The post CZ Takes Aim At Peter Schiff, Questions Gold’s Verifiability Amid Fort Knox Audit Concerns appeared first has once again sparked discussion on X over the debate between gold and Bitcoin, taking a dig at critic Peter Schiff. Known for his sharp remarks, CZ pointed out one of gold’s key limitations compared to digital assets: its verifiability. CZ Sparks the Fort Knox Discussion This comes amid the growing.

Tag: cryptocurrencies

The post Dogecoin May Encounter Resistance at $0. 20 with Over 11 Billicom. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → Dogecoin faces a strong resistance level at $0. 20, where over 11. 12 billion DOGE tokens were accumulated by investors, according to on-chain data from Glassnode. This concentration creates a supply barrier that could hinder price rallies unless strong buying volume emerges. Dogecoin’s $0. 20 resistance stems from mass accumulation of 11. 12 billion tokens at that price point. On-chain analysis highlights how this zone acts as a supply wall during market recoveries. Recent price action shows Dogecoin trading around $0. 18, with a 7% surge but still below the key level; breaking it could signal a rally. Dogecoin $0. 20 resistance level analyzed: 11. 12 billion DOGE accumulated, forming a major barrier. Discover on-chain insights and future outlook for DOGE traders. Stay informed on crypto trends-explore more now! What is the $0. 20 Resistance Level for Dogecoin? The Dogecoin $0. 20 resistance level represents a critical price zone where a significant volume of the cryptocurrency was purchased, creating a natural barrier to upward price movement. According to on-chain data from analytics firm Glassnode, over 11. 12 billion DOGE tokens were accumulated around this price, indicating heavy investor interest.

The post 21RP ETF, 20-Day Countdown Begins appeared com. The post 21RP (19. 60%), Ethereum, Cardano, Solana, and others. WisdomTree files for CoinDesk 20 ETF. Will hold 20 largest digital assets by market cap that are eligible for inclusion in.

