The post Polkadot System Chains Upgrade Passes as DOT Tests Lower Bollinger Band Support at $2. 88 appeared com. Rebeca Moen Nov 03, 2025 03: 04 DOT price trades at $2. 88 down 2. 7% as unanimous referendum approval for system chains upgrade provides positive catalyst amid broader crypto weakness testing key technical support levels. Quick Take • DOT trading at $2. 88 (down 2. 7% in 24h) • Unanimous system chains upgrade referendum signals strong community backing • Price testing lower Bollinger Band support at $2. 83 • Following Bitcoin’s weakness amid broader risk-off sentiment Market Events Driving Polkadot Price Movement The most significant development for Polkadot this week was the unanimous passage of a referendum to upgrade all system chains and schedule the Asset Hub Migration. This technical advancement demonstrates robust community consensus and positions the network for enhanced functionality, providing a positive fundamental backdrop despite current price weakness. Polkadot’s participation in Hong Kong Fintech Week from November 3-7 adds another layer of institutional exposure, showcasing the network’s interoperability solutions to a global audience. However, the failure of the Staking Dashboard funding referendum reflects some community friction over resource allocation, though this had minimal market impact. In the absence of major breaking news catalysts, DOT price action is primarily driven by technical factors and broader cryptocurrency market sentiment. The token is experiencing selling pressure alongside Bitcoin and other major cryptocurrencies, with risk-off sentiment dominating trading decisions. DOT Technical Analysis: Testing Critical Support Zone Price Action Context DOT price currently sits below all major moving averages, trading at $2. 88 compared to the 20-day SMA at $3. 01 and 50-day SMA at $3. 59. This positioning indicates sustained bearish pressure, with the token down 26% from its 52-week high of $5. 31. The current price action shows Polkadot following Bitcoin’s weakness rather than establishing independent strength. Volume on Binance spot market reached $14. 4 million in 24 hours, indicating moderate institutional.

Tag: cryptocurrency

The post Iran’s Bitcoin Mining Industry: Inside the World’s Fifth-Largest Operaticom. With 95% of mining operations running illegally and consuming enough power to light up entire cities, Iran’s crypto boom is pushing an already fragile power grid to the breaking point. A Nation Turning to Digital Currency Iran’s cryptocurrency interest exploded after 2017 when international sanctions cut off access to global banking systems. Unable to use traditional finance, the country turned to Bitcoin and other digital currencies as a way around restrictions. Today, Iran controls about 4. 2% of global Bitcoin mining power, ranking fifth worldwide behind the United States, Kazakhstan, Russia, and Canada. This is a major drop from March 2021 when Iran held 7. 5% of the global hashrate, but it still represents significant operations. The appeal is simple: electricity in Iran costs between $0. 01 and $0. 05 per kilowatt-hour, making it incredibly cheap to mine Bitcoin. With costs as low as $1,300 to mine a single Bitcoin that can sell for over $100,000, the profit margins are enormous. Around 22% of Iran’s population now uses or owns cryptocurrency, with an estimated 10 million users in the country. For many Iranians facing severe inflation-the rial lost 37% of its value against the dollar in 2024 alone-crypto offers a way to protect savings from collapse. The Illegal Mining Problem Iranian officials report that approximately 427, 000 active crypto mining devices operate across the country. The shocking part? An estimated 95% are illegal, operating without proper authorization. These underground operations consume roughly 2, 000 megawatts of electricity-equal to what two nuclear reactors produce. Energy officials say crypto mining now accounts for 15-20% of Iran’s electricity shortage problems. The illegal miners hide their operations everywhere: abandoned homes, rural farms, underground tunnels, and even industrial facilities disguised as legitimate businesses. During one internet outage related to conflict with Israel, power consumption dropped by 2, 400 megawatts when over 900, 000.

