The post Top Cryptos To Invest in November 2025 appeared com. Crypto Presales Compare Bitcoin, Sui, and BullZilla as the top cryptos to invest in November 2025. Learn why BullZilla’s presale stands out with huge ROI potential. Have you noticed how crypto investors always say, “next bull run, I won’t miss out,” and then somehow still miss out? It is like planning a diet after Thanksgiving. Bitcoin closed “Uptober” with a rare seven-year losing streak, dropping almost 4 percent and watching sentiment cool as investors waited for a clearer direction. Meanwhile, U. S. spot Bitcoin ETFs recorded inflows of over $3. 16 billion, reminding everyone that big money still sees value in crypto. As global markets shift with interest rate moves and new regulations, investors now look beyond just price charts for smarter high-growth opportunities. That is where the hunt for top cryptos to invest in November 2025 intensifies, as investors position themselves ahead of the next major rally. BullZilla (ZIL) is rising fast as a powerful presale contender while Bitcoin consolidates its dominance and Sui builds stronger momentum through DeFi expansion. Liquidity is rotating back into high-growth assets, pushing people to act early rather than watch opportunities slip away again. Now the biggest question emerges: which project offers real potential, the proven icon, the bold innovator, or the underdog ready to explode? Grab Millions Of BZIL Tokens Before The 3. 04 Percent Price Surge Hits Bitcoin Holds Key Supports While Infrastructure Expansion Drives New Demand Bitcoin recently slipped below $110000 after its October downturn, but has continued to find support above $107000. A breakdown could retest $100000, but analysts believe a positive macro shift could push it back toward $120000. Despite price pressure, institutional demand remains incredibly strong, especially through spot ETFs that continue accumulating supply. Bitcoin Hyper, a layer 2 for Bitcoin, has already raised more than $25. 6 million to build enhanced.

Tag: infrastructure

The post U. S. Treasury cuts Q4 borrowing estimate to $569B appeared com. The Federal borrowing estimate for the U. S. Treasury Department for the final three months of the year was reduced to $569 billion, thanks to a stronger cash position and improved revenue collection. The three months, which ended on Wednesday, saw $21 billion in short-term borrowing, down from the $590 billion forecast issued in July, indicating a decrease in short-term borrowing. Officials attribute most of the changes to more cash than expected at the beginning of the quarter. The data available suggests that in early October, the Treasury had approximately $891 in cash, which was above the $850 in summer gross cash. Using a substantial portion of the trove allowed the department to slow its rate of wealth increase for spending and debt repayment while still meeting all obligations. Treasury leverages a strong cash buffer The Treasury’s cut results from careful cash management, given there were months of heavy issuance to rebuild reserves following the suspension of the debt ceiling at the start of the calendar year. In previous quarters, the Treasury had increased sales of short-term bills to replenish its coffers. But strong tax inflows and cautious outlays have left it with a much larger cushion than expected. According to analysts, this could ease some of the tension in the bond markets, which have been pressured by the rapid pace of supply and an increase in longer-term interest rates. A borrowing reduction was a strong move to get the Treasury stabilizer working again, according to analysts quoted by the Financial Times. In addition, reductions in the borrowing requirement may help steady Treasury yields, making it easier for investors to anticipate interest rate hikes by the Federal Reserve. Nonetheless, economists claim that the reduction is not an indication of general fiscal moderation. Spending at the federal level remains unchanged, and borrowing.

MSI made a Raspberry Pi-like PC with Intel x86 processors

TLDR Michael Burry posted his first warning on X since April 2023, suggesting a market “bubble” exists but sees no clear way to profit from it Burry changed his profile name to “Cassandra Unchained,” referencing the Greek figure whose true predictions were never believed He is not currently shorting or buying the market, choosing to [.] The post Big Short Investor Michael Burry Breaks Silence to Warn of Market Bubble appeared first on CoinCentral.

