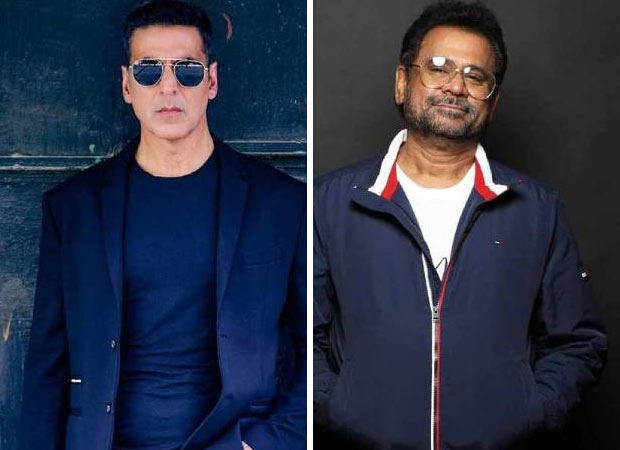

**Anees Bazmee and Akshay Kumar Reunite for a Reimagined Version of *Sankranthiki Vasthunam***

After delivering blockbuster hits like *Welcome* and *Singh Is Kinng*, Anees Bazmee and Akshay Kumar are teaming up once again. Reliable sources have confirmed that the duo’s next project will be a reimagined version of the Venkatesh-led Telugu film *Sankranthiki Vasthunam*. Produced by Dil Raju, the upcoming film is being touted as an out-and-out comic entertainer.

According to a source close to Bollywood Hungama, “Anees and Akshay loved the plot of the lead character stuck between his wife and ex-girlfriend that *Sankranthiki Vasthunam* revolves around. However, the original film had a strong Telugu flavor. To make the story more relatable for the Hindi-speaking audience, Anees Bazmee is reimagining the film while keeping the core plot intact.”

The source added, “Anees is a master at creating fresh screenplays based on already established films. This project will be not only bigger than the original but also funnier, as Anees plans to incorporate several new gags into the narrative, which were absent in the original. Over the past three decades, Bazmee has excelled in writing love triangles with a comedic touch, and this film fits perfectly into his style of situational comedy.”

Currently, the writing process is underway in full swing. The makers aim to start filming the untitled project in February 2026. Importantly, the film is not a remake but rather a reimagined take on the original. The screenplay will blend new scenes with existing elements to create a fresh cinematic experience.

“It’s about 60% fresh sequences and 40% original content to preserve the essence of the plot,” the source revealed.

Stay tuned for more updates on this exciting comic venture from Anees Bazmee and Akshay Kumar!

—

**Also Read:** [Akshay Kumar and Disha Patani Wrap Up ‘Welcome to the Jungle’ Song Shoot in Dubai](#)

*Bollywood News Live Updates*

https://www.bollywoodhungama.com/news/bollywood/exclusive-akshay-kumar-anees-bazmee-reunite-madcap-love-triangle-reimagined-sankranthiki-vasthunam-go-floors-february-2026/