Institutional caution and market uncertainty may drive short-term risk-off sentiment, impacting broader crypto investment strategies. The post Ethereum joins Bitcoin in recording third-largest weekly ETF outflow at $508M appeared first on Crypto Briefing.

Tag: cryptocurrency

The post MATIC Price Prediction: Target $0. 45-$0. 52 Range Within 30 Days Despite Current Bearish Momentum appeared com. Zach Anderson Nov 05, 2025 06: 25 MATIC price prediction suggests recovery to $0. 45-$0. 52 range over next month as oversold conditions near key support at $0. 35, with immediate resistance at $0. 58. MATIC Price Prediction Summary • MATIC short-term target (1 week): $0. 42 (+10. 5%) reaching EMA 26 resistance • Polygon medium-term forecast (1 month): $0. 45-$0. 52 range testing SMA 20 to upper Bollinger Band • Key level to break for bullish continuation: $0. 58 (strong resistance confluence) • Critical support if bearish: $0. 35 (immediate support) and $0. 33 (strong support floor) Recent Polygon Price Predictions from Analysts The current market environment shows a notable absence of fresh analyst predictions for MATIC over the past three days, suggesting either consolidation in sentiment or analysts waiting for clearer directional signals. This silence often precedes significant moves in cryptocurrency markets, as technical patterns develop without fundamental news interference. The lack of recent predictions contrasts with MATIC’s current technical setup, which presents clear levels for both bullish and bearish scenarios. This creates an opportunity for independent technical analysis to guide our Polygon forecast without the noise of conflicting analyst opinions. MATIC Technical Analysis: Setting Up for Potential Reversal Polygon technical analysis reveals a cryptocurrency approaching oversold territory with several converging factors that could trigger a reversal. The current RSI reading of 38. 00 sits in neutral territory but trending toward oversold conditions, historically a precursor to bounces in MATIC. The MACD histogram showing -0. 0045 indicates bearish momentum, but the relatively small magnitude suggests this selling pressure may be waning. More significantly, MATIC’s position at 0. 29 within the Bollinger Bands places it much closer to the lower band ($0. 31) than the upper band ($0. 56), indicating potential for mean reversion toward the middle band at $0. 43. Current trading volume of $1,074,371 on.

The post Canada Follows U. S. com. Canada to establish new stablecoin laws, mirroring the U. S. GENIUS Act passed in July. Stablecoins are gaining worldwide attention for their ease of use in payment transactions. Canada is on track to introduce new regulations for stablecoins. The Canadian government has unveiled plans to create new federal laws to regulate fiat-backed stablecoins under its 2025 budget. Canada Moves Forward with Stablecoin Regulations As disclosed in the government’s 2025 budget released on Tuesday, November 4, 2025, stablecoin issuers will need to meet certain criteria under the proposed legislation. These requirements include holding sufficient reserves and establishing redemption policies. In addition, they must implement risk management frameworks to protect personal and financial data. Beginning in the 2026-2027 fiscal year, the Bank of Canada would allocate $10 million over two years to ensure smooth sailing. Subsequently, stablecoin issuers would pay an estimated $5 million in annual costs, regulated under the Retail Payment Activities Act. Essentially, the government aims for faster, cheaper, safer digital transactions for 41. 7 million Canadians. This is also part of modernizing the entire payment system. For now, Canada does not have a Central Bank Digital Currency (CBDC). Canada canceled its digital loonie plans in September 2024. At the time, Bank of Canada Governor Tiff Macklem said, “No strong case yet.” However, Canada shifted focus from digital currency development to modernizing its domestic payment systems. As we discussed earlier, the National Bank of Canada took an unexpected move by adopting a bearish stance toward Bitcoin. Notably, they filed documents with the SEC in the United States to exercise a put option on BlackRock iShares Bitcoin Trust ETF holdings at more than $1. 3 million. Despite this move, Canada does not want to fall behind in regulatory pressure and global competition. The move to establish a stablecoin law follows the U. S. passing the.

