Por CIARÁN FAHEY BERLÍN (AP) Bayern Múnich finalmente perdió un partido. El defensor neerlandés Danilho Doekhi anotó dos veces para el Union Berlín, manteniendo al poderoso equipo bávaro en un empate 2-2 el sábado en la Bundesliga, poniendo fin a la racha récord de 16 victorias consecutivas de Bayern en todas las competiciones al [.].

Tag: general

Sydney Sweeney’s no-nonsense attitude spoke for itself once more as the professional athlete behind her latest film revealed how the actress “got down and dirty …” (Video […]

The post Ripple Has Value Beyond XRP, Crypto Founder Pushes Back at VCs appeared on BitcoinEthereumNews.com. Critics say Ripple’s $40B value relies on XRP; Aljarrah calls this a misunderstanding. VCs fund Ripple partly for XRP exposure, letting it expand without selling tokens. Ripple grew fast with six acquisitions in two years and launched its USD-backed RLUSD stablecoin. Discussions about Ripple’s new $500 million funding continue to intensify in the XRP community as critics claim the company is not worth $40 billion. Versan Aljarrah, founder of Black Swan Capitalist, said critics who claim Ripple’s value comes only from its XRP holdings don’t understand how the company actually works. Specifically, Aljarrah argued that claiming Ripple has no value beyond XRP shows a fundamental misunderstanding of its architecture. Ripple’s infrastructure, liquidity hubs, and strategic partnerships serve as a bridge between traditional finance and blockchain rails. XRP functions as the settlement layer, not the core product. One cannot exist meaningfully without the other. VCs Claim Ripple’s Value Comes Mainly From XRP — and Little Else Notably, the controversy started after reports that several venture capitalists think Ripple’s valuation is too high and is mostly based on its XRP holdings. One investor said Ripple is “worth nothing without XRP,” while another stated that its equity alone can’t explain its $40 billion valuation. Some investors suggested firms may have joined the funding to get indirect exposure to XRP at a discount, rather than because they believed in Ripple’s products. A former Ripple employee noted that the funding enables Ripple to acquire other companies without selling XRP, maintains market confidence, and supports the $40 billion valuation seen in secondary markets like Carta. Arrington: Critics Are Ignoring Ripple’s Real-World Traction TechCrunch founder and Arrington Capital CEO Michael Arrington has also pushed back against these claims, describing the anti-Ripple perspective as “stunning amounts of cognitive dissonance.” He pointed out that critics often argue that Ripple’s…

Jimmy Butler stepped up on Friday to pinpoint the reason behind the Warriors’ 129-104 blowout loss against the Denver Nuggets. The Dubs took on the Nikola Jokic-led squad without their star player.