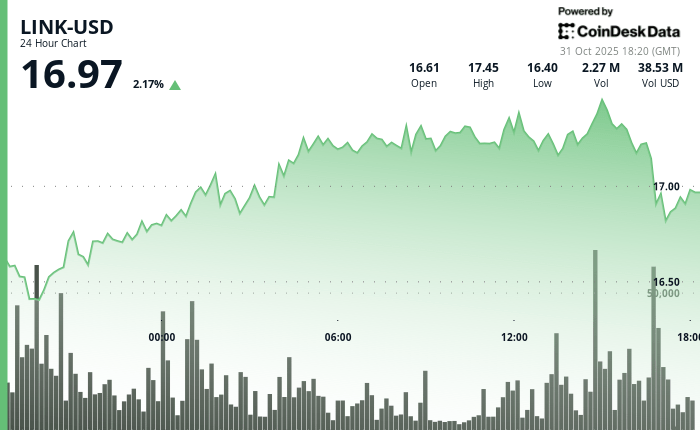

The post Modest Bounce as Stellar Integraticom. The native token of oracle network Chainlink LINK$17. 15 bounced 3. 6% on Friday, reversing some of Thursday’s losses as traders stepped in around key support level. LINK briefly cleared the $17 level with a surge in trading volume some 3 million tokens changed hands during a morning breakout up -, pointing to renewed accumulation, CoinDesk Research’s market insight tool suggested. However, weakness during the U. S. trading hours drove LINK back below $17. Recently, the token traded at $16. 96. On the news front, payments-focused Stellar (XLM) announced to integrate Chainlink’s Cross-Chain Interoperability Protocol (CCIP), Data Feeds, and Data Streams. The move enables developers and institutions building on Stellar to access real-time data and trusted cross-chain infrastructure for tokenized assets. With over $5. 4 billion in quarterly RWA volume and a fast-growing DeFi footprint, Stellar’s adoption of Chainlink tooling signals expanding demand for secure, interoperable financial infrastructure. Key technical levels to watch: LINK now holds near-term support at $16. 37 with upside targets at $17. 46 and $18. 00. Whether the token can build on Friday’s rebound may depend on broader market flows and follow-through from dip-buying. Support/Resistance: Solid support holds at $16. 37 after multiple successful tests, while $17. 46 resistance shows repeated rejection patterns. Volume Analysis: 78% volume surge during breakout attempt confirms institutional interest, explosive selling volume indicates position rebalancing. Chart Patterns: Late-session flush-out pattern creates classic oversold setup for accumulation strategies. Targets & Risk/Reward: Holding above $16. 89 targets $17. 46 retest with upside to $18. 00, downside risk limited to $16. 37 support. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. Source:.

IPO Genie, the launchpad aiming to make early access in Web3 actually fair, transparent, and data-backed, is launching its much [.] The post Airdrop Alert: Early Whitelist for IPO Genie (PO) Unlocks Presale + Free Token Rewards appeared first on Coindoo.

The post Ripple’s David Schwartz Update Triggers Massive Bullish Signals Amid XRP Whale Buying Spree ⋆ ZyCrypto appeared com. The XRP community is on fire after Ripple’s Chief Technology Officer, David “JoelKatz” Schwartz, announced a major new role that could mark a turning point for XRP’s market trajectory. In a post on X, Schwartz revealed that he will serve as a strategic advisor to Evernorth, a newly formed investment vehicle dedicated to expanding XRP’s reach across defi and capital markets. The company, helmed by former Ripple executive Asheesh Birla, aims to become the largest publicly traded XRP treasury on the Nasdaq under the ticker “XRPN.” Evernorth recently confirmed its plans to go public through a business combination with Armada Acquisition Corp II, a deal expected to raise more than $1 billion in gross proceeds. The move will give Evernorth both regulatory credibility and significant financial firepower to accumulate XRP and develop liquidity, lending, and yield infrastructure around it. Advertisement Schwartz’s involvement points to Ripple’s deepening ties to Evernorth’s strategy and reinforces confidence in XRP’s institutional potential. Analysts have widely interpreted his announcement as a sign that Ripple is positioning XRP for mainstream capital market integration, potentially similar to how MicroStrategy amplified Bitcoin’s exposure in traditional finance. Market momentum appears to reflect that optimism. Data from Santiment shows XRP climbed back above $2. 50 after briefly dipping below $1. 90 just ten days earlier. Despite widespread fear and uncertainty among retail traders, prices have surged, moving in the opposite direction of crowd sentiment. On-chain data also shows that whales accumulated more than 30 million XRP over 24 hours between 20th and 21st October, signaling growing confidence among deep-pocketed investors. Adding to the excitement, technical analysts are now spotting a bullish “inverse head and shoulders” pattern on XRP’s chart, targeting a potential move toward the $3. 10 resistance level. With whale accumulation, improving sentiment, and Ripple’s top engineer joining.

The post Ethereum’s Fusaka Upgrade Goes Live com. Ethereum is moving closer to its next major evolution. On Tuesday, the network’s latest hard fork, Fusaka, went live on the Hoodi testnet, marking the final testing stage before its official mainnet activation later this year. Hoodi is the third and final testnet for Fusaka, following earlier deployments on Holesky and Sepolia. According to the Ethereum Foundation (@ethereumfndn), the mainnet rollout will happen at least 30 days after Hoodi testing, with December 3 set as the tentative date for the official hard fork. Fusaka is more than just another upgrade. It represents the next phase of Ethereum’s long-term roadmap, focused on scalability, efficiency, and Layer 2 optimization. Ethereum Surpasses Bitcoin in Digital Asset Treasuries by Total Supply Ethereum now leads with 4. 1% of total supply held by institutional treasuries, followed by Bitcoin (3. 6%) and Solana (2. 7%). The surge in ETH holdings coincided with Donald Trump’s signing of the GENIUS Act,. pic. twitter. com/o3d2NwmG6m CryptoRank. io (@CryptoRank_io) October 29, 2025 The Road to Fusaka The Ethereum community has been preparing for this moment for months. Each testnet deployment served as a trial ground for new features and infrastructure refinements. The first implementation on Holesky tested network synchronization and consensus adjustments. Sepolia followed, validating node performance and gas parameter tuning. Now, with Hoodi live, developers are finalizing tests for rollup scaling and parallel execution, two pillars of the upcoming upgrade. Fusaka’s mainnet launch on December 3 will be the first step in a three-stage rollout designed to gradually expand Ethereum’s data and transaction capacity. Rollout Timeline Ethereum developers confirmed a structured schedule for Fusaka’s release: Dec 3, 2025 → Fusaka mainnet launch Dec 17, 2025 → Blob capacity increase Jan 7, 2026 → Second blob capacity hard fork Each stage unlocks new capabilities. The first activation will introduce key EIPs, while the later forks.

The ax is falling on Amazon corporate offices. The Seattle-based retail giant confirmed it will cut approximately 14, 000 corporate jobs, and employees will begin receiving layoff notices starting Tuesday, Amazon announced. It’s unclear how many of those jobs will be lost in Washington state. Puget Sound Business Journal reporter Nick Pasion, who covers big tech, says the Amazon workers he’s talked to report that their managers are being tight-lipped, but “They are feeling a palpable sense of fear within the company, just concerned that they might be impacted. Some of their friends might be impacted.” And that’s not a baseless.