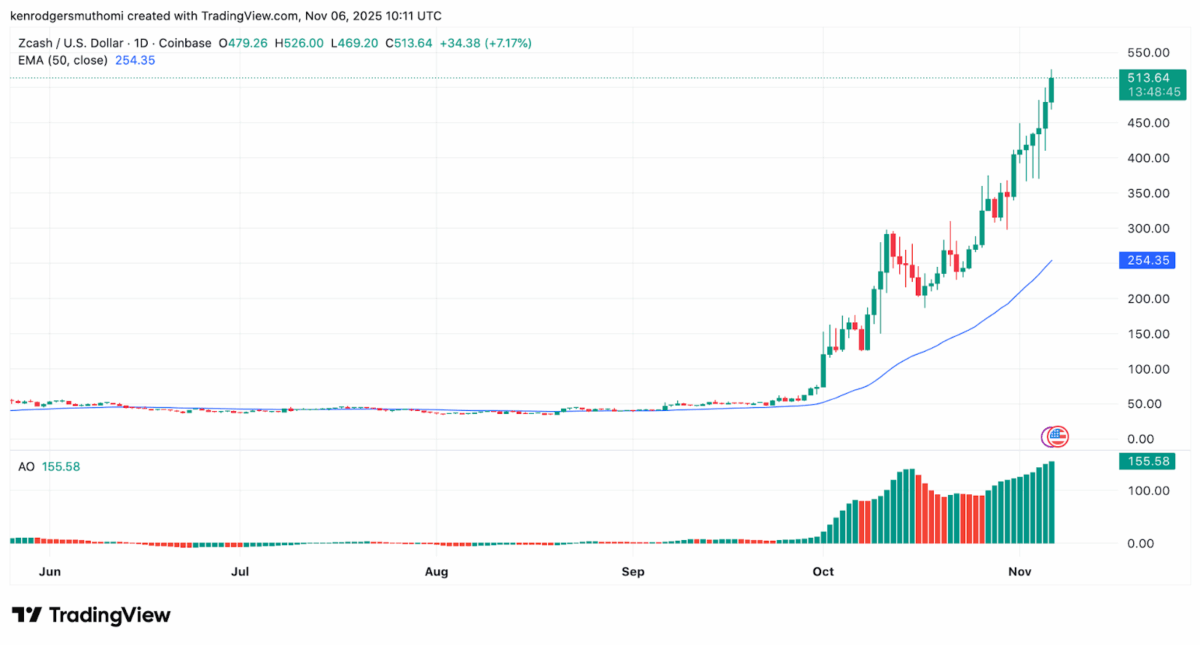

The post Zcash Surges 19% as Crypto Market Declines, Boosting Privacy Cocom. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → Zcash price surge defies the crypto market downturn, climbing over 19% to $526 in 24 hours amid heightened trading volume of $1. 68 billion. This rally highlights the appeal of privacy coins using zk-SNARKs technology, even as Bitcoin dips below $100, 000. Zcash (ZEC) gains 19% while broader market falls, trading at $526 with $1. 68 billion volume. Technical indicators like the 50-day EMA and Awesome Oscillator show strong bullish momentum since early October. Discover the Zcash price surge amid crypto market struggles. Explore privacy tech, technical analysis, and expert insights driving ZEC’s 19% rally to $526. Stay informed on privacy coins’ resilience-read now for key takeaways. What is causing the Zcash price surge? Zcash price surge stems from renewed interest in its privacy features during a market-wide sell-off. While Bitcoin fell below $100, 000 and other assets declined, Zcash climbed over 19% in 24 hours to $526, boosted by $1. 68 billion in trading volume according to CoinMarketCap data. This divergence underscores the value of zk-SNARKs for shielded transactions, drawing traders focused.

The post Bitcoin, Ethereum ETFs Shed $2. 6 Billion com. In brief The price of Bitcoin and Ethereum has plunged this week. U. S. investors have been cashing out of the spot Bitcoin and Ethereum ETFs. Since October 29, a total of $2. 6 billion has left the crypto investment vehicles. Investors have cashed out a combined $2. 6 billion from U. S. Bitcoin and Ethereum exchange-traded funds over the past week, marking one of the largest redemption periods in the funds’ history. The more than $1. 9 billion that left the Bitcoin funds and $718. 9 million pulled out of their Ethereum counterparts since October 29, according to data from Farside Investors, has helped put downwards pressure on the two largest cryptocurrencies by market value. On Tuesday, Bitcoin dropped below $100, 000 for the first time since May. BTC was recently trading at slightly over $103, 428, up 2. 6% on the day but still about 18% below its October record of $126, 080, CoinGecko data shows. Ethereum was changing hands for $3,439, a more than 5% 24-hour jump, although it has plummeted by 13% over the past week. The second-biggest digital coin by market capitalization has struggled to trade near the record it touched in August of $4,946. Investors have largely veered away from crypto and other risk-on assets since October amid worries over U. S. President Donald Trump’s escalation of his trade war against China, the ongoing government shutdown, low market liquidity, and diminishing prospects of a third U. S. interest rate cut before year’s end. Despite Trump’s pro-crypto rhetoric and policy, Bitcoin has suffered shocks-along with tech stocks in recent months, a result of ongoing macro uncertainties. In February, the spot BTC ETFs had their longest and most painful losing streak, with investors pulling out over $2. 2 billion over eight consecutive days following the president’s tariff announcements. Approved by the SEC last year, the BTC and ETH.

