I was very surprised to hear the news that professional boxing savant Jake Paul will be squaring off against former unified heavyweight champion Anthony Joshua next month. It will be Paul’s biggest test in the ring to date, both literally and figuratively. The match is set to take place Dec. 19 at the Kaseya Center [.].

Category: general

Eric Dane plays a firefighter with ALS in NBC’s Brilliant Minds, reflecting his own diagnosis while raising awareness about the disease.

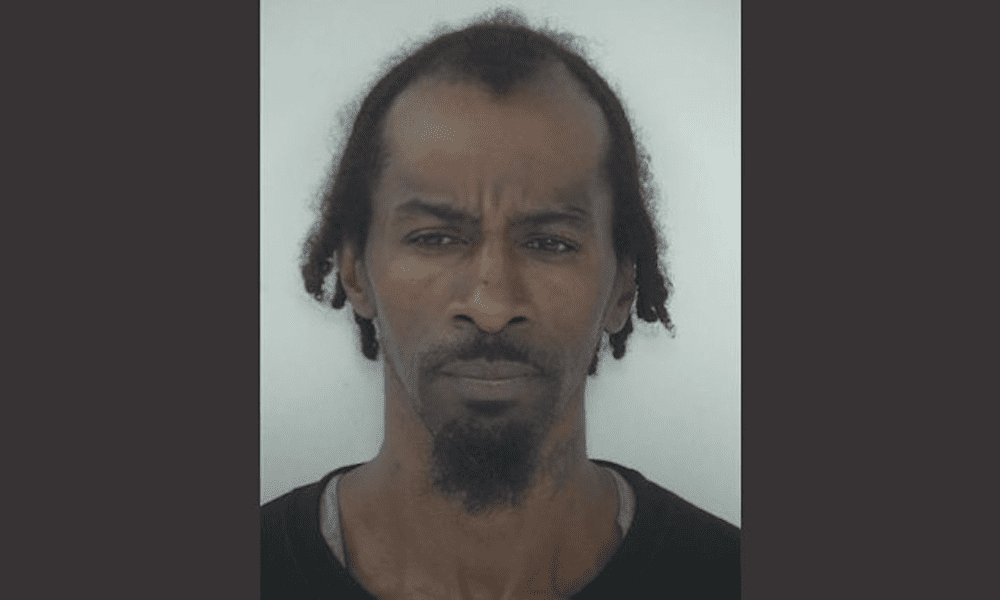

A Fayette County jury has found Terrence Brown guilty of armed robbery, aggravated assault, and possession of a firearm by a convicted felon, according to the District Attorney’s Office. Prosecutors [.].

The post 63K Bitcoin Exits Long-Term Wallets: A Surge of Speculative Short-Term Buying appeared com. Bitcoin is struggling to reclaim momentum as it trades below the critical $90,000 level, with selling pressure dominating the market and fear spreading rapidly. Many analysts are leaning toward calling the start of a new bear market, arguing that Bitcoin likely topped in early October near $126,000. Momentum has weakened sharply since then, and investor behavior now reflects a shift toward risk-off positioning. This unprecedented transfer is clearly visible in the Long-Term Holder Net Position Change chart, which shows a massive red bar a negative daily difference signaling heavy outflows from long-term holder wallets. This type of behavior typically appears during late-stage bull markets or near local and cycle tops, when long-time investors with substantial profit margins begin realizing gains. At the same time, the corresponding Short-Term Holder Net Position Change chart shows a huge green bar, confirming that newer, more reactive market participants are buying these coins, often at elevated prices. Long-Term Holders Distribute as Short-Term Buyers Absorb Supply CryptoOnchain explains that the current market structure is being shaped by a clear divergence in behavior between Long-Term Holders (LTHs) and Short-Term Holders (STHs). LTHs historically considered the “strong hands” of the market are now heavily distributing, sending large amounts of Bitcoin into the market after months or even years of holding. At the same time, STHs are aggressively buying and accumulating this supply, often entering positions at elevated prices despite growing volatility. This dynamic is not inherently a bearish signal on its own. In fact, such transitions are common during late-stage bull markets, where early investors secure profits while new participants enter the market with.

AEW star Adam Copeland recently opened up about his retirement and when he wants to hang up his boots. He has been one of the top stars of the Jacksonville-based promotion.

Discover how childhood bonds with animals quietly shape your adult nervous system and why their steady love still lives in your body today.

Ole Miss and Lane Kiffin appear to have settled on a strategy to handle the coaching carousel circus surrounding the program at least for the next week. At Monday’s press conference, the Ole Miss coach said he’s only taking questions about the Egg Bowl. “I’m sure you’ve got a lot of other questions but Read more. The post Lane Kiffin repeatedly declines to answer questions about his future appeared first on Awful Announcing.

TLDR Senator Cynthia Lummis criticized JPMorgan for its anti-crypto stance and called for an end to Operation Chokepoint 2. 0. Lummis argued that JPMorgan’s actions damage public trust in traditional banks and hinder the growth of digital assets in the U. S. The dispute started when JPMorgan closed the accounts of Jack Mallers, CEO of the Bitcoin [.] The post Senator Cynthia Lummis Calls for End to Operation Chokepoint 2. 0, Criticizes JPMorgan appeared first on Blockonomi.