The post Evernorth’s $1 Billion+ XRP Purchase Marks Largest Single Institutional Acquisition for Digital Asset ⋆ ZyCrypto appeared com. Ripple-backed digital asset firm Evernorth Holdings acquired a large stack of XRP. The large purchases swung market sentiments upward amid new whale inflows to the asset. This year, corporate crypto treasuries have increased their holdings as more firms seek to diversify their balance sheets. Institutional Investors Raise XRP Holdings On-chain data shows Evernorth Holdings accumulated more than 388. 7 million XRP worth over $1 billion after flagging up its crypto treasury. This marks a significant milestone for the company, which launched on Oct 20. Evernorth is considering listing the publicly traded XRP company on Nasdaq, much to the delight of the community. Asheesh Birla, Evernorth CEO, has pledged more collaborations with the asset, including deals with Rippleworks and the SBI Group. Birla stepped down from Ripple to take charge of Evernorth, thereby strengthening the connection between the two entities. Plans are also underway to finalize a merger with Armada Acquisition Corp. II. The company is also set to raise about $1 billion for crypto purchases. “We’re backed by a world-class group of investors and leaders, including SBI, Ripple, Arrington Capital, Pantera Capital, and Kraken firms that share our conviction in XRP’s future. For the first time, XRP has clear regulatory standing in the United States, opening the door for large-scale adoption,” Birla added. He described the company as a trusted and transparent bridge to public markets at a time when institutional demand for cryptocurrency is surging. Previously, XRP faced negative pressure following the lawsuits filed by the United States Securities and Exchange Commission (SEC) alleging the sale of unregistered securities. Advertisement President Trump’s second term altered the entire dynamic with a pro-crypto approach. This signaled the bulls to ramp up investment as authorities ushered in clear rules. Top assets, such as Bitcoin (BTC), Ethereum (ETH),.

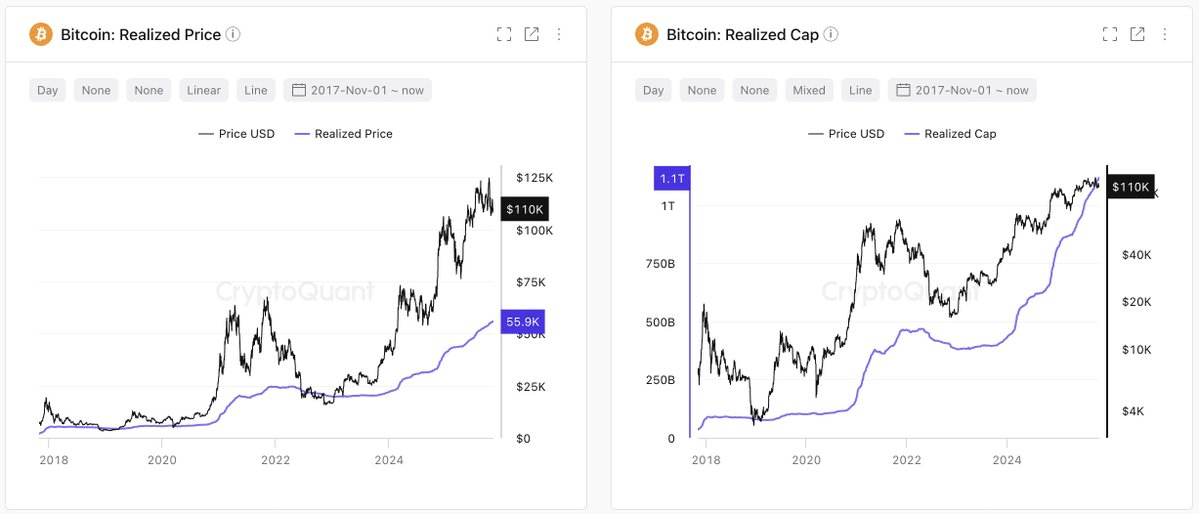

The post Strategy’s Bitcoin Buying Slows, Analysts See Potential for Renewed Momentum appeared com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → MicroStrategy’s Bitcoin accumulation has slowed after two years of aggressive buying, with its market premium thinning to 1. 2x amid BTC consolidation at $110,000. However, analysts view this as a temporary pause, not a halt, emphasizing the company’s robust model for converting capital into Bitcoin exposure and projecting yields up to 30%. MicroStrategy holds over 640, 000 BTC, representing about 3% of global supply, supporting sustained growth potential. The slowdown reflects market timing rather than flaws in the firm’s Bitcoin strategy, with shares rising 5% recently on recovery optimism. A new B- rating from S&P opens access to a $4. 9 trillion credit pool, potentially tripling funding for further Bitcoin acquisitions, per TD Cowen analysis. Explore how MicroStrategy’s Bitcoin engine slows but remains primed for growth. Analysts bullish on yields and credit access amid BTC at $110,000-discover key insights and projections for 2025 investors now. What is MicroStrategy’s Current Bitcoin Accumulation Pace? MicroStrategy’s Bitcoin accumulation has notably decelerated following two years of steady increases, with recent quarterly data showing a reduced pace of purchases. The company’s market premium to net asset value.