The post Crypto recovery remains slow despite global liquidity boost: Wintermute appeared com. Global liquidity is rising, stocks are soaring, and interest rates are falling but crypto markets are not bouncing back. Wintermute says why. Summary Wintermute reports that crypto is underperforming despite global liquidity expansion and rate cuts. The report says liquidity is flowing into equities, AI, and prediction markets, not crypto. Wintermute says the four-year Bitcoin halving cycle no longer explains price movements. Recovery depends on renewed ETF inflows and institutional activity in DAT markets. Despite a favorable macroeconomic environment, the cryptocurrency market continues to underperform other risk assets, according to Wintermute’s latest market update dated Nov. 3. The report highlights that although global liquidity is expanding with central banks cutting interest rates, ending quantitative tightening (QT), and stock markets sitting near all-time highs, capital is not flowing into crypto markets at the same pace. Wintermute attributes this underperformance to a redirection of liquidity. While financial conditions have improved globally, the inflows are primarily targeting equities, artificial intelligence (AI) sectors, and prediction markets. In contrast, ETF inflows and Digital Asset Treasury (DAT) activity, which were key drivers of crypto growth earlier in the year, have largely stalled. “The tap isn’t off, it’s just pointed somewhere else,” the report noted. Stablecoin supply remains the only inflow metric showing growth, with over $100 billion added year-to-date. Meanwhile, Bitcoin ETF assets under management have stagnated around $150 billion, and secondary DAT volumes have plummeted. Market data reinforces this slowdown. BTC (BTC) and ETH (ETH) have both been range-bound, with Bitcoin hovering near $101,000 and Ethereum around $3,300. The broader market also suffered heavy losses last week gaming, layer-2s, and meme coins recording double-digit drops. Wintermute says four-year Bitcoin cycle is dead Wintermute also argues that the traditional four-year Bitcoin cycle theory is no longer relevant. The firm believes that price performance in mature markets.

