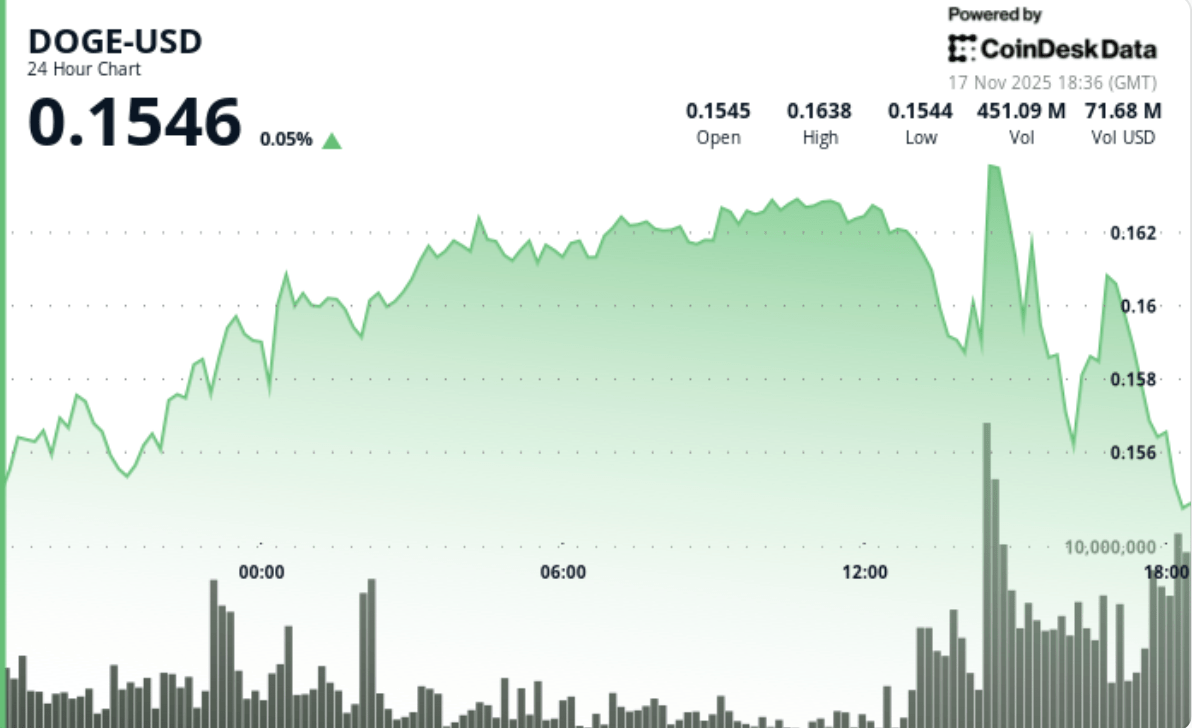

The post Bitcoin Death Cross Could Mean This for Dogecoin on the Fear & Greed Index. Analysts warn that while the Death Cross doesn’t guarantee further crashes, it tends to pressure high-beta assets like DOGE during liquidity contractions. Whale selling and accelerating spot Bitcoin ETF outflows contributed to broader risk-off contagion. Meme coin flows tightened as traders rotated into higher-liquidity majors, despite DOGE seeing intermittent whale accumulation events. Price Action Summary DOGE climbed 4. 41% to $0. 156, with volume spiking 29. 6% above weekly averages. Strong bid defense appeared at $0. 1551-$0. 1580, where buyers absorbed heavy sell pressure. DOGE broke above $0. 1640 intraday before trending lower into the close. Final-hour profit-taking triggered a 2. 57% drop, sending DOGE back toward key support. DOGE traded within a 5. 8% intraday range, tracking broader BTC-driven volatility. Technical Analysis Dogecoin opened the session with clear bullish structure, building an ascending pattern driven by strong volume at the $0. 158 support zone. The rally benefitted from broader market stabilization ahead of the BTC Death Cross event but failed to produce a decisive breakout beyond the $0. 163-$0. 165 resistance band. The afternoon volume spike 1. 26B DOGE traded confirmed aggressive defense of support and suggested institutional accumulation was present beneath market price. However, the tone shifted dramatically into the close. As BTC slid further below $94,000 and the Death Cross narrative spread across futures desks, DOGE experienced algorithmic rotational selling identical to.

https://bitcoinethereumnews.com/bitcoin/bitcoin-death-cross-could-mean-this-for-dogecoin-doge-price/

Tag: source

Singapore Pioneers Tokenized Government Bonds With CBDC Settlement

**Revolutionary: Singapore Pioneers Tokenized Government Bonds With CBDC Settlement**

Singapore has taken a groundbreaking step by pioneering the issuance of tokenized government bonds settled using Central Bank Digital Currency (CBDC). This innovative approach marks a significant advancement in the integration of blockchain technology within the financial sector.

