**New York and Connecticut Attorneys General Lead Lawsuit Against Department of Education Over New PSLF Rule**

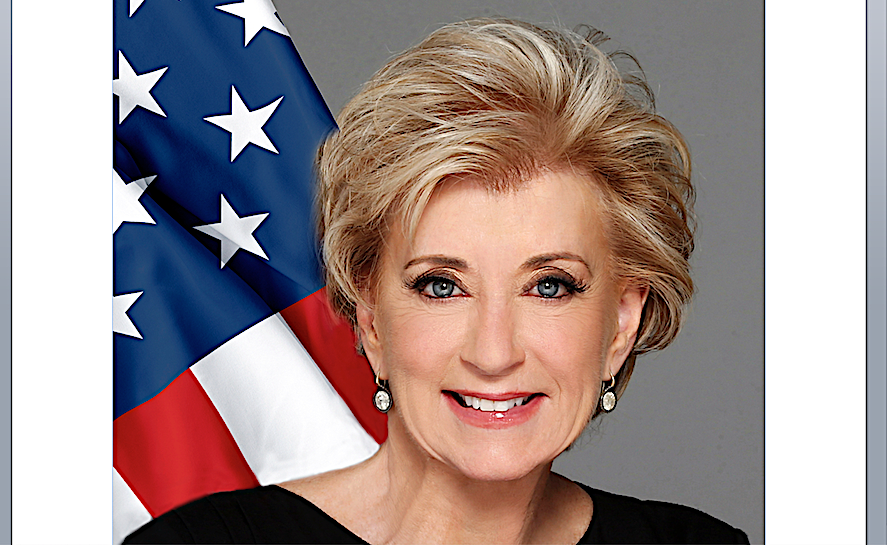

New York Attorney General Letitia James, Connecticut Attorney General William Tong, and 20 other state attorneys general have filed a lawsuit in the U.S. District Court for the District of Massachusetts against the U.S. Department of Education and Linda McMahon, in her official capacity as Secretary of the Department of Education.

Linda McMahon, former CEO of World Wrestling Entertainment (WWE) in Stamford, is named in the suit concerning a new federal rule restricting eligibility for the Public Service Loan Forgiveness (PSLF) program. The PSLF program allows government and nonprofit employees to have their federal student loans forgiven after ten years of qualifying service.

The lawsuit alleges that the Department of Education’s new rule unlawfully limits eligibility by disqualifying entire state governments, hospitals, schools, and nonprofit organizations if the government unilaterally determines they have engaged in activities disfavored by the previous administration. These activities reportedly include support for immigrants, gender-affirming health care, or diversity programs.

According to the attorneys general, this rule is not only unlawful but also politically motivated. They argue the rule intends to punish states and organizations that the administration opposes.

The PSLF program was established by Congress in 2007. Attorney General James emphasized its importance, saying, “Public Service Loan Forgiveness was created as a promise to teachers, nurses, firefighters, and social workers that their service to our communities would be honored.”

She added, “Instead, this administration has created a political loyalty test disguised as a regulation. It is unjust and unlawful to cut off loan forgiveness for hardworking Americans based on ideology. I will not let our federal government punish New York’s public servants for doing their jobs or standing up for our values.”

The Department of Education finalized the controversial new rule on October 31, with the rule scheduled to take effect in July of next year.

James and the other attorneys general warn that entire classes of public workers—including teachers, health professionals, and legal aid attorneys representing immigrants—could suddenly lose PSLF eligibility despite fulfilling all program requirements.

Highlighting current tensions, James pointed out that earlier this year, the U.S. Department of Justice sued New York over its “Protect Our Courts Act.” This state law ensures that immigration enforcement does not deter individuals from seeking justice in state courts. Under the new PSLF rule, the attorneys general contend that the administration could deem the “Protect Our Courts Act” as having a “substantial illegal purpose” and use that as grounds to deny loan forgiveness to thousands of New York public employees.

The lawsuit underscores that the new rule is flatly illegal. The PSLF law guarantees forgiveness for anyone who works full-time in qualifying public service. It does not grant the Department of Education authority to impose ideological tests or selectively target state policies or social programs while exempting federal agencies from similar scrutiny.

The group of attorneys general is asking the federal court to declare the new rule unlawful, vacate it, and bar the Department of Education from enforcing or implementing it. They stand united in their commitment to protect the promise of loan forgiveness for public servants nationwide.

https://westfaironline.com/fairfield/ags-james-tong-other-sue-linda-mcmahon-and-her-department/