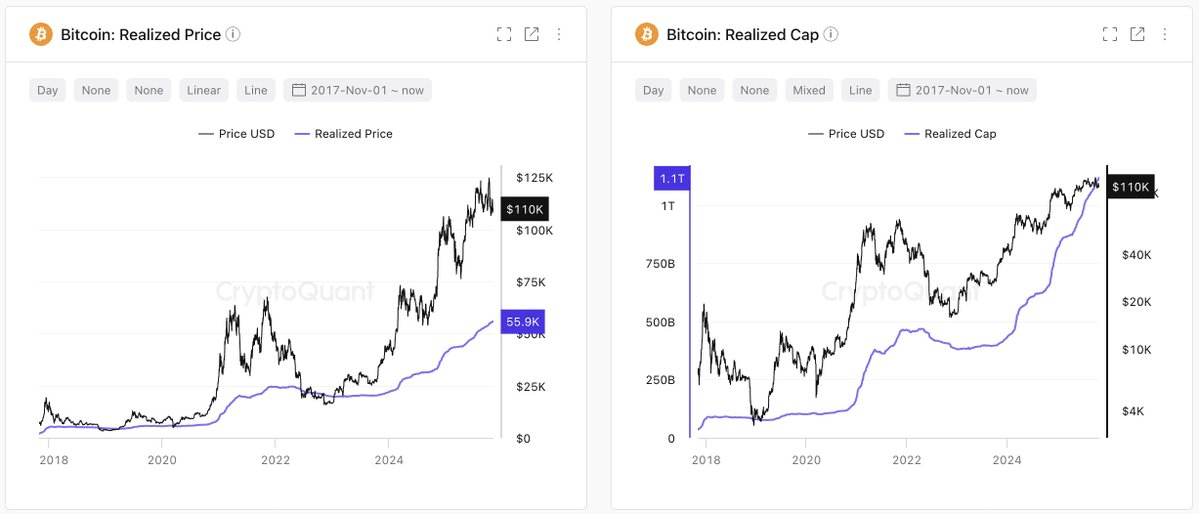

Bitcoin’s Realized Cap Rise Signals Robust Demand as Price Climbs Above $110,000

Bitcoin’s realized capitalization has surged by more than $8 billion over the past week, pushing the total value beyond $1.1 trillion. This rise corresponds with the cryptocurrency’s realized price surpassing $110,000, according to data from CryptoQuant. The realized cap measures the total dollar value of all Bitcoin coins based on their last moved price, providing insight into the overall investment held by holders.

This upward movement underscores resilient onchain inflows despite lingering negative sentiment following the recent $19 billion crypto market downturn. Key contributors to these inflows include Bitcoin treasury firms and exchange-traded funds (ETFs), which have remained significant accumulators. Ki Young Ju, founder and CEO of CryptoQuant, noted that demand has heavily relied on these entities, though their buying activity has recently slowed. This suggests that while onchain signals reveal strong underlying interest, broader price recovery may depend on the resumption of aggressive acquisitions.

How Are Bitcoin Miners Contributing to Network Growth?

Ki Young Ju describes the rising Bitcoin hash rate as a “clear long-term bullish signal” for Bitcoin’s evolution as a reliable store of value. Several major mining operations have scaled their fleets recently. For example, American Bitcoin—a firm linked to the Trump family—acquired 17,280 application-specific integrated circuits (ASICs) at a cost of approximately $314 million, as reported in August.

These expansions not only increase mining efficiency but also reflect strong confidence in Bitcoin’s future despite geopolitical and economic uncertainties. The increased hash rate strengthens the blockchain against potential attacks, supporting sustained network health. Data from CryptoQuant shows miners escalating their activity even as market sentiment remains in “Fear” territory, demonstrating operational resilience that could help stabilize prices.

Despite these positive onchain indicators, overall investor confidence remains subdued after the sharp market decline experienced at the start of October. However, external factors such as potential Federal Reserve interest rate cuts could trigger a market turnaround.

Frequently Asked Questions

What Role Do ETFs Play in Bitcoin’s Price Recovery?

ETFs have been major drivers of Bitcoin demand, significantly contributing to the recent $8 billion realized cap increase through consistent inflows. Although purchasing activity from ETFs has recently slowed, CryptoQuant highlights that a resurgence—potentially between $10 billion and $15 billion in inflows—could push Bitcoin’s price toward $140,000 in November, according to projections from Bitfinex analysts.

Will Bitcoin Reach $140,000 in November Based on Current Trends?

Yes. Bitcoin could climb to $140,000 by November if ETF inflows double and the Federal Reserve implements two interest rate cuts in the fourth quarter. Seasonal market strength in Q4 combined with easing monetary policy are key catalysts. However, risks such as tariffs and geopolitical tensions remain potential headwinds.

Key Takeaways

- Strong Onchain Inflows: The $8 billion rise in realized cap highlights robust demand from treasury firms and ETFs, positioning Bitcoin’s realized price above $110,000.

- Miner Expansion Signals Bullishness: Increases in hash rate, fueled by fleet upgrades like American Bitcoin’s $314 million ASIC purchase, reinforce long-term network growth.

- Recovery Catalysts Ahead: Renewed ETF buying and Federal Reserve easing could propel Bitcoin to $140,000, making it crucial for investors to closely monitor these developments.

Conclusion

Bitcoin’s realized cap increase of more than $8 billion—driven by onchain inflows from ETFs and treasury firms, alongside miners expanding their hash rates—paints a picture of underlying strength despite recent market fears. As Ki Young Ju of CryptoQuant emphasizes, sustained demand from these channels will be vital for maintaining momentum.

Looking ahead, a potential resurgence in ETF activity combined with supportive Federal Reserve policies could propel Bitcoin toward $140,000 by November, presenting opportunities for informed investors amid this evolving landscape. Analyses from CryptoQuant and Bitfinex underline the importance of tracking institutional activity and macroeconomic shifts.

Given that Bitcoin’s realized price reflects the real investment locked in by holders, these trends suggest a solid foundation for a recovery in 2025. Market participants should stay vigilant on onchain metrics and policy announcements to capitalize on emerging bullish signals within the cryptocurrency space.

Bitcoin’s network continues to show resilience, with miners’ investments ensuring robust security. The dynamic between ETF flows and broader economic policies will likely determine the pace of recovery, making it essential to monitor these factors closely. As the year unfolds, these developments may redefine Bitcoin’s trajectory within the global financial ecosystem.