The adoption of tokenized government bonds allows for enhanced transparency, efficiency, and accessibility in bond issuance and settlement processes. By leveraging CBDC for settlement, Singapore aims to streamline transactions, reduce costs, and increase the overall security of financial operations.

This initiative positions Singapore at the forefront of digital finance innovation, setting a precedent for other countries exploring the benefits of combining traditional financial instruments with digital currencies. Stay tuned for more updates on this revolutionary development in the world of finance.

*Source:* [Insert source link here]

https://bitcoinethereumnews.com/tech/singapore-pioneers-tokenized-government-bonds-with-cbdc-settlement/

XRP Price Today: XRP Forms Bullish ‘W’ Pattern as Traders Eye Breakout Above $2.53

After several days of consolidation, the XRP price is building strength near a critical resistance zone, sparking optimism among market participants. However, growing whale activity and profit-taking suggest that traders remain cautious, waiting for stronger confirmation before committing to the next leg up.

**XRP Price Holds Steady Amid Profit-Taking and Rising Volume**

As of November 11, 2025, XRP trades at $2.45, marking a modest 1.16% daily decline from $2.48. Despite the dip, trading volume surged by more than 34%, reaching $6.14 billion in the last 24 hours. This increase in volume during a pullback often signals repositioning among traders rather than panic selling, indicating potential accumulation ahead of XRP’s next move.

XRP was trading at around $2.45, down 3.15% in the past 24 hours at press time. The steady price action and high volume have pushed XRP’s total market capitalization to roughly $147.5 billion. While short-term selling persists, the broader structure remains bullish as long as prices hold above the $2.15-$2.20 demand zone.

**Analysts Spot Bullish ‘W’ Formation**

Technical analysts are closely watching a bullish “W” pattern forming on the 12-hour XRP/USDT chart—a classic double-bottom structure that signals reversal potential. According to crypto trader Steph_iscrypto, “Support around $2.00 remains firm, with a possible breakout above $2.53 that could propel XRP toward $3.25 if volume confirms the move.”

This bullish pattern, alongside Ripple’s recent regulatory progress, aligns with broader market optimism. Still, analysts caution that social media enthusiasm surrounding the “W” formation could amplify volatility as traders rush to interpret similar chart setups shared across X.

**Whale Activity Sparks Mixed Sentiment**

On-chain data adds another layer of intrigue. Analyst Ali recently noted that, “90 million XRP were sold by whales in just 72 hours,” referencing a Santiment chart that showed large holder activity earlier this month. Over 6 billion XRP moved during this period, corresponding with a price decline from $3.30 to $2.30.

This suggests renewed interest from retail investors, possibly taking advantage of lower entry points. Historically, similar whale sell-offs have coincided with short-term bottoms and recovery phases, giving bulls reason to remain optimistic.

**Technical Outlook: Resistance at $2.65-$2.70 Key for Bullish Continuation**

From a technical standpoint, the current XRP price faces strong resistance between $2.43 and $2.65, where multiple moving averages (20, 50, and 100-day EMAs) have converged. This range has capped every rebound since September, making a daily close above $2.70 the key trigger for a sustained breakout.

A breakout above $2.70 could propel the XRP price toward $2.90 and possibly $3.10. Yet, bulls have successfully defended the structural base between $1.95 and $2.15, preventing deeper corrections.

Notably, open interest in XRP futures has recently climbed to $4.11 billion, indicating increased speculative positioning. However, a combination of rising open interest and falling prices typically signals new short entries, suggesting traders are bracing for volatility near the resistance zone.

**Traders Await Confirmation Before the Next Move**

The setup for Ripple (XRP) now appears binary: a decisive breakout above $2.70 could trigger a bullish reversal toward $2.90 and eventually $3.10, while another rejection may push prices back toward the $2.15 accumulation pocket.

Overall, sentiment remains mixed but cautiously optimistic. With whale activity stabilizing, technical structures tightening, and buyers defending key levels, XRP’s next move could determine the tone for the rest of November. Traders now await confirmation—and potentially, the start of the next major XRP price rally.

https://bitcoinethereumnews.com/tech/xrp-price-today-xrp-forms-bullish-w-pattern-as-traders-eye-breakout-above-2-53/

How Base Transforms Institutional Payments

**Revolutionary JPM Coin Expansion: How Base Transforms Institutional Payments**

The post *How Base Transforms Institutional Payments* appeared on com.