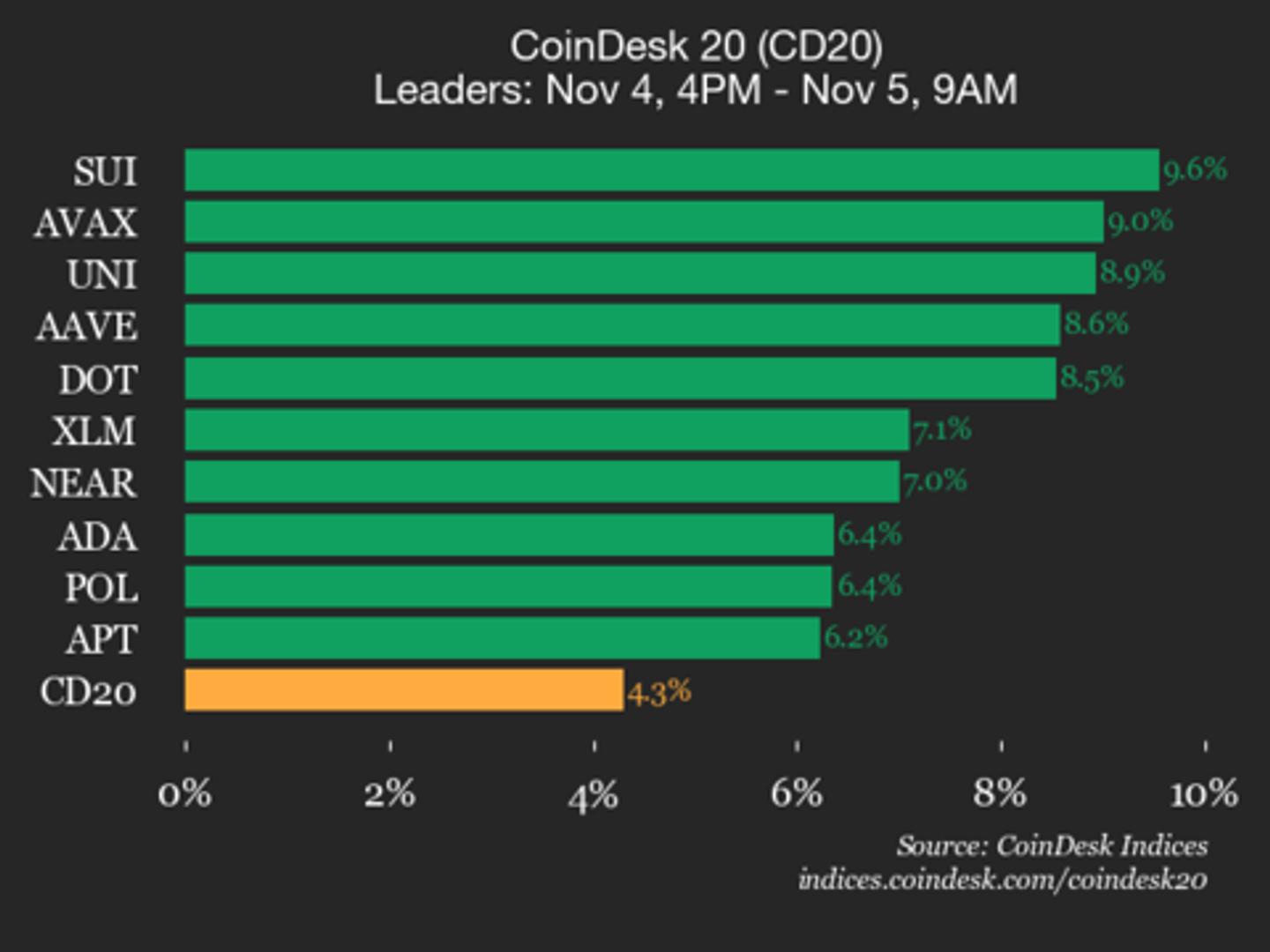

CoinDesk 20 Performance Update: SUI Gains 9.6%, Leading Index Higher

Binance Coin trades at $942. 86, down 1. 25% as technical indicators signal oversold conditions while maintaining position above 200-day moving average support. (Read More).

