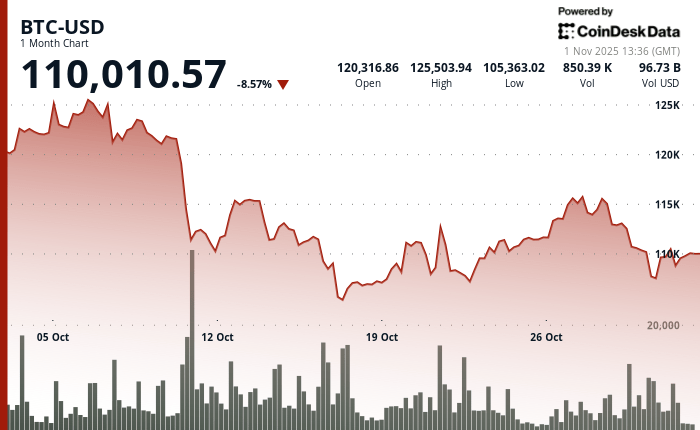

The post Bitcoin Broke the Uptober Streak, but a Handful of Altcoins Managed to Finish Higher appeared com. Bitcoin closed October lower, snapping its six-year “Uptober” streak while BNB eked out a gain as a mid-month jolt left most majors stuck below early highs. The shock landed Oct. 10, when President Donald Trump threatened steep new tariffs on China amid rare-earth tensions, touching off a broad risk-off move. Bitcoin slid from roughly the low $120,000s toward about $105,000 in fast trade, and altcoins fell harder as thin liquidity met heavy leverage. Over Oct. 10-11, derivatives venues auto-liquidated an estimated tens of billions of dollars in positions and more than half a trillion dollars in market value evaporated before a shaky rebound set a floor. It was a macro headline colliding with crowded positioning, not a crypto-specific catalyst. By month’s end, CoinDesk Data showed bitcoin finishing October in the red, the outcome that breaks what traders call “Uptober.” On CoinGlass’s Bitcoin Monthly Returns heat map, October 2025 is the first red October since 2018 and ends a green run that stretched from 2019 through 2024. That lore matters because the pattern persisted across very different regimes late-cycle surges and post-sell-off recoveries alike so a miss in 2025 resets expectations and reminds traders that seasonality is a tendency, not a promise. CoinGlass’s Bitcoin Monthly Returns Heat Map (CoinGlass) The month’s shape was remarkably consistent across one-month TradingView charts. Bitcoin started firm, suffered the synchronized Oct. 10-11 air pocket, then spent the back half of the month climbing without retaking its early peak. Ether traced the same flush-base-fade arc and stalled beneath the round-number band it tested in the first week. Solana and XRP echoed that rhythm with a sequence of lower highs into the final sessions. In practical terms, late rebounds did not flip resistance into support, which is why the monthly candles printed red for those four.

The post Evernorth’s $1 Billion+ XRP Purchase Marks Largest Single Institutional Acquisition for Digital Asset ⋆ ZyCrypto appeared com. Ripple-backed digital asset firm Evernorth Holdings acquired a large stack of XRP. The large purchases swung market sentiments upward amid new whale inflows to the asset. This year, corporate crypto treasuries have increased their holdings as more firms seek to diversify their balance sheets. Institutional Investors Raise XRP Holdings On-chain data shows Evernorth Holdings accumulated more than 388. 7 million XRP worth over $1 billion after flagging up its crypto treasury. This marks a significant milestone for the company, which launched on Oct 20. Evernorth is considering listing the publicly traded XRP company on Nasdaq, much to the delight of the community. Asheesh Birla, Evernorth CEO, has pledged more collaborations with the asset, including deals with Rippleworks and the SBI Group. Birla stepped down from Ripple to take charge of Evernorth, thereby strengthening the connection between the two entities. Plans are also underway to finalize a merger with Armada Acquisition Corp. II. The company is also set to raise about $1 billion for crypto purchases. “We’re backed by a world-class group of investors and leaders, including SBI, Ripple, Arrington Capital, Pantera Capital, and Kraken firms that share our conviction in XRP’s future. For the first time, XRP has clear regulatory standing in the United States, opening the door for large-scale adoption,” Birla added. He described the company as a trusted and transparent bridge to public markets at a time when institutional demand for cryptocurrency is surging. Previously, XRP faced negative pressure following the lawsuits filed by the United States Securities and Exchange Commission (SEC) alleging the sale of unregistered securities. Advertisement President Trump’s second term altered the entire dynamic with a pro-crypto approach. This signaled the bulls to ramp up investment as authorities ushered in clear rules. Top assets, such as Bitcoin (BTC), Ethereum (ETH),.

Two people have died and at least six others were injured on Saturday in a shooting on the Greek island.

Madrid Will Pay For Woody Allen’s Next Movie If He Uses ‘Madrid’ In Title

Berkshire again proved a net seller of stocks as its cash balance swelled above $380 billion.

‘The Chair Company’: When You Can Watch Episode 4

TLDR Michael Burry posted his first warning on X since April 2023, suggesting a market “bubble” exists but sees no clear way to profit from it Burry changed his profile name to “Cassandra Unchained,” referencing the Greek figure whose true predictions were never believed He is not currently shorting or buying the market, choosing to [.] The post Big Short Investor Michael Burry Breaks Silence to Warn of Market Bubble appeared first on CoinCentral.