—

**Revolutionary JPM Coin Expansion: How Base Transforms Institutional Payments**

In the evolving landscape of digital finance, JPM Coin continues to lead the charge in transforming institutional payments. The recent expansion of JPM Coin, powered by Base, marks a significant milestone in streamlining and securing transactions for financial institutions worldwide.

Base, a cutting-edge blockchain platform, enhances the speed, transparency, and efficiency of payments, enabling institutions to move funds seamlessly across borders. This integration not only reduces transaction costs but also minimizes settlement times, offering a revolutionary approach to traditional payment systems.

As JPM Coin expands its reach through Base, institutions stand to benefit from increased liquidity, robust security protocols, and improved interoperability. This development paves the way for broader adoption of digital assets within the financial sector, signaling a new era of institutional payment processing.

Stay tuned for further updates on how Base and JPM Coin continue to reshape the future of institutional payments.

https://bitcoinethereumnews.com/tech/how-base-transforms-institutional-payments/

Bullish $115K Target Within Reach If This Key Metric Holds Strong

**Bitcoin Price Prediction: Bullish $115K Target Within Reach If This Key Metric Holds Strong**

The post Bullish $115K Target Withcom appeared first on Crypto News.

—

Bitcoin continues to capture the attention of investors and enthusiasts alike as it approaches a potentially significant milestone. Analysts are increasingly optimistic, setting a bullish target of $115,000 for the cryptocurrency.

This optimistic outlook hinges on the strength of a key metric that has historically signaled robust market momentum. If this metric maintains its current trajectory, the $115K target is well within reach, suggesting strong upward momentum in the coming months.

Stay tuned for more updates and in-depth analysis as the market evolves.

https://bitcoinethereumnews.com/tech/bullish-115k-target-within-reach-if-this-key-metric-holds-strong/

From Stable Trading To Wild Speculation

**Ethereum Market Shifts Dramatically: From Stable Trading to Wild Speculation**

The post *From Stable Trading To Wild Speculation* appeared on com.

—

### Ethereum Market Shifts Dramatically: From Stable Trading to Wild Speculation

The Ethereum market has experienced a significant transformation recently, moving away from a period of stable trading towards an era marked by wild speculation. This shift has captured the attention of investors and analysts alike, highlighting the dynamic and often unpredictable nature of the cryptocurrency landscape.

As market conditions evolve, traders are witnessing increased volatility, rapid price movements, and heightened trading volumes. These changes reflect broader trends in the crypto ecosystem, driven by factors such as technological developments, regulatory news, and shifting investor sentiment.

Stay tuned for more updates and in-depth analysis as the Ethereum market continues to evolve.

https://bitcoinethereumnews.com/tech/from-stable-trading-to-wild-speculation/

Amazing Pyramiding ZEC Longs Strategy Nets Trader $5.65 Million Unrealized Profit

**Amazing Pyramiding ZEC Longs Strategy Nets Trader $5.65 Million**

A trader has achieved an impressive $5.65 million in unrealized profits using an amazing pyramiding strategy with ZEC longs. This strategic approach has proven highly effective in maximizing gains by systematically increasing the position size as the trade moves in favor.

**Source:**

[Insert Source Here]

https://bitcoinethereumnews.com/tech/amazing-pyramiding-zec-longs-strategy-nets-trader-5-65-million-unrealized-profit/

Crypto Leaders React to Mamdani’s Win: Will New York’s Blockchain Adoption Come to a Halt?

**Crypto Leaders React to Mamdani’s Win: Will New York’s Blockchain Adoption Come to a Halt?**

The recent victory of Mamdani has sparked widespread discussion among cryptocurrency leaders and enthusiasts. Many are now questioning the future of blockchain adoption in New York, a state that has been at the forefront of embracing this transformative technology.

As the news unfolds, stakeholders are eager to understand the potential implications of this win on regulation, innovation, and the overall crypto ecosystem within the region. Will Mamdani’s leadership slow down the momentum New York has gained, or will it open the door for new opportunities?

Stay informed with the latest updates and expert insights by signing up for our newsletter. Enter your email below to receive exclusive offers and timely news directly in your inbox.

—

**Newsletter Sign-Up**

For updates and exclusive offers, enter your email here:

[Email Subscription Field]

—

*This website uses cookies to enhance your experience. By continuing to use this website, you consent to our use of cookies. For more details, please visit our [Privacy Center](#) or [Cookie Policy](#).*

HBAR Price Climbs as ETF Adds 380 Million Tokens Amid Renewed Demand

Despite short-term consolidation, analysts expect renewed strength in Hedera Hashgraph (HBAR) as ETF inflows and enterprise adoption continue to rise. Currently trading at around $0.17 and exhibiting bullish momentum, investors anticipate potential upside amid expanding network activity and growing market stability.

