Annoyed by constant Wi-Fi drops? Here’s the fix you need

Category: general

TIUA launches a national Christ-centered Family Restoration & Re-Entry Initiative to restore families, empower returning citizens, and strengthen communities through faith, education, chaplaincy training, and leadership development. This movement provides pathways for healing, economic stability, and spiritual transformation for individuals and families impacted by incarceration. [PR. com].

Jacobs Solutions: Affordable Now, Attractive For The Next Contraction

Almost 82 million people are expected to travel over Thanksgiving.

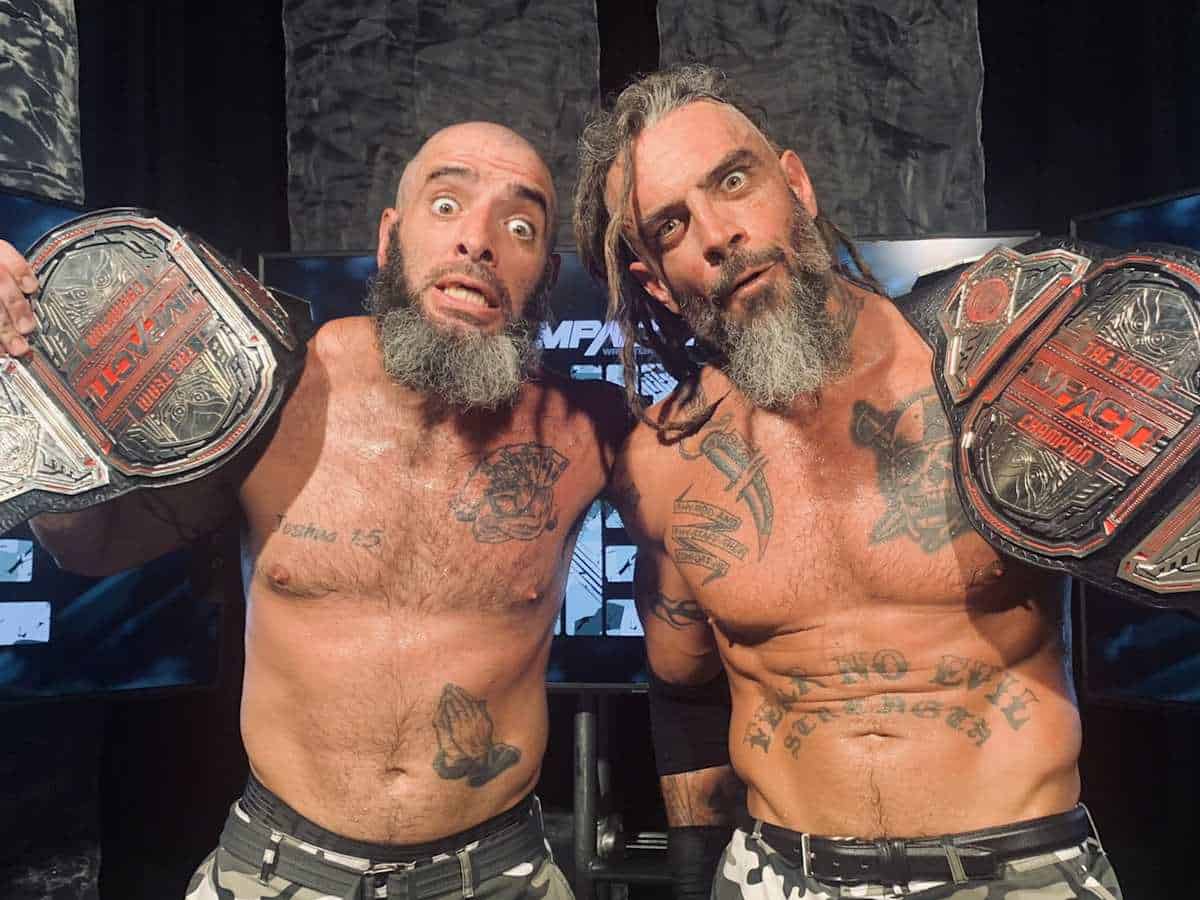

AEW President Tony Khan addressed the long-standing ban that kept the Briscoe Brothers off Warner Bros. Discovery networks following Mark Briscoe’s TNT Championship victory on Saturday. During the AEW Full Gear press conference, Khan confirmed that the executive responsible for preventing the team from appearing on television is no longer employed by the company. Mark [.] The post Tony Khan Confirms Executive Responsible For Briscoe Ban Is ‘Long Gone’ appeared first.

Recall alert! Check your cabinets and garages for these 6 products

They showed up empty-handed, sat down and waited to be served. Once the meal was finished, I had to ask them to help me clear the plates.

Thousands protested across Mexico on Saturday under the banner of “Generation Z,” denouncing rising violence after the public killing of an anti-crime mayor earlier this month. In Mexico City, a small group of hooded protesters tore down fences around the National Palace where President Claudia Sheinbaum lives, prompting a clash with riot police who deployed tear gas, according to Reuters witnesses.

McLaren has issued an apology to both Lando Norris and Oscar Piastri after the duo were disqualified from the F1 Las Vegas GP for excessive plank wear.

“Do India want to put 4 points at stake to gain 12?” – Aakash Chopra on the hosts needing to go for a win in IND vs SA 2025 2nd Test

Former India player Aakash Chopra has opined that the Indian team need to look for a win in the second Test against South Africa.