**Zcash (ZEC) Surges 19% Amid Broader Crypto Market Decline**

Zcash (ZEC) has surged over 19% in the past 24 hours, trading at $526 with a robust $1.68 billion in volume, according to CoinMarketCap data. This impressive gain stands out as the wider cryptocurrency market experiences significant declines. Bitcoin (BTC), for example, briefly fell below the $100,000 mark, dragging many other digital assets downward.

—

### What Is Causing the Zcash Price Surge?

The recent Zcash rally stems largely from renewed interest in its advanced privacy features during a time of market-wide sell-offs. While most cryptocurrencies have struggled, Zcash’s unique technology—built around zk-SNARKs—has drawn traders looking for anonymity and security amid volatile conditions.

This divergence highlights the growing value of shielded transactions that protect user identities and transaction details, a feature increasingly sought after given rising regulatory scrutiny in the crypto space.

—

### How Do Zcash Privacy Features Drive Market Performance?

Zcash utilizes zk-SNARKs (zero-knowledge succinct non-interactive arguments of knowledge), a zero-knowledge proof protocol allowing users to verify transactions without exposing sender, receiver, or transaction amount.

Unlike Bitcoin’s fully transparent ledger, Zcash offers optional shielding which appeals strongly to privacy advocates. According to blockchain analysts at Electric Coin Company, over 10% of Zcash transactions are now shielded, up from previous quarters. This adoption boost correlates closely with the token’s recent price momentum.

As the Zcash developer team lead puts it:

*“Privacy is a fundamental right in digital finance, and zk-SNARKs deliver it efficiently without compromising network security.”*

In essence, zk-SNARKs reduce data exposure while maintaining proof integrity—a tech edge that resonates in today’s uncertain market.