**Canary HBAR ETF Expands Holdings Above 380 Million Tokens**

New portfolio data released on November 5, 2025, reveals that the Canary ETF (HBR) has significantly increased its exposure to Hedera Hashgraph. The fund now holds over 380 million HBAR tokens. According to market data analyzed by ALLINCRYPTO, the total value of these holdings is approximately $66 million, based on the latest market prices.

This accumulation represents one of the largest institutional positions in Hedera to date, signaling growing investor confidence and participation in the token’s ecosystem. The near-complete allocation toward HBAR highlights the fund’s focused investment strategy on assets underpinned by enterprise adoption and blockchain utility.

With this expansion, Canary ETF has become a key institutional vehicle for gaining exposure to Hedera’s token economy, which continues to garner attention for its scalability and energy-efficient network design.

**Institutional Confidence Builds Around Hedera’s Growth Outlook**

The ETF’s increased holdings align with broader positive developments across the Hedera ecosystem. Over recent months, the token has benefited from a surge in tokenized asset projects, enterprise partnerships, and decentralized applications. These trends have driven stronger institutional engagement, positioning HBAR as a growing component of blockchain-based portfolios.

Canary ETF’s move also reflects rising interest in assets with practical, real-world use cases such as payments, supply chain tracking, and decentralized identity management. Market observers note that funds of this scale often enhance liquidity depth and improve overall market visibility for the underlying asset.

If HBAR maintains its current momentum or records further growth, the ETF’s valuation could approach the $70 million mark. This allocation trend mirrors a gradual institutional shift toward tokens associated with active network use and sustainable infrastructure — areas where Hedera has kept a strong, consistent focus.

**Analysts Anticipate Prolonged Consolidation Before Next Phase**

Analyst BOLUCEE_BLOCK offers a neutral forecast for HBAR’s price trend, suggesting the token may undergo a consolidation phase before its potential recovery. The projection indicates that HBAR could trade sideways through the remainder of 2025, with stabilization possibly extending into early 2026.

According to the analysis, this period of consolidation may reflect cooling momentum following months of accumulation and a lack of new large-scale catalysts. In a less favorable scenario, slower enterprise expansion or reduced adoption rates could keep the asset range-bound for an extended period.

Despite these conditions, the strong presence of institutional holdings is expected to provide underlying market support, helping maintain stability while the ecosystem awaits future adoption triggers.

**Altcoin Price Strengthens Above Key Support Zone**

At press time, Hedera was trading near $0.17, up approximately 4.77% in the past 24 hours. This price increase lifted its market capitalization above $7.3 billion, with a trading volume nearing $295 million, indicating renewed buyer interest.

Intraday data reflected a temporary surge to $0.176, followed by slight profit-taking that brought the price down to around $0.172. At this level, buying pressure has consistently absorbed selling activity, suggesting a strong support zone.

Sustaining prices above this key support could pave the way toward the $0.18 resistance level in the short term. Additionally, the steady rise in trading volume points to growing interest from traders, coinciding with increased institutional accumulation.

As long as demand remains strong, Hedera’s market may continue consolidating gains achieved during the recent ETF expansion phase, setting the stage for potential future growth.

https://bitcoinethereumnews.com/tech/hbar-price-climbs-as-etf-adds-380-million-tokens-amid-renewed-demand/

XRP Whale Sell-Off Signals Potential Downside Near $2.2 Support Zone

**XRP Whales Offload 900,000 Tokens in Five Days, Fueling Bearish Market Sentiment**

XRP whales have recently intensified selling pressure by offloading approximately 900,000 tokens over the past five days. This significant sell-off has coincided with weakening on-chain metrics and technical indicators, driving a bearish sentiment in the market and pushing prices toward critical support levels between $2.20 and $2.30.

At the same time, Open Interest has dropped 15.73% to $3.52 billion, signaling reduced leverage and heightened risk aversion among traders. Liquidation heatmaps reveal dense clusters at $2.20 and $2.30, highlighting key volatility triggers with over $100 million in potential liquidations.

—

### What Is Driving the Recent XRP Whale Selling Pressure?

Large investors, or whales, have become the dominant force behind the recent XRP sell-off, distributing around 900,000 tokens in just five days. This surge in selling activity reflects growing caution among market participants amid broader volatility.

