It has been a week of ups and downs for Ripple (XRP) investors, as the price has tumbled by over 10% due to a loss of bullish momentum. However, according to whale on-chain movement analysis, XRP whales are not leaving the market; instead, they are actively investing in a new crypto coin called Mutuum Finance (MUTM).

### Mutuum Finance Gains Momentum

With a current price of only $0.035, Mutuum Finance is rapidly gaining popularity in the crypto market. The coin stands out because of its innovative DeFi lending mechanism, real yield system, and impressive growth rate. Notably, Stage 6 of its presale is already 85% sold, making Mutuum Finance one of the top candidates to be the next big crypto surge in Q4 of this year and into 2026. Demand for the token is escalating at a pace that defies existing estimates and market predictions.

### XRP Price Pressure Intensifies

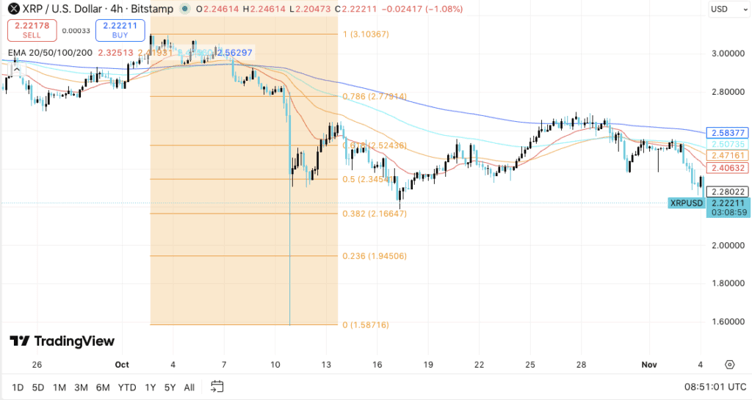

XRP has experienced a challenging week, falling more than 10% and maintaining a tight trading range between $2.16 and $2.52, which coincides with the Fibonacci support level of 0.382. While bulls are fighting to protect this support region, XRP is struggling to move past its Exponential Moving Average (EMA) resistance levels. This resistance is currently preventing any significant upward momentum.

To regain momentum, XRP needs to break through the current resistance level at $2.52. Doing so could open the path towards higher targets between $2.77 and $3.10. Conversely, failure to overcome this resistance might result in a decline to around $1.94. Adding to the excitement, open interest in XRP is increasing, signaling that significant volatility is imminent—though it remains unclear whether this will be to the upside or downside.

### Investors Eye Mutuum Finance as an Alternative

The uncertainty surrounding XRP’s near-term price action has led many investors to explore other promising opportunities. Mutuum Finance (MUTM), with its compelling growth prospects and innovative DeFi model, is emerging as a strong contender. This project is increasingly viewed as a relatively better growth option, positioning itself as one of the next cryptos to explode.

### Mutuum Finance Presale Enters Rapid Growth Phase

Mutuum Finance’s presale is nearing completion and gaining significant traction across the DeFi ecosystem. Currently at 85% completion of Phase 6, the project enjoys strong engagement and enthusiasm among investors. At this phase, the token is priced at $0.035, offering a last chance for investors to buy before the price rises to $0.04 in Phase 7.

So far, Mutuum Finance has garnered more than 17,810 individual supporters and raised upwards of $18.5 million in presale funding. Beyond its fundraising success, Mutuum Finance’s appeal lies in its utility-focused approach, a clear development roadmap, and a commitment to creating a transparent, sustainable lending platform. These factors collectively position MUTM as a prime crypto to watch within a highly competitive market.

### Imminent Testnet Launch to Showcase Core DeFi Functionality

A significant upcoming milestone is scheduled for Q4 of 2025: the launch of Mutuum Finance’s Sepolia testnet. This will be the first live environment to feature the project’s loaning and value creation system. Users will have the opportunity to obtain funding by providing collateral in ETH and USDT, while also earning MUTM rewards through mtTokens.

The testnet will also facilitate the development and testing of critical operational functions such as risk management, interest rate algorithms, and loan processing before these features are fully deployed on the mainnet. This phased approach demonstrates Mutuum Finance’s dedication to ensuring platform longevity and operational success.

### Looking Ahead

With growing excitement and anticipation, Mutuum Finance is positioned for substantial growth and innovation within the DeFi space. As the market contemplates the “next crypto to explode,” MUTM stands out as a project deserving of close monitoring and consideration.

For more information about Mutuum Finance (MUTM), visit their official website through the following link:

[Website: Linktree]

https://bitcoinethereumnews.com/finance/ripple-whales-are-loading-up-on-mutuum-finance-mutm-to-save-portfolios-as-xrp-tanks-10-in-a-week/