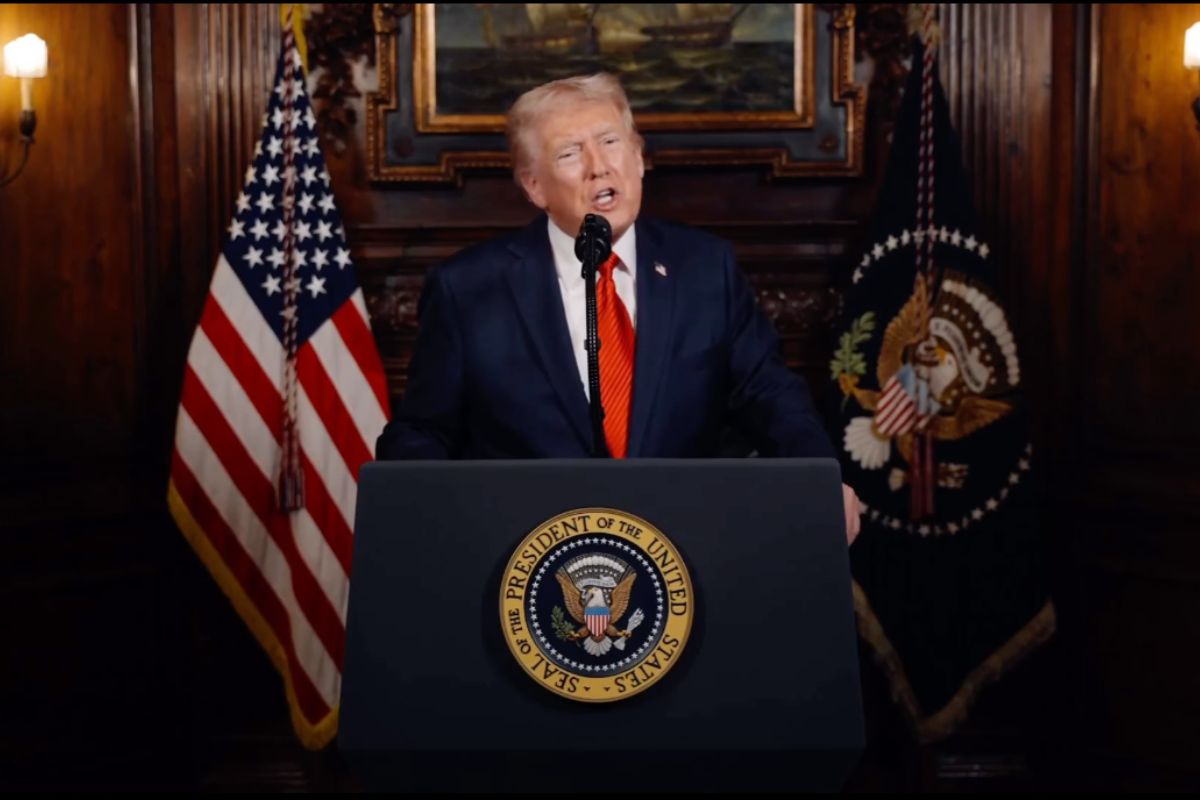

Saudi Arabia’s Crown Prince Mohammed bin Salman (MBS) arrived in Washington, DC, on 18 November 2025, for crucial discussions aimed at strengthening the Kingdom’s relationship with the United States. The most prominent statement from the White House was MBS’s pledge to invest up to $1 trillion in the US, signalling a significant shift in economic engagement. US President Donald Trump welcomed MBS, expressing his appreciation: ‘It’s an honour to be your friend, and it’s an honour that you’re here.’ In response, the Crown Prince indicated that Saudi Arabia was open to joining the Abraham Accords, the historic normalization agreements between Israel and Arab nations. While the Abraham Accords, signed in 2020, include Israel, Bahrain, the United Arab Emirates, and Morocco, MBS reiterated his desire to include the establishment of a Palestinian state in the framework. He emphasised the importance of a clear path towards a two-state solution, highlighting the Kingdom’s broader regional ambitions. The Run-up to the $1 Trillion Investment Earlier in 2025, Trump announced a strategic partnership with Saudi Arabia to foster economic prosperity, with MBS pledging an initial $600 billion investment across sectors such as security, defence, technology, and healthcare. During Tuesday’s talks, it became evident that the $1 trillion figure was more aspirational than definitive. MBS told President Trump that Saudi investments in the US could approach the $1 trillion mark. Trump expressed his support, stating he would work closely with the Crown Prince to help realise this goal. Key Agreements and Strategic Initiatives According to a White House press release, the leaders signed several agreements and memoranda of understanding (MOUs) to deepen cooperation: Civil Nuclear Energy Cooperation: The Joint Declaration on the Completion of Negotiations establishes the legal framework for a long-term, multi-billion-dollar nuclear partnership with Saudi Arabia. Critical Minerals Framework: This enhances collaboration to diversify