The post US-China Tariff Reductions Signal Eased Trade Tensions appeared com. Key Points: US and China adjust tariff measures following agreements in economic consultations. Initiates tariff reductions impacting billions in trade. Agricultural and mineral trade expected to grow following eased tensions. China and the United States have initiated adjustments in tariff measures following recent economic consultations, signifying a potential easing of trade tensions starting November 2025. These measures could enhance bilateral trade, impacting agriculture and mineral sectors, fostering commodity-linked cryptocurrencies and DeFi protocols, yet no immediate effect on principal crypto assets is expected. US-China Tariff Easing Spurs Agricultural Expansion Both nations have implemented tariff removals as an outcome of recent consultations. The US announced initiatives to lift the “Fentanyl Tariff” and suspend “Counterpart Tariffs.” This action aligns with bilateral negotiations aiming to stabilize economic exchanges. In response to these developments, the Chinese government initiated similar adjustments to ease corresponding trade barriers. Immediate changes include a reduction in targeted tariffs, facilitating smoother commodity and agricultural trade. Further cooperation extends to Fentanyl drug control and supply of critical minerals. Huo Jianguo noted these steps as foundational, predicting future agreements on broader trade issues, including maritime logistics. He mentioned that further talks would involve the “Rule of Origin” and additional trade restrictions. “The current implementation between the two sides is the first aspect of the consensus outcome, involving tariff adjustment and reciprocal measures; future steps will include origin rules and maritime sector restrictions as well as drug control and agriculture cooperation.” Huo Jianguo, source. Financial implications are notable with reductions expected to bolster US exports and augment Chinese imports, counteracting previous tensions. The US Treasury’s stance emphasizes tracking these impacts for macroeconomic stability. Community feedback across platforms reflects mild optimism, as digital markets perceive a shift toward positive developments. Tariff Revisions Echo 2020 Trade Movements Did you know? The 2025 reduction in tariffs.

The post Kiyosaki Urges Bitcoin Investment Amid Fears of Shifting U. S. Politics After NYC Election appeared com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → Robert Kiyosaki urges investors to buy Bitcoin and Ethereum as safeguards against shifting economic policies in the U. S., calling them “people’s money” amid concerns over socialist influences in New York City’s leadership. Author of ‘Rich Dad Poor Dad’ Robert Kiyosaki promotes BTC and ETH acquisition on social media. Kiyosaki links cryptocurrency investment to protecting financial freedom in a changing political landscape. He previously forecasted Bitcoin reaching at least $180,000 by year-end, according to reports from COINOTAG. Robert Kiyosaki Bitcoin Ethereum advice: Learn why the financial expert recommends BTC and ETH now. Discover his views on U. S. economic shifts and how to build real wealth. Start investing today for long-term security. What is Robert Kiyosaki’s Advice on Bitcoin and Ethereum? Robert Kiyosaki, the renowned American businessman and author of the bestselling book Rich Dad Poor Dad, recently advised his followers to invest in Bitcoin (BTC) and Ethereum (ETH), describing them as “people’s money” essential for financial protection. This recommendation comes in the wake of significant political developments, particularly the New York mayoral election results. Kiyosaki emphasizes the importance of real.

The post Canada Follows U. S. com. Canada to establish new stablecoin laws, mirroring the U. S. GENIUS Act passed in July. Stablecoins are gaining worldwide attention for their ease of use in payment transactions. Canada is on track to introduce new regulations for stablecoins. The Canadian government has unveiled plans to create new federal laws to regulate fiat-backed stablecoins under its 2025 budget. Canada Moves Forward with Stablecoin Regulations As disclosed in the government’s 2025 budget released on Tuesday, November 4, 2025, stablecoin issuers will need to meet certain criteria under the proposed legislation. These requirements include holding sufficient reserves and establishing redemption policies. In addition, they must implement risk management frameworks to protect personal and financial data. Beginning in the 2026-2027 fiscal year, the Bank of Canada would allocate $10 million over two years to ensure smooth sailing. Subsequently, stablecoin issuers would pay an estimated $5 million in annual costs, regulated under the Retail Payment Activities Act. Essentially, the government aims for faster, cheaper, safer digital transactions for 41. 7 million Canadians. This is also part of modernizing the entire payment system. For now, Canada does not have a Central Bank Digital Currency (CBDC). Canada canceled its digital loonie plans in September 2024. At the time, Bank of Canada Governor Tiff Macklem said, “No strong case yet.” However, Canada shifted focus from digital currency development to modernizing its domestic payment systems. As we discussed earlier, the National Bank of Canada took an unexpected move by adopting a bearish stance toward Bitcoin. Notably, they filed documents with the SEC in the United States to exercise a put option on BlackRock iShares Bitcoin Trust ETF holdings at more than $1. 3 million. Despite this move, Canada does not want to fall behind in regulatory pressure and global competition. The move to establish a stablecoin law follows the U. S. passing the.

