The post Journalist Dubbed “FED Spokesperson” Speaks Out on FED’s December Interest Rate Decision! “Unseen in 8 Years!” appeared com. As the US government shutdown continues, the Fed cut interest rates by 25 basis points in October in the absence of key economic data. With the end of the lockdown, all eyes are on the FED’s final interest rate decision for 2025 in December, and Wall Street Journal reporter Nick Timiraos, known as the FED spokesperson, shared his predictions for the FED’s December interest rate decision. Nick Timiraos, known as a FED insider, stated that the FED has a major disagreement on its interest rate decision. Major Disagreement Among Fed Members! Timiraos reported that there is a deepening disagreement within the Fed regarding the December interest rate cut. Timiraos noted that an unusual conflict has emerged between the hawkish and dovish figures of the Fed. The famous name stated that during Jerome Powell’s nearly eight-year tenure, there had never been such a level of separation before. “There is a rarely seen division among Fed members. Following the second interest rate cut at the end of October, the rhetoric of hawkish members has become even harsher. The hawks now believe that further rate cuts are risky.” Some Fed officials argue for a rate cut, citing slowing inflation and the limited economic impact of tariffs, while others cite sticky inflation and the impact of tariffs as reasons for not cutting rates. According to Timiraos, the US government shutdown and the disruption of the release of important data have further deepened this division among members. Nick Timiraos recently stated that Powell’s statement at his last press conference, “A rate cut in December is not a certainty,” was not a message to the market. According to Timiraos, Powell’s statement was a message aimed at explaining the division among FED members. With interest rates hovering around 3. 75%-4%, markets are still pricing in a rate cut.