After weeks of sideways action, ETH remains trapped in a consolidation range, sparking uncertainty among traders who are looking for [.] The post Ethereum Price Nears Key Support as Analysts Eye a Potential Rebound appeared first on Coindoo.

Bitcoin struggles to maintain key levels as long-term holders continue to sell. Market dynamics hinge on Federal Reserve’s upcoming decisions, potentially influencing volatility. (Read More).

The post UAE’s Ultra-Rich Are Driving a Fierce Crypto Revolution com. The traditional wealth management and private banking world, much of which is hard-bitten and twice shy when it comes to cryptocurrency investing, is under mounting pressure again to deliver digital assets to wealthy clients, particularly in crypto hotspots like Dubai, Switzerland and Singapore. Swiss software firm Avaloq, which serves many private banks and wealth managers, examined high net worth (HNW) investing attitudes in the UAE (based on surveys of 3, 851 investors and 456 wealth professionals conducted in February/March 2025), and found that while demand for digital assets in that region is unusually high (39% of wealthy clients hold crypto), only 20% of those crypto investors used a traditional wealth manager. The UAE, known for its oil-rich, ultra-high net-worth family offices and a low tax center for expat workers, is also quickly becoming one of the world’s hottest crypto hubs, with Dubai offering a clear regulatory framework in the form of the Virtual Assets Regulatory Authority (VARA), which has been in place since 2022. These days, the kids of ultra-high net-worth families are educating their elders about crypto for example, the Trumps. Against this backdrop, Avaloq’s UAE snapshot found that 63% of investors have switched managers or are considering doing so. The reason is partly because their questions about crypto are going unanswered, according to the survey. “As crypto has evolved as an asset class, there has been a growing need among private banking relationship managers to cater to clients who are basically not being served,” said Akash Anand, head of Middle East and Africa at Avaloq, in an interview with CoinDesk. “Hence there has been a rush among traditional wealth managers to get equipped to offer crypto.” The roadblocks So why weren’t these traditional financial institutions serving what their clients want? The simple answer is that crypto, by its.

The post Indian Court XRP Ruling May Complicate WazirX Hack Claims Process appeared com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → The Madras High Court in India has ordered WazirX’s operator, Zanmai Labs, to provide a bank guarantee of approximately $11,800 for a user’s frozen 3, 532 XRP tokens following a 2024 cyberattack that stole $235 million in assets. This ruling recognizes cryptocurrency as property held in trust, potentially complicating WazirX’s Singapore-based restructuring for Indian users. Madras High Court mandates bank guarantee for WazirX user’s XRP holdings post-hack. Ruling affirms cryptocurrency as possessable property under Indian law, enabling trust-based claims. WazirX’s $235 million loss from 2024 hack leaves insufficient tokens for user liabilities, per court documents. Discover how the Indian court’s WazirX ruling impacts crypto users after the $235M hack. Explore restructuring plans and legal implications for exchanges. Stay informed on crypto regulations today. What is the significance of the Madras High Court ruling on WazirX cryptocurrency claims? The Madras High Court ruling on WazirX marks a pivotal moment in recognizing cryptocurrencies as legal property in India. Delivered on Saturday by Justice N. Anand Venkatesh, the decision requires WazirX’s operator, Zanmai Labs, to issue a bank guarantee worth about $11,800 to.

Madras High Court confirms crypto can be owned and held in trust. WazirX has been barred from redistributing investors’ unaffected XRP holdings. Ruling strengthens investor rights and Web3 governance in India. In a landmark ruling that could reshape cryptocurrency in India, the Madras High Court has declared that cryptocurrencies qualify as property under Indian law. [.] The post Cryptocurrency is as ‘property’ under Indian law, rules Madras High Court appeared first.