The sell-off aligns with a 12% decrease in large holder accumulation over the past week, according to on-chain data from Santiment. Together with technical weaknesses, this selling pressure underscores a market environment marked by caution and increased short-term bearish risks.

—

### How Are Technical Indicators Reflecting XRP’s Current Market Position?

Technical analysis shows a clear bearish tilt in XRP’s price action:

– **Relative Strength Index (RSI):** Currently at 35.22, approaching oversold territory, suggesting the possibility of buying interest emerging soon.

– **Directional Movement Index (DMI):** The negative directional indicator (-DI) stands at 36.38, overpowering the positive directional indicator (+DI) of 13.13.

– **Average Directional Index (ADX):** At 39.19, confirming strong downward trend momentum.

Price action has formed lower highs and repeatedly faces rejection by a descending resistance trendline, limiting any upward breakout attempts. XRP is consolidating within the $2.20–$2.30 demand zone, a historically significant area known for accumulation and potential price rebounds.

—

### Open Interest and Derivatives Market Contraction

The derivatives market for XRP has seen a notable pullback, with Open Interest falling by 15.73% to $3.52 billion. This decline reflects a broad reduction in trader participation, typically associated with periods of uncertainty and risk aversion.

According to Coinglass data, such retrenchment in leverage often leads to more stable price movements but also points to diminished speculative enthusiasm. Glassnode analysts note that Open Interest drops of over 15% frequently precede consolidation phases lasting several weeks.

Despite the current slowdown in derivatives activity, XRP’s long-term outlook remains underpinned by ongoing ripple ecosystem advancements, including cross-border payment integrations. Traders should watch for rebounds in Open Interest as a potential signal of renewed market confidence and possible whale accumulation resuming.

—

### The Role of Liquidation Zones in XRP’s Price Volatility

Liquidation zones are pivotal in shaping XRP’s current price risks. Coinglass heatmaps highlight concentrated liquidation clusters around $2.30 and $2.20, where more than $100 million in leveraged positions could be liquidated.

These zones act as magnets for price action—breaching them can trigger cascading forced liquidations, potentially amplifying price swings. For example:

– A breakdown below $2.20 may initiate a chain reaction of sell-offs.

– Holding above $2.20 could prompt short-covering, leading to a relief rally.

Binance futures data supports this vulnerability, showing a 20% spike in 24-hour liquidation volumes in recent sessions.

CryptoQuant analysts emphasize the influence of such liquidity pockets on short-term price direction, advising leveraged traders to exercise caution. Recent price tests near the upper boundary of this range confirm the need for sustained trading volume to validate a bullish reversal.

—

### Frequently Asked Questions

**What factors are contributing to XRP whale selling pressure in 2025?**

XRP whale selling pressure is primarily driven by profit-taking following recent gains, coupled with macroeconomic uncertainties and ongoing regulatory developments surrounding Ripple’s legal challenges. Over five days, approximately 900,000 XRP tokens were distributed, increasing market supply and exerting downward price pressure. While this intensifies short-term bearish risks, it does not diminish XRP’s long-term utility in cross-border payments.

**Will XRP hold the $2.20 support level amid current volatility?**

The $2.20 support is a critical technical level for XRP, historically acting as a strong floor during corrections. Current technical readings—including an RSI near oversold and consolidation within a key demand zone—suggest bulls could defend this level if accompanied by an uptick in volume. However, failure to hold $2.20 may expose lower support zones around $2.00, emphasizing the need for traders to prepare for potential volatility.

—

### Key Takeaways

– **Whale Offloads Signal Caution:** The sell-off of 900,000 XRP tokens by large holders has increased bearish sentiment, pressing prices toward crucial support levels.

– **Open Interest Contraction:** A 15.73% drop to $3.52 billion reflects reduced leverage in the market, which may stabilize prices but limit short-term upside momentum.

– **Liquidation Zones at the Forefront:** Traders should focus on the $2.20–$2.30 range as key zones for price volatility and potential directional shifts.

—

### Conclusion

XRP’s current market environment is characterized by intensified whale selling pressure, declining Open Interest, and concentrated liquidation clusters, fostering cautious trading sentiment. Prices are testing a vital demand zone between $2.20 and $2.30, with bearish technicals dominating. However, oversold signals do provide some hope for a rebound if buyers mount strong defenses.

As the Ripple network continues to expand its real-world applications, investors should closely monitor on-chain metrics and technical signals. Staying informed and prepared can offer strategic advantages in navigating this evolving landscape.

https://bitcoinethereumnews.com/tech/xrp-whale-sell-off-signals-potential-downside-near-2-2-support-zone/