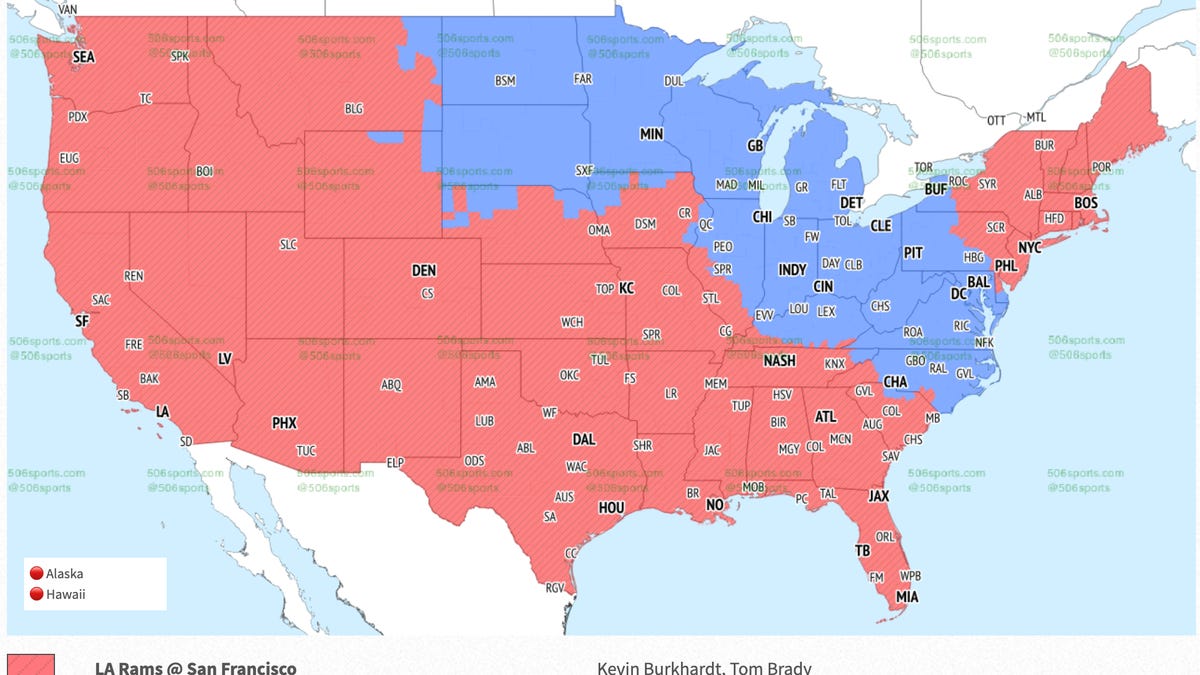

Week 10 NFL television maps are out and if you reside in the blue area of the map, you’ll see the Washington Commanders vs. Detroit Lions on FOX.

The post ‘Sell Your House And Buy XRP’ — Solana Exec’s Advice Goes Viral appeared on BitcoinEthereumNews.com. They say journalists never truly clock out. But for Christian, that’s not just a metaphor, it’s a lifestyle. By day, he navigates the ever-shifting tides of the cryptocurrency market, wielding words like a seasoned editor and crafting articles that decipher the jargon for the masses. When the PC goes on hibernate mode, however, his pursuits take a more mechanical (and sometimes philosophical) turn. Christian’s journey with the written word began long before the age of Bitcoin. In the hallowed halls of academia, he honed his craft as a feature writer for his college paper. This early love for storytelling paved the way for a successful stint as an editor at a data engineering firm, where his first-month essay win funded a months-long supply of doggie and kitty treats – a testament to his dedication to his furry companions (more on that later). Christian then roamed the world of journalism, working at newspapers in Canada and even South Korea. He finally settled down at a local news giant in his hometown in the Philippines for a decade, becoming a total news junkie. But then, something new caught his eye: cryptocurrency. It was like a treasure hunt mixed with storytelling – right up his alley! So, he landed a killer gig at NewsBTC, where he’s one of the go-to guys for all things crypto. He breaks down this confusing stuff into bite-sized pieces, making it easy for anyone to understand (he salutes his management team for teaching him this skill). Think Christian’s all work and no play? Not a chance! When he’s not at his computer, you’ll find him indulging his passion for motorbikes. A true gearhead, Christian loves tinkering with his bike and savoring the joy of the open road on his 320-cc Yamaha R3. Once a speed demon who hit…

Meaningful 7 Little Words Answer is. We hope this helped you to finish today’s 7 Little Words puzzle. You can find all of the answers for each day’s set of clues in the 7 Little Words section of our website. The post Meaningful 7 Little Words Answer appeared first on Try Hard Guides.

Aegean has launched a year-end sale for travel to/from Greece and 21 European countries between November 17 and January 18, 2026 The discount in economy class is 20% or 30% on both Aegean and Olympic Air flights and is available for bookings until November 9. […]

Adrianna Smith records a double-double and the Black Bears rally falls short against the Hawks.

The brand debuted with five K-beauty-inspired SKUs, but has plans to expand in the future.