Short-Term Bitcoin Holders Face Mounting Losses as BTC Drops to $96,041

Bitcoin (BTC) has seen a significant decline, falling to $96,041, marking an 8.7% weekly loss. Realized losses among short-term holders have surged to levels not observed since April 2025, signaling widespread panic selling from recent buyers. Over 148,000 BTC was sold by short-term holders within a 48-hour period, with shark and fish investor cohorts contributing approximately 70,100 BTC to the sell-off.

Discover why Bitcoin short-term holder losses are accelerating in 2025, how STHs are dumping 148k BTC amid price weakness, and what this means for BTC trends and future trading strategies. Stay informed with key insights below.

What Are Bitcoin Short-Term Holder Losses and Why Do They Matter?

Bitcoin short-term holder (STH) losses refer to the unrealized and realized financial setbacks experienced by investors who have held BTC for less than 155 days. These losses occur particularly when market prices drop below their purchase price.

These losses are important because they often trigger widespread selling, amplifying market downturns and eroding confidence among newer investors. As of late November 2025, short-term holder supply in loss has climbed to 4.9 million BTC—a peak reminiscent of previous volatile periods.

How Have Short-Term Holders Contributed to Recent BTC Price Declines?

Short-term holders have played a pivotal role in Bitcoin’s recent price slide. Data from Checkonchain indicates a sharp rise in both realized and unrealized losses over the past few weeks. This surge has coincided with BTC’s price action, which has formed lower lows within a descending channel since late October.

The asset’s price at press time stands at $96,041, reflecting a 5.91% daily drop and an 8.7% weekly loss. The increased losses mainly stem from purchases made at higher levels—around $102,000 to $107,000—now well above BTC’s current valuations.

Historically, such elevated loss levels often precede intensified selling as holders attempt to minimize further damage. Market analysts note that when short-term holder supply in loss surpasses 4 million BTC, it often corresponds with broader capitulation phases. For example, in April 2025, prices hovered between $74,000 and $76,000 during a similar downturn.

This pattern highlights the vulnerability of newer investors to rapid price swings, thereby contributing to ongoing bearish momentum.

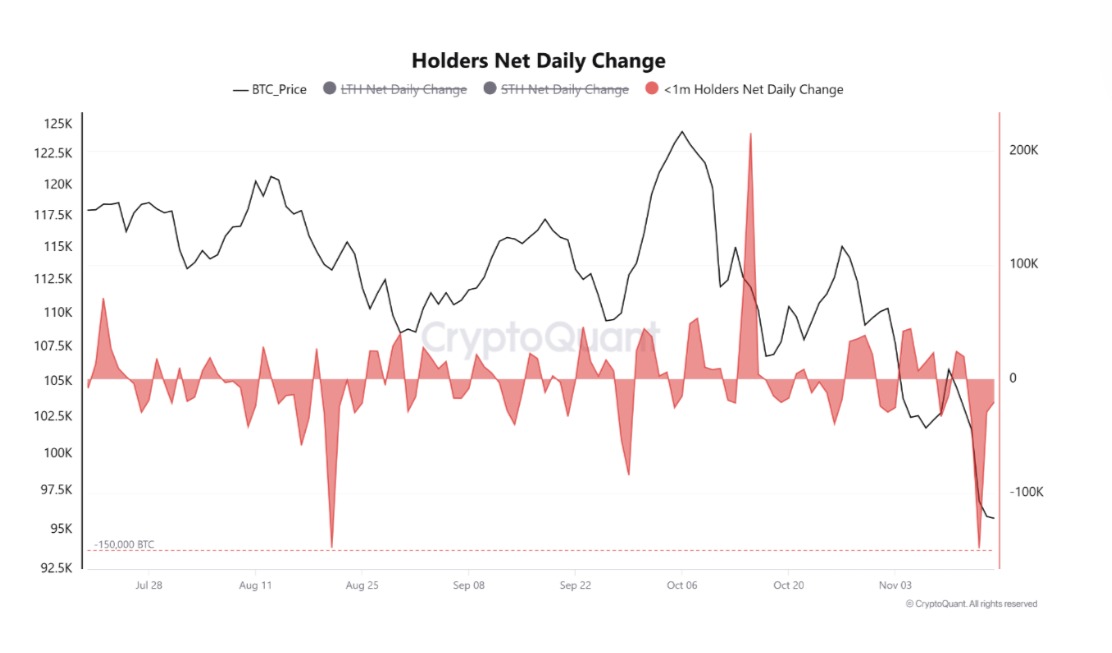

Supporting this, data from CryptoQuant reveals that short-term holders offloaded 148,000 BTC acquired below $100,000 over the past 48 hours. This shift from accumulation to distribution exacerbates downward pressure as BTC breaches key support zones.

For instance, shark cohorts—wallets holding 100 to 1,000 BTC—recorded a net balance change of -53,700 BTC over the 30-day period ending November 16, per Checkonchain metrics. Likewise, fish holders (10 to 100 BTC) experienced a -16,400 BTC change, showcasing a coordinated sell-off across retail and mid-tier investors.

Frequently Asked Questions

What Causes Bitcoin Short-Term Holder Losses to Spike During Market Downturns?

Bitcoin short-term holder losses spike when prices fall below the average purchase cost of coins held for under 155 days. This often prompts holders to realize losses through sales. In the current cycle, a drop from $107,000 peaks has left 4.9 million BTC underwater, leading to 148,000 BTC being dumped in 48 hours as holders cut losses to avoid deeper declines.

Is the Current BTC Sell-Off from Short-Term Holders a Sign of a Larger Market Bottom?

The intense sell-off from short-term holders may indicate nearing capitulation rather than a full market bottom. Historical data from CryptoQuant shows similar patterns before significant rebounds. Investors should watch for slowing sales and increased spot buying to confirm stabilization around $94,000 support, potentially setting up a recovery toward $99,000.

Key Takeaways

- Accelerating Losses: Bitcoin short-term holder losses reached an 8-month high of 4.9 million BTC, driven by prices dipping below $100,000 cost bases.

- Massive Dumping: Over 148,000 BTC sold by short-term holders in 48 hours, with sharks and fish contributing significant net outflows totalling 70,100 BTC.

- Trading Outlook: Monitor for a reduction in selling pressure. BTC could test $94,000 on the downside or rebound to $99,000 if fresh demand emerges.

Conclusion

Bitcoin short-term holder losses have intensified significantly in late 2025, with 4.9 million BTC now underwater and over 148,000 coins sold amid broader market declines toward $96,041. This capitulation from recent buyers, backed by data from Checkonchain and CryptoQuant, highlights the risks associated with short-term positioning in volatile assets.

As selling pressure begins to ease, renewed spot demand could foster stabilization. Investors should stay vigilant for signs of reversal to navigate upcoming opportunities effectively.

Source: Checkonchain