The post AVAX Tests 52-Week Lows at $13. 27 Despite Granite Upgrade Launch appeared com. Jessie A Ellis Nov 22, 2025 03: 05 Avalanche trades at $13. 27 after hitting new yearly lows, down 25% monthly despite launching technical upgrades as broader crypto markets decline alongside traditional assets. Quick Take • AVAX trading at $13. 27 (down 3. 4% in 24h) • Granite upgrade launch failed to prevent price decline to 52-week lows • Testing critical support near $12. 57 with oversold technical readings • is trading near the lower Bollinger Band at.

Tag: crypto-specific

The post Crypto recovery remains slow despite global liquidity boost: Wintermute appeared com. Global liquidity is rising, stocks are soaring, and interest rates are falling but crypto markets are not bouncing back. Wintermute says why. Summary Wintermute reports that crypto is underperforming despite global liquidity expansion and rate cuts. The report says liquidity is flowing into equities, AI, and prediction markets, not crypto. Wintermute says the four-year Bitcoin halving cycle no longer explains price movements. Recovery depends on renewed ETF inflows and institutional activity in DAT markets. Despite a favorable macroeconomic environment, the cryptocurrency market continues to underperform other risk assets, according to Wintermute’s latest market update dated Nov. 3. The report highlights that although global liquidity is expanding with central banks cutting interest rates, ending quantitative tightening (QT), and stock markets sitting near all-time highs, capital is not flowing into crypto markets at the same pace. Wintermute attributes this underperformance to a redirection of liquidity. While financial conditions have improved globally, the inflows are primarily targeting equities, artificial intelligence (AI) sectors, and prediction markets. In contrast, ETF inflows and Digital Asset Treasury (DAT) activity, which were key drivers of crypto growth earlier in the year, have largely stalled. “The tap isn’t off, it’s just pointed somewhere else,” the report noted. Stablecoin supply remains the only inflow metric showing growth, with over $100 billion added year-to-date. Meanwhile, Bitcoin ETF assets under management have stagnated around $150 billion, and secondary DAT volumes have plummeted. Market data reinforces this slowdown. BTC (BTC) and ETH (ETH) have both been range-bound, with Bitcoin hovering near $101,000 and Ethereum around $3,300. The broader market also suffered heavy losses last week gaming, layer-2s, and meme coins recording double-digit drops. Wintermute says four-year Bitcoin cycle is dead Wintermute also argues that the traditional four-year Bitcoin cycle theory is no longer relevant. The firm believes that price performance in mature markets.

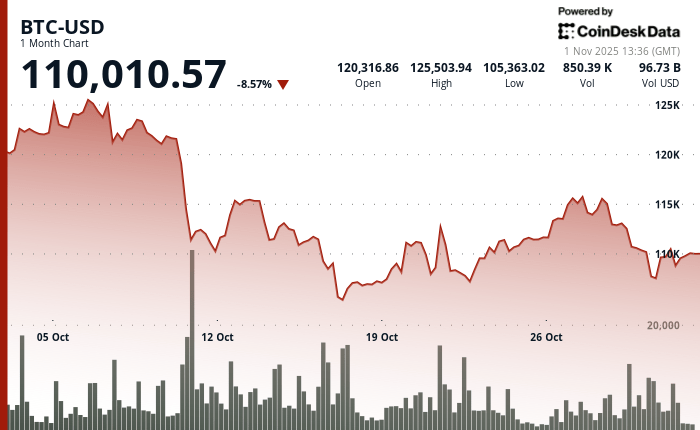

The post Bitcoin Broke the Uptober Streak, but a Handful of Altcoins Managed to Finish Higher appeared com. Bitcoin closed October lower, snapping its six-year “Uptober” streak while BNB eked out a gain as a mid-month jolt left most majors stuck below early highs. The shock landed Oct. 10, when President Donald Trump threatened steep new tariffs on China amid rare-earth tensions, touching off a broad risk-off move. Bitcoin slid from roughly the low $120,000s toward about $105,000 in fast trade, and altcoins fell harder as thin liquidity met heavy leverage. Over Oct. 10-11, derivatives venues auto-liquidated an estimated tens of billions of dollars in positions and more than half a trillion dollars in market value evaporated before a shaky rebound set a floor. It was a macro headline colliding with crowded positioning, not a crypto-specific catalyst. By month’s end, CoinDesk Data showed bitcoin finishing October in the red, the outcome that breaks what traders call “Uptober.” On CoinGlass’s Bitcoin Monthly Returns heat map, October 2025 is the first red October since 2018 and ends a green run that stretched from 2019 through 2024. That lore matters because the pattern persisted across very different regimes late-cycle surges and post-sell-off recoveries alike so a miss in 2025 resets expectations and reminds traders that seasonality is a tendency, not a promise. CoinGlass’s Bitcoin Monthly Returns Heat Map (CoinGlass) The month’s shape was remarkably consistent across one-month TradingView charts. Bitcoin started firm, suffered the synchronized Oct. 10-11 air pocket, then spent the back half of the month climbing without retaking its early peak. Ether traced the same flush-base-fade arc and stalled beneath the round-number band it tested in the first week. Solana and XRP echoed that rhythm with a sequence of lower highs into the final sessions. In practical terms, late rebounds did not flip resistance into support, which is why the monthly candles printed red for those four.