The post Standard Chartered CEO Predicts Blockchacom. Hong Kong aligns with fintech-driven economic strategies. Potential $20 billion in Bitcoin ETF inflows expected. Standard Chartered CEO Bill Winters announced on November 3 that both the bank and Hong Kong SAR leadership foresee eventual blockchain settlement for all transactions and full currency digitization. Winters’ statement underscores institutional and governmental commitment to blockchain, which could drive significant financial market shifts, impacting cryptocurrencies like Bitcoin and Ethereum, amid global digital currency trends.” This bold prediction underscores a strong commitment to blockchain integration and digital currency foresight. Standard Chartered is strategically aligning itself with governmental agendas, positioning for potential first-mover advantages as blockchain frameworks become prevalent. Yet, no public fund allocations or new projects were announced explicitly alongside this statement. Geoffrey Kendrick, Head of Digital Assets Research, Standard Chartered, “I would expect at least another $20 billion by year-end [in Bitcoin ETF inflows], a number which would make my $200, 000 year-end forecast possible.” Blockchain Adoption’s Broader Financial Implications Explained Did you know? Standard Chartered’s move echoes previous blockchain adoptions by global financial institutions, including pilots from BlackRock and JPMorgan, reinforcing the ongoing transition to digital assets. According to CoinMarketCap, Bitcoin (BTC) is priced at $107,904. 20, with a market cap of formatNumber(2152011730482, 2) and dominance at 59. 53%. It has experienced a 1. 90% drop over the last 24 hours, contributing to a 90-day decrease of 5. 56%. Trading volume surged by 71. 14%, marking an active trading landscape. Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 04: 02 UTC on November 3, 2025.

The post Polkadot System Chains Upgrade Passes as DOT Tests Lower Bollinger Band Support at $2. 88 appeared com. Rebeca Moen Nov 03, 2025 03: 04 DOT price trades at $2. 88 down 2. 7% as unanimous referendum approval for system chains upgrade provides positive catalyst amid broader crypto weakness testing key technical support levels. Quick Take • DOT trading at $2. 88 (down 2. 7% in 24h) • Unanimous system chains upgrade referendum signals strong community backing • Price testing lower Bollinger Band support at $2. 83 • Following Bitcoin’s weakness amid broader risk-off sentiment Market Events Driving Polkadot Price Movement The most significant development for Polkadot this week was the unanimous passage of a referendum to upgrade all system chains and schedule the Asset Hub Migration. This technical advancement demonstrates robust community consensus and positions the network for enhanced functionality, providing a positive fundamental backdrop despite current price weakness. Polkadot’s participation in Hong Kong Fintech Week from November 3-7 adds another layer of institutional exposure, showcasing the network’s interoperability solutions to a global audience. However, the failure of the Staking Dashboard funding referendum reflects some community friction over resource allocation, though this had minimal market impact. In the absence of major breaking news catalysts, DOT price action is primarily driven by technical factors and broader cryptocurrency market sentiment. The token is experiencing selling pressure alongside Bitcoin and other major cryptocurrencies, with risk-off sentiment dominating trading decisions. DOT Technical Analysis: Testing Critical Support Zone Price Action Context DOT price currently sits below all major moving averages, trading at $2. 88 compared to the 20-day SMA at $3. 01 and 50-day SMA at $3. 59. This positioning indicates sustained bearish pressure, with the token down 26% from its 52-week high of $5. 31. The current price action shows Polkadot following Bitcoin’s weakness rather than establishing independent strength. Volume on Binance spot market reached $14. 4 million in 24 hours, indicating moderate institutional.