Bitcoin closed October lower, snapping its six-year “Uptober” streak, while BNB eked out a gain as a mid-month jolt left most majors stuck below early highs.

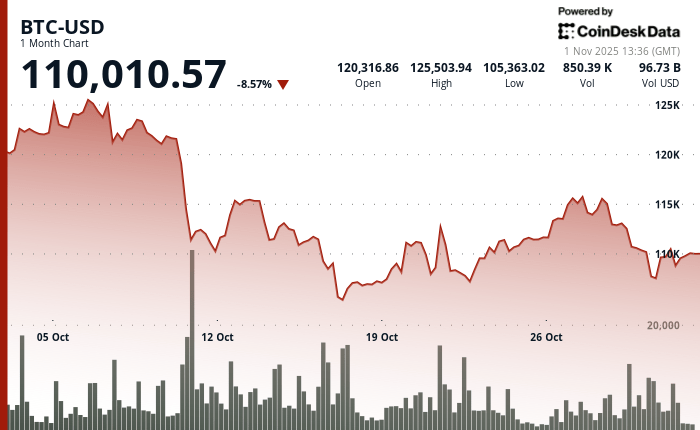

The shock landed on October 10, when President Donald Trump threatened steep new tariffs on China amid rare-earth tensions, touching off a broad risk-off move. Bitcoin slid from roughly the low $120,000s toward about $105,000 in fast trade, and altcoins fell harder as thin liquidity met heavy leverage.

Over October 10-11, derivatives venues auto-liquidated an estimated tens of billions of dollars in positions, and more than half a trillion dollars in market value evaporated before a shaky rebound set a floor. This was a macro headline colliding with crowded positioning, not a crypto-specific catalyst.

By month’s end, CoinDesk Data showed Bitcoin finishing October in the red, breaking what traders call “Uptober.” On CoinGlass’s Bitcoin Monthly Returns heat map, October 2025 is the first red October since 2018 and ends a green run that stretched from 2019 through 2024.

This lore matters because the pattern persisted across very different regimes—late-cycle surges and post-sell-off recoveries alike. So, a miss in 2025 resets expectations and reminds traders that seasonality is a tendency, not a promise.

The month’s shape was remarkably consistent across one-month TradingView charts. Bitcoin started firm, suffered the synchronized October 10-11 air pocket, then spent the back half of the month climbing without retaking its early peak.

Ether traced the same flush-base-fade arc and stalled beneath the round-number band it tested in the first week. Solana and XRP echoed that rhythm with a sequence of lower highs into the final sessions.

In practical terms, late rebounds did not flip resistance into support, which is why the monthly candles printed red for those four.

BNB broke ranks. It absorbed the mid-month downdraft, carved higher lows through the final third of the month, and closed October about 4.2% higher—leaving a green print while peers slipped.

Outside the top 10, several names also finished October up, including ZEC, XMR, and WBTC, underscoring that pockets of strength persisted beneath the surface even as leaders cooled.

Why the “Uptober” brand stuck is straightforward. It is a community nickname born from Bitcoin’s tendency to post gains in October over the past decade, reinforced by that CoinGlass grid showing every October from 2019 through 2024 in the green.

Flipping the cell to red this year does not erase the historical tilt, but it does nudge risk management back to tape confirmation rather than calendar confidence.

The numbers that different dashboards show can diverge for mundane reasons. CoinGlass presents calendar-month, close-to-close results that isolate October. Rolling 30-day readings on major trackers update continuously and often include early-October highs, so they can show a steeper decline into November 1 even when the strict calendar month looks milder.

The direction is the same; the measurement window drives the magnitude.

https://bitcoinethereumnews.com/bitcoin/bitcoin-broke-the-uptober-streak-but-a-handful-of-altcoins-managed-to-finish-higher/?utm_source=rss&utm_medium=rss&utm_campaign=bitcoin-broke-the-uptober-streak-but-a-handful-of-altcoins-managed-to-finish-higher

Be First to Comment