supply chains and align strategic mineral development efforts. Artificial Intelligence (AI) MOU: The landmark AI agreement grants Saudi access to US technological systems while safeguarding US innovations from foreign influence, ensuring America’s leadership in AI development. In addition, a new US-Saudi Strategic Defence Agreement (SDA) was signed, strengthening the countries’ eight-decade defence partnership and bolstering regional deterrence. Trump indicated that more initiatives are on the horizon, with both sides planning to intensify engagement on trade issues. Focus areas include reducing non-tariff barriers, standard recognition, and creating a more favourable investment climate. Furthermore, the US Treasury Department and Saudi Ministry of Finance agreed to deepen cooperation on capital markets technology, standards, and regulations, aiming to strengthen their financial partnership. Human Rights and Diplomatic Considerations During the press conference, a journalist raised concerns about human rights, particularly the 2018 killing of journalist Jamal Khashoggi at the Saudi consulate in Turkey. Trump responded that Prince Mohammed ‘knew nothing about it,’ dismissing the question and saying, ‘And we can leave it at that. You don’t have to embarrass our guest by asking a question like that.’ Ambitious Economic Goals The pledge of up to $1 trillion emerged as the centrepiece of the Trump-MBS meeting. If realised, this level of Saudi investment could significantly expand US exports, reduce trade barriers, create jobs, and foster long-term economic growth. The move signals a strategic shift, with implications for bilateral relations and global markets. While details remain to be finalised, the pledge underscores the deepening economic ties between Saudi Arabia and the United States, with potential benefits for American industries and the broader economy.

https://www.ibtimes.co.uk/saudi-crown-prince-signals-potential-1-trillion-investment-us-key-takeaways-1756290

Author: admin

Who are the winners and losers in the final Pa. budget bargain?

