The post Hoskinson Affirms Cardano ISO 20022 Support as Deadline Nears appeared com. Charles Hoskinson reaffirmed Cardano’s (ADA) support for ISO 20022, aligning it with XRP, HBAR, and ALGO. The statement comes 13 days before SWIFT’s hard November 22 migration deadline for the new global banking standard. A June report showed less than half of central banks were fully compliant, creating an opportunity for ISO 20022-ready blockchains. Charles Hoskinson has positioned Cardano (ADA) alongside other ISO 20022-compliant blockchains, reaffirming the network’s support for the new standard. The move comes as the global banking industry enters the final 13-day countdown to SWIFT’s hard migration deadline. Related: 13 Days Left: Banks Face ISO 20022 Mandate as XRP, Stellar Tout Compliance Hoskinson described the standard as “necessary to open banking and combining the TradFi and DeFi worlds.” He added that ADA “is glad to be holding the line with XRP, HBAR, ALGO, and others.” ISO 20022 support is essential to open banking and combining the tradFi and DeFi worlds. Ada is Glad to be holding the line with XRP, HBAR, ALGO, and others pic. twitter. com/9uZX4xgeQ3 Charles Hoskinson (@IOHK_Charles) November 10, 2025 The November 22 date was set by the Society for Worldwide Interbank Financial Telecommunication (SWIFT). It marks the final, non-negotiable end of the “co-existence period,” where old MT and new MX formats operated side-by-side. The Mandate: A Unified Standard for Global Finance ISO 20022 introduces a unified data format. This standard is designed to enhance cross-border wire transfers, securities settlements, and institutional payment messaging. It replaces older, text-based systems with structured, metadata-rich formats. This new structure enables faster, more transparent communication between banks, payment processors, and digital asset networks. The global rollout, however, has faced multiple setbacks. Implementation has been postponed three times in five years due to difficulties in modernizing legacy infrastructure. SWIFT previously delayed the migration from November 2021 to 2022 before finalizing.

Tag: interoperability

The post Litecoin Shows Relative Strength vs. Bitcoin Amid Whale Accumulation and Rising On-Chacom. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → Litecoin’s rally in November 2025 stems from strong on-chain activity and whale accumulation, decoupling it from struggling altcoins like Ethereum. With a 4. 8% gain against Bitcoin’s flat performance, LTC’s total value locked in DeFi surged 12% to $2. 1 million, signaling sustained investor confidence. LTC outperforms with +4. 8% in November 2025 amid altcoin downturns. Whale wallets holding 100k+ LTC increased 6% over three months, indicating accumulation. Daily on-chain volume reached a record $15. 1 billion, up alongside 12% DeFi TVL growth to $2. 1 million. Discover why Litecoin rally is gaining momentum in 2025 with whale activity and on-chain surges. LTC breaks resistance at $102-explore insights and stay ahead in crypto markets today. Why is Litecoin rallying in November 2025? Litecoin rally is driven by robust on-chain metrics and strategic whale positioning amid a broader altcoin slump. As of November 2025, LTC has climbed 4. 8%, contrasting Ethereum’s 10% decline and highlighting its resilience. This momentum, up 11. 83% against Bitcoin, positions Litecoin as a hedge in uncertain markets. COINOTAG recommends • Professional traders group 💎 Join a professional trading community Work with senior.

