The 10 Best Animated Series For Adults

Category: general

Stocks got a lift from rising hopes that the Federal Reserve will cut its main interest rate again at its next meeting in December.

GOLDEN, COLO. UT Tyler men’s basketball delivered another complete team effort on Saturday night, picking up an 87-79 road win at Colorado School of Mines behind five players in double figures and a wire-to-wire performance that featured runs on both sides. The Patriots opened the game with poise, scoring the first four points behind a [.].

How to extract audio from a video file on iPhone

He posted a launch video ahead of a press event in Tallahassee. The post James Fishback launches campaign for Governor appeared first on Florida Politics Campaigns & Elections. Lobbying & Government.

UK government will buy tech to boost AI sector in $130M growth push

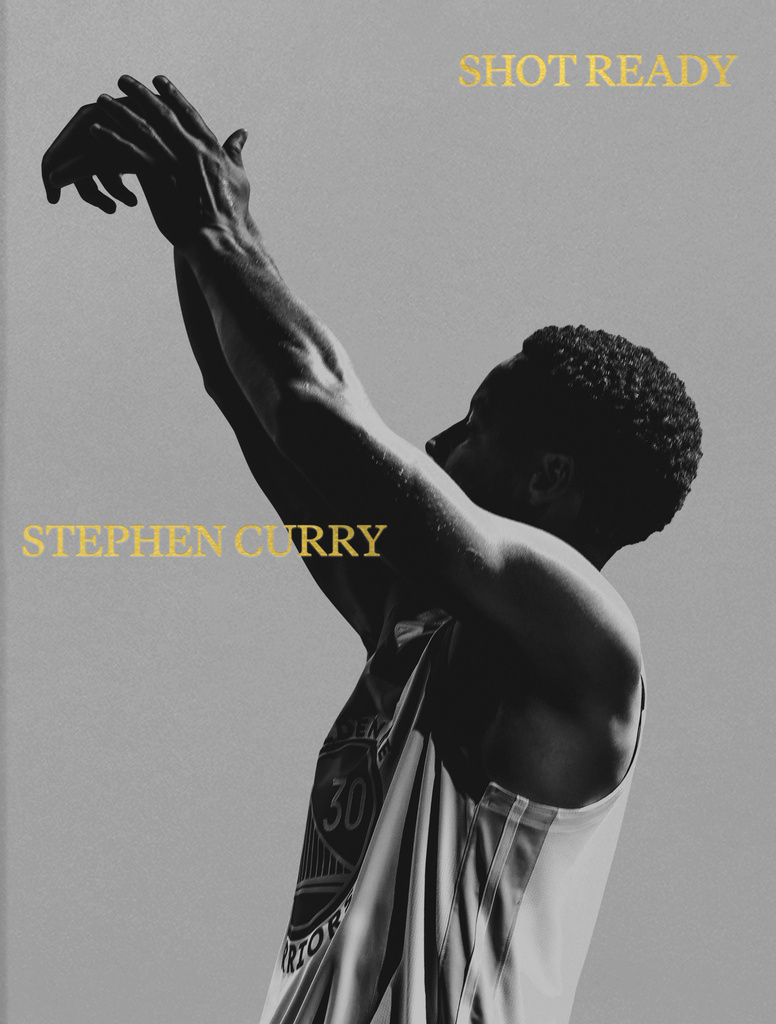

“Being shot ready requires practice, training and repetition, but it rewards that work with an unmatched feeling of transcendence.” That’s Golden State Warrior Stephen Curry in his new book, “Shot Ready.” The basketball star takes his readers from rookie to veteran, accompanied by inspiring words and photos. One doesn’t have to be into basketball to feel the greatness. One World. $50.

Tennis legend Martina Navratilova asked a burning question that most Americans want to know concerning the assassination of Charlie Kirk and an assassination attempt on US President Donald Trump.

Cases that could have been settled quickly for a fraction of the ultimate cost have instead become years-long courtroom battles.