—

### Technical Indicators Support ZEC’s Bullish Momentum

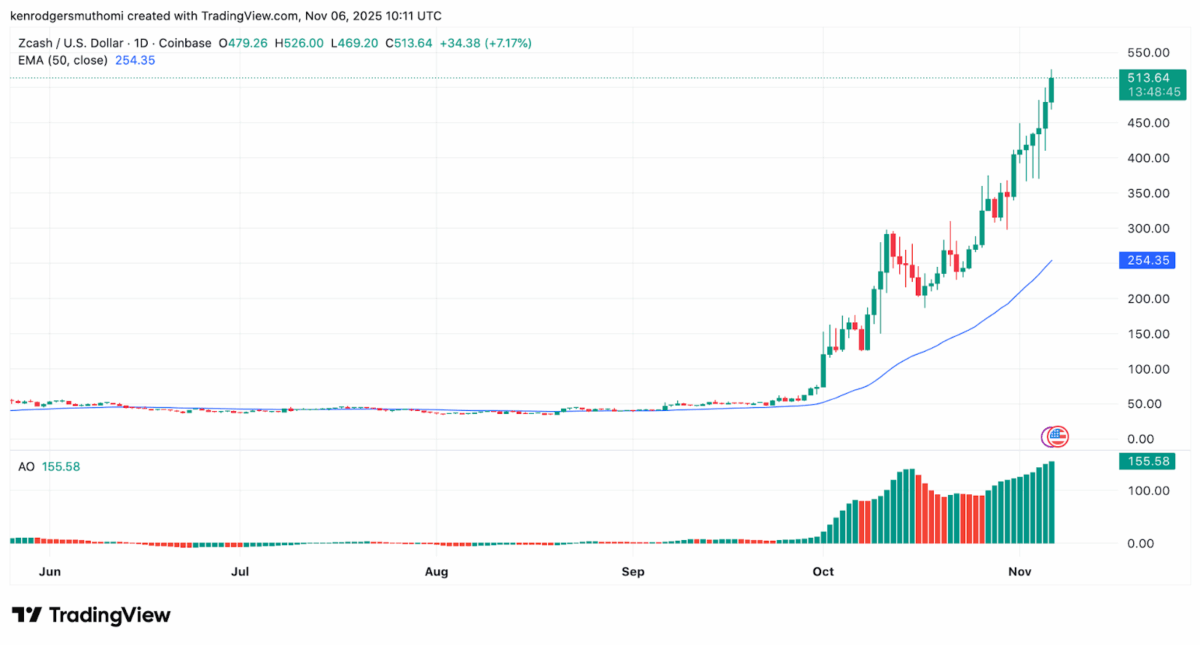

Zcash’s price has been on an upward trajectory since early October, rallying from roughly $30-$60 to above $500. This sharp move has caught traders’ attention, especially as most major cryptocurrencies struggle to hold ground.

Key technical indicators highlight this strength:

– **50-Day Exponential Moving Average (EMA):** ZEC’s price currently sits well above its 50-day EMA, which is trending upward. This pattern indicates sustained buying pressure and a positive trend.

– **Awesome Oscillator (AO):** The AO has turned solidly positive at 155.58 with increasing green bars, signaling rising bullish momentum.

Together, these tools reflect genuine market support rather than short-term speculative spikes. The Awesome Oscillator, which compares recent to older price bars, shows buyers gaining control when green bars grow, reinforcing the uptrend.

—

### Rising Popularity and Social Sentiment Fuel ZEC Rally

Beyond charts, social media sentiment has played an influential role in Zcash’s price action. Comments from prominent figures helped boost interest:

– Billionaire investor Naval Ravikant stated, *“Bitcoin is insurance against fiat. Zcash is insurance against Bitcoin.”*

– BitMEX Co-Founder Arthur Hayes chimed in on October 31, *“Let me jinx this. EC to $400 and beyond!”*

Following these remarks, ZEC price surged as much as 36%, despite a prevailing market downtrend. Such endorsements attracted retail traders, amplifying trading volumes and enthusiasm.

—

### Why Does the Zcash Rally Stand Out?

Zcash’s strong performance contrasts sharply with the broader market decline, highlighting privacy features as a differentiator amid uncertainty. As the crypto community debates transparency versus privacy, Zcash’s optional shielding positions it uniquely.

However, the sustainability of this price surge remains uncertain, especially if overall market conditions persist weak. Investors are closely monitoring developments in the coming days to gauge whether the uptrend will hold.

—

### Is Zcash a Good Investment During Market Volatility?

Zcash’s privacy advantages make it appealing in volatile markets, and its price holding above key EMAs strengthens its technical case. While the recent 19% rally is promising, investors should remember that past performance is not a guarantee of future results.

On-chain data showing increased adoption and rising daily active addresses—up 15% last month—signal growing use cases, especially in DeFi privacy protocols. Nonetheless, consulting financial advisors is recommended for personalized guidance when considering ZEC as part of a diversified portfolio.

—

### Key Takeaways

– **Privacy Innovation:** Zcash’s zk-SNARKs enable anonymous transactions, differentiating it from transparent blockchains like Bitcoin.

– **Bullish Technicals:** The 50-day EMA and Awesome Oscillator confirm sustained upward momentum since early October.

– **Sentiment Boost:** Remarks from Naval Ravikant and Arthur Hayes have driven retail interest amid market sell-offs.

—

### Conclusion

Zcash stands out in the current turbulent crypto landscape by delivering strong privacy features coupled with solid technical momentum. Its recent 19% rally amid a broad market downturn underscores growing investor interest in privacy coins. While challenges remain, Zcash’s unique value proposition may continue to attract attention as traders seek security and anonymity in digital finance.

Stay tuned for further developments as the market evolves.

—

*For more insights and updates on privacy-focused cryptocurrencies, keep following [Your Site or Blog Name].*

https://bitcoinethereumnews.com/crypto/zcash-surges-19-as-crypto-market-declines-boosting-privacy-coin-interest/