The post Polkadot System Chains Upgrade Passes as DOT Tests Lower Bollinger Band Support at $2. 88 appeared com. Rebeca Moen Nov 03, 2025 03: 04 DOT price trades at $2. 88 down 2. 7% as unanimous referendum approval for system chains upgrade provides positive catalyst amid broader crypto weakness testing key technical support levels. Quick Take • DOT trading at $2. 88 (down 2. 7% in 24h) • Unanimous system chains upgrade referendum signals strong community backing • Price testing lower Bollinger Band support at $2. 83 • Following Bitcoin’s weakness amid broader risk-off sentiment Market Events Driving Polkadot Price Movement The most significant development for Polkadot this week was the unanimous passage of a referendum to upgrade all system chains and schedule the Asset Hub Migration. This technical advancement demonstrates robust community consensus and positions the network for enhanced functionality, providing a positive fundamental backdrop despite current price weakness. Polkadot’s participation in Hong Kong Fintech Week from November 3-7 adds another layer of institutional exposure, showcasing the network’s interoperability solutions to a global audience. However, the failure of the Staking Dashboard funding referendum reflects some community friction over resource allocation, though this had minimal market impact. In the absence of major breaking news catalysts, DOT price action is primarily driven by technical factors and broader cryptocurrency market sentiment. The token is experiencing selling pressure alongside Bitcoin and other major cryptocurrencies, with risk-off sentiment dominating trading decisions. DOT Technical Analysis: Testing Critical Support Zone Price Action Context DOT price currently sits below all major moving averages, trading at $2. 88 compared to the 20-day SMA at $3. 01 and 50-day SMA at $3. 59. This positioning indicates sustained bearish pressure, with the token down 26% from its 52-week high of $5. 31. The current price action shows Polkadot following Bitcoin’s weakness rather than establishing independent strength. Volume on Binance spot market reached $14. 4 million in 24 hours, indicating moderate institutional.

Ray introduces label selectors, enhancing scheduling capabilities for developers, allowing more precise workload placement on nodes. The feature is a collaboration with Google Kubernetes Engine. (Read More).

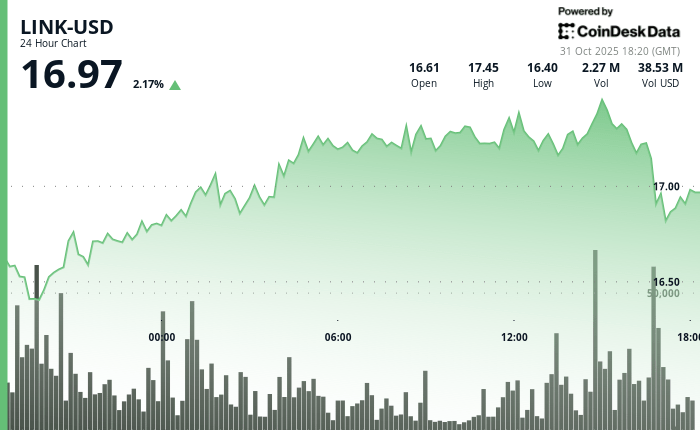

The post Modest Bounce as Stellar Integraticom. The native token of oracle network Chainlink LINK$17. 15 bounced 3. 6% on Friday, reversing some of Thursday’s losses as traders stepped in around key support level. LINK briefly cleared the $17 level with a surge in trading volume some 3 million tokens changed hands during a morning breakout up -, pointing to renewed accumulation, CoinDesk Research’s market insight tool suggested. However, weakness during the U. S. trading hours drove LINK back below $17. Recently, the token traded at $16. 96. On the news front, payments-focused Stellar (XLM) announced to integrate Chainlink’s Cross-Chain Interoperability Protocol (CCIP), Data Feeds, and Data Streams. The move enables developers and institutions building on Stellar to access real-time data and trusted cross-chain infrastructure for tokenized assets. With over $5. 4 billion in quarterly RWA volume and a fast-growing DeFi footprint, Stellar’s adoption of Chainlink tooling signals expanding demand for secure, interoperable financial infrastructure. Key technical levels to watch: LINK now holds near-term support at $16. 37 with upside targets at $17. 46 and $18. 00. Whether the token can build on Friday’s rebound may depend on broader market flows and follow-through from dip-buying. Support/Resistance: Solid support holds at $16. 37 after multiple successful tests, while $17. 46 resistance shows repeated rejection patterns. Volume Analysis: 78% volume surge during breakout attempt confirms institutional interest, explosive selling volume indicates position rebalancing. Chart Patterns: Late-session flush-out pattern creates classic oversold setup for accumulation strategies. Targets & Risk/Reward: Holding above $16. 89 targets $17. 46 retest with upside to $18. 00, downside risk limited to $16. 37 support. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. Source:.