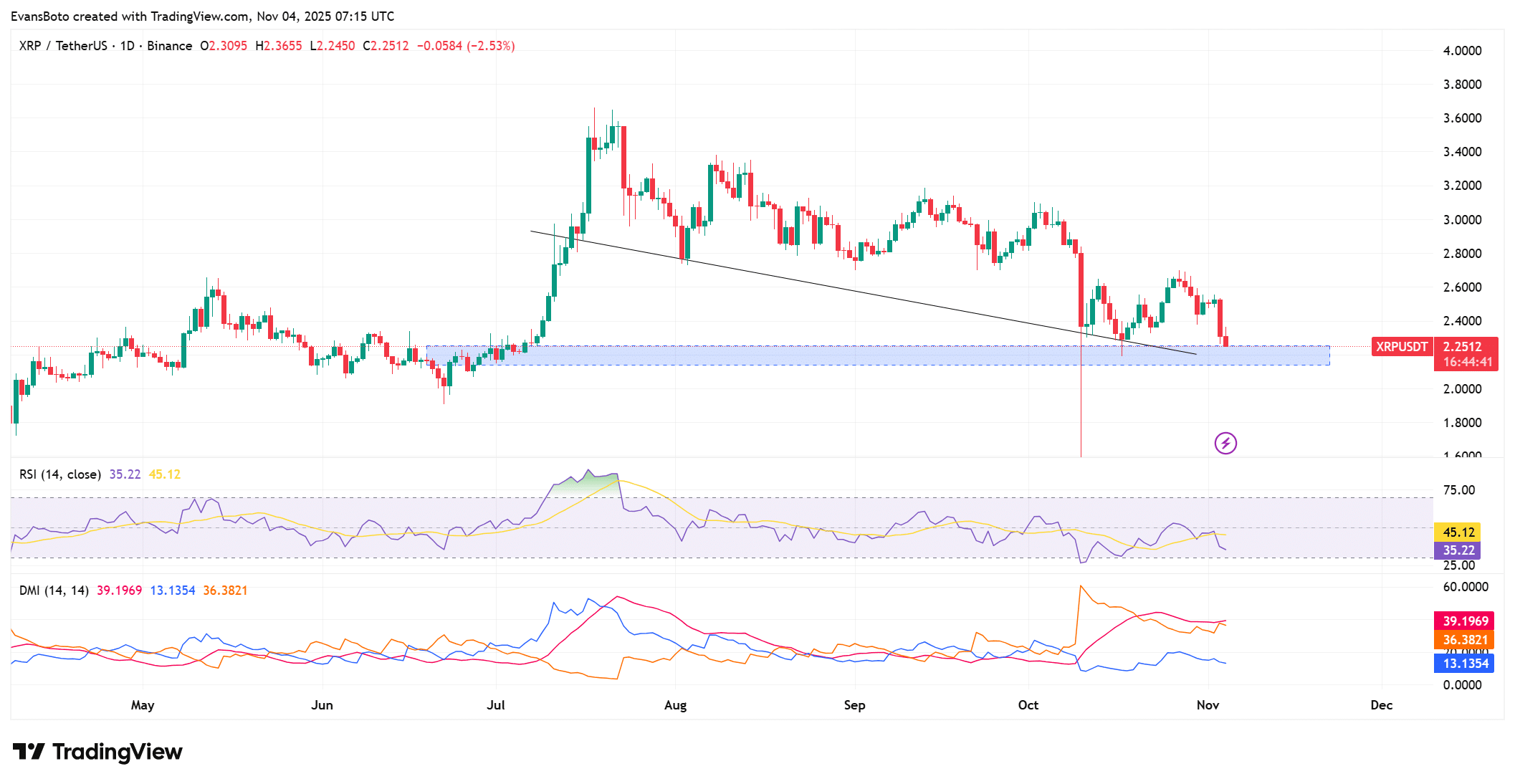

The post XRP Whale Sell-Off Signals Potential Downside Near $2. 2 Support Zone appeared com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → XRP whale investors have sold off 900, 000 tokens in five days amid falling Open Interest and bearish technicals, pushing prices toward the $2. 20-$2. 30 demand zone. This activity signals heightened caution, with potential for volatility around liquidation clusters. XRP whales offload 900, 000 tokens in five days, fueling bearish market sentiment. Open Interest drops 15. 73% to $3. 52 billion, indicating reduced leverage and risk aversion among traders. Liquidation heatmaps show dense clusters at $2. 20 and $2. 30, highlighting key volatility triggers with over $100 million in potential liquidations. XRP whale selling pressure intensifies as 900, 000 tokens are offloaded, dropping prices near $2. 20 support. Analyze technicals and Open Interest for trading insights-stay informed on crypto trends today. What is driving the recent XRP whale selling pressure? XRP whale selling pressure has emerged as a dominant force in the cryptocurrency market, with large investors offloading approximately 900, 000 XRP tokens over the past five days. This activity has coincided with weakening on-chain metrics and technical indicators, amplifying bearish sentiment and driving the price toward critical support levels between $2. 20 and $2. 30. As traders monitor these developments,.

TLDR DTCC now lists nine XRP ETFs on its platform Products include both futures-based and spot-based strategies Four futures XRP ETFs are already trading in the market Five-spot XRP ETFs are still awaiting final SEC approval November 13 set as potential launch date for spot products The Depository Trust & Clearing Corporation has listed nine [.] The post DTCC Lists Nine XRP ETFs as Countdown to Potential Launch Begins appeared first on CoinCentral.

TLDR Solana price crashed to $158 after breaking down from a symmetrical triangle pattern. SOL dropped below critical support at $178 to $180, confirming strong bearish momentum. The cryptocurrency now tests the historical demand zone between $155 and $165. Bitwise’s BSOL ETF accumulated $400 million in assets during its first week of trading. The BSOL [.] The post SOL Price Plunges to $158 as BSOL ETF Fails to Spark Rally appeared first on CoinCentral.

Bitcoin’s November sell-off worsens as investors take risk off on worries about the AI trade