Month: November 2025

Source: Bloomberg, 4:26

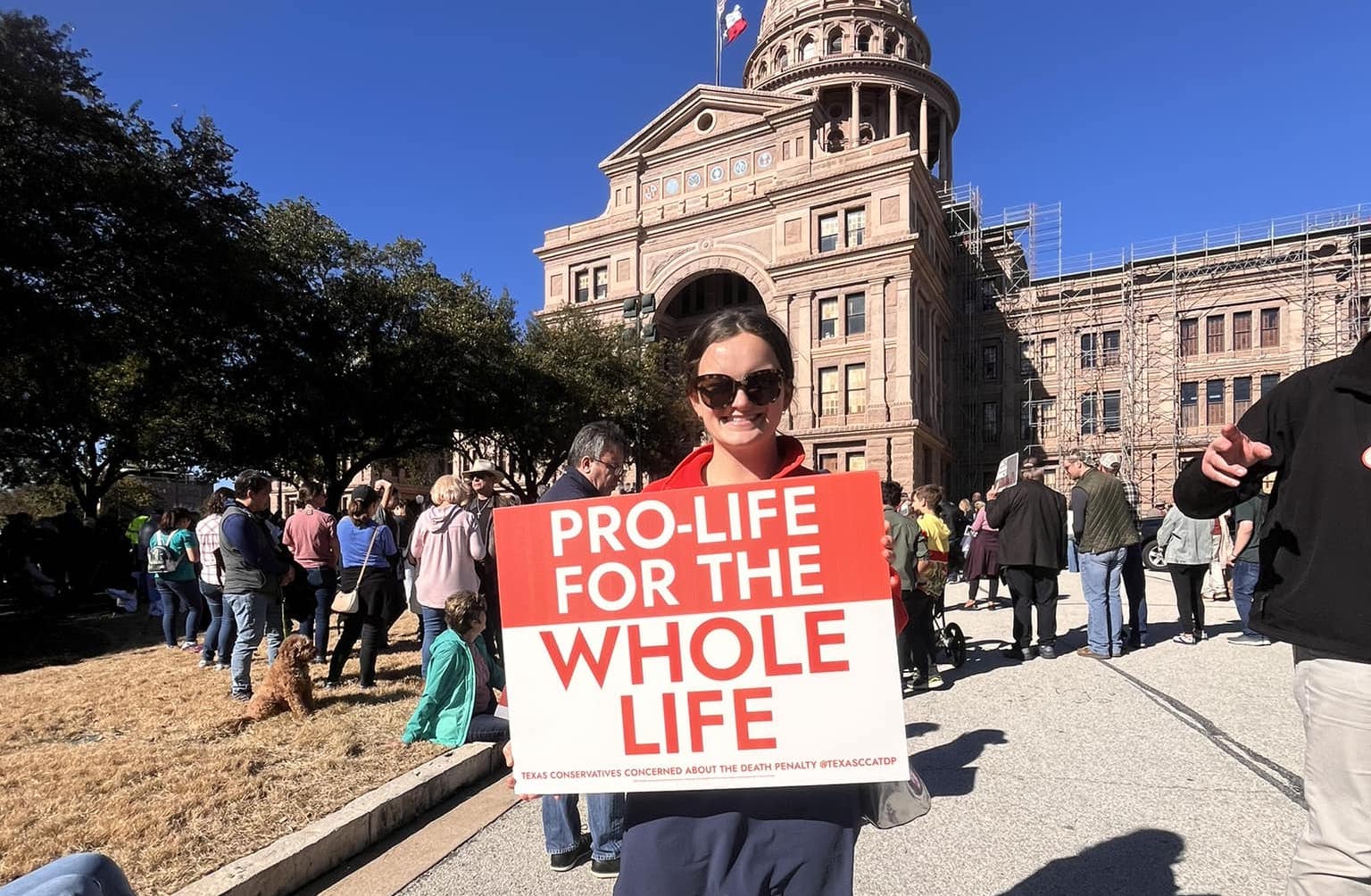

National support for the death penalty is at an all-time low, with younger adults from both major political parties spurning capital punishment. But in Texas’ execution chamber, the pace of lethal injections has not let up, even as some condemned Texans-including Melissa Lucio and Robert Roberson-have had their high-profile executions halted with only days or [.] The post Pro-Life, Anti-Death Penalty appeared first on The Texas Observer.

That should be all the information you need to solve for the Egyptian queen who was a lover of Julius Caesar and Mark Antony crossword clue! Be sure to check more clues on our Crossword Answers. The post Egyptian queen who was a lover of Julius Caesar and Mark Antony Crossword Clue appeared first on Try Hard Guides.

A new update related to Wendy Williams’ health surfaced on Tuesday. In its exclusive, TMZ reported that the TV host did not have frontotemporal dementia.

The Bay Area Reporter reports that since 1987, the daytime drama “The Bold and the Beautiful” has kept viewers enthralled with its tales of the glamourous life within the Los Angeles fashion industry. Read more at The Bay Area Reporter.

After Canon released the pretty incredible R6 Mark III with a slew of features never seen before in a prosumer scaled camera body, it seems that the rumor mill over in Sony land dialed it up to 12 as worry set in over the fact that the R6 Mark II was already the worlds best [.].

The post Bitwise Chainlink ETF Listed on DTCC, When Will It Launch? appeared com. Key Notes Bitwise’s spot Chainlink ETF has appeared on DTCC, a pre-trade market infrastructure platform. This is not an assurance that the US SEC will approve the fund. Grayscale has also filed an S-1 registration to list the spot Chainlink ETF. Bitwise’s spot Chainlink Exchange Traded Fund (ETF) has been listed on the Depository Trust and Clearing Corporation’s registry. This is usually a positive sign that the fund is gradually inching closer to its launch. At the same time, it is not a guarantee that the United States Securities and Exchange Commission (SEC) will greenlight the fund. Bitwise Inch Closer to Chainlink ETF Approval On Nov. 11, the Bitwise Chainlink ETF found its way to DTCC’s “active” and “pre-launch” categories. It was listed under the ticker CLNK. This suggests that there is an ongoing effort to launch the fund, and based on history, such a move is a strong indicator of its proximity to a greenlight. Still, it is not an assurance that the US SEC will approve the spot Chainlink ETF for trading. Bitwise Chainlink ETF LNK listed on DTCC pre-launch funds list 🔥INK pic. twitter. com/4sgYnxGkE5 Zach Rynes | CLG (@ChainLinkGod) November 12, 2025 Meanwhile, Bitwise Asset Management first submitted its S-1 registration for a spot Chainlink ETF that tracks LINK LINK $16. 10 24h volatility: 0. 3% Market cap: $11. 20 B Vol. 24h: $743. 55 M price in August. The firm noted that the shares of the trust will list on a US national exchange. However, Bitwise did not decide on the specific venue for listing the shares at the time. The ETF will be structured as a Delaware statutory trust. In addition, its Net Asset Value (NAV) will be linked to the CME CF Chainlink-Dollar Reference Rate (New York Variant), a benchmark maintained by CF Benchmarks. At the time of.