By Zack Hoopes, pennlive. com After 19 weeks of a budget impasse that affected many areas of life among Pennsylvanians, the short-term political problems have been solved through a series of give-and-take compromises. The long-term political problems remain. The quick version of this year’s budget impasse is that Democrats offered to come down from Gov. Josh Shapiro’s original budget request, which featured $51. 5 billion in general fund spending, but were leery of going too far below the $50 billion mark and cutting into the bone of programs they’ve championed. Republicans were adamant that Shapiro’s budget framework ran an excessive deficit and would result in runaway spending, passing a flat-funded budget bill of $47 to $48 billion multiple times to make the point. In the final couple weeks, Republicans were suddenly willing to move their number upward. On Nov. 12, Shapiro signed a budget deal centered on $50. 1 billion in appropriations from the general fund, with most of the 4. 7% increase over last year’s budget going toward additional K-12 education subsidies and shoring up Medicaid. The spending allocations weren’t that different from the $50. 25 billion budget that House Democrats had offered in October, but lawmakers pointed to some concessions and compromises that created a tipping point. Most-often cited was axing the Regional Greenhouse Gas Initiative (RGGI), a cap-and-trade pollution control system long opposed by Republicans. The budget deal includes language striking regulations created under former Gov. Tom Wolf that set up Pennsylvania to join the program, but which were challenged by the GOP in a court case that will now be rendered moot. Many Democrats were surprised that Republicans had given them so much spending leeway in exchange for those items; many Republicans were surprised that Democrats would hand them a win on RGGI in order to get the spending they wanted. “I think part of it was [Republicans] agreeing to do more than $50 billion,” Senate Minority Leader Jay Costa, D-Allegheny County, said when asked what the breakthrough was. “They had been so mired in this $47. 9 billion, then $49. 9 billion, and we just said ‘it needs to start with a five’” in order to be workable. “The second willingness [from Republicans] was to do the earned income tax credit at 10%. Those were the two major things,” Costa said. The budget deal includes a new Working Pennsylvanians Tax Credit, a refundable credit that allows lower-income families to apply 10% of their federal earned income tax credit to their Pennsylvania taxes. Republicans made it clear multiple times that they were uncomfortable with the $50. 1 billion total spend, but had learned to live with it in exchange for booting RGGI and other conservative priorities. “Four months ago, we would not have had the policy that is going to create jobs, create economic growth,” Senate President Pro Tempore Kim Ward, R-Westmoreland County, said when asked why the final dollar figure couldn’t have been settled over the summer. “Any number was going to be high for fiscal hawks, and most of us legislative Republicans are, in fact, that,” said House Minority Leader Jesse Topper, R-Bedford County. “But we understand that in divided government, there has to be a compromise,” Topper said. “In our world, if you were going to increase spending, you had to have policy initiatives that could eventually support that spending,” and those policy initiatives required painstaking negotiation with Democrats. Below are some of those compromises cited by both sides of the aisle. Lost: Carbon cap-and-trade RGGI has long been championed by progressive Democrats concerned about climate change, at the same time it’s been villainized by conservative groups who back the natural gas industry. Letting go of RGGI was both difficult for Democrats, and also gave them a major bargaining chip. “I would say RGGI probably was the hardest piece of it” to sell to his fellow Democrats, Costa said. “But our members understood that the value of other items that were in the fiscal code outweighed the concern for repealing RGGI.” “I, in the past, have supported RGGI myself,” said House Majority Leader Matt Bradford, D-Montgomery County. “The simple reality is, when there is an opportunity to move Pennsylvania forward dramatically, like this budget presented, we would be foolish not to take it.” Many Democrats who voted in favor were clearly torn over the issue. “I still think RGGI would be a good idea for Pennsylvania, but I’m also realistic, and I’m willing to vote yes to end this impasse,” said Sen. Carolyn Comitta, D-Chester County. “If we need to put RGGI aside to move forward, let’s do that, but let’s remember that climate change is real, it’s here, and it’s beginning to impact nearly every aspect of our lives.” RGGI is an 11-state program that puts a cap on greenhouse gas emissions from power plants, with fossil fuel generators having to purchase credits to exceed the limits; those credits are then used to subsidize renewable energy and provide rebates to ratepayers. Republicans believed the program would be uniquely harmful to Pennsylvania, since the commonwealth is a net exporter of electricity largely fueled by natural gas. Sen. Wayne Langerholc, R-Cambria County, described abrogating RGGI as “one of the biggest policy wins in the past ten years” for conservatives. On the campaign trail in 2022, Shapiro had expressed hesitancy to move forward on joining RGGI without legislative buy-in, but kept fighting the lawsuit he inherited from Wolf. Shapiro also offered to pull out of the lawsuit if Republicans agreed to his alternative green energy plan. On Wednesday, the governor framed the agreement to drop RGGI as a way to get Republicans to the table, given that they had largely refused to negotiate on clean energy while the specter of RGGI was still in place. “For years, the Republicans who’ve led the Senate have used RGGI as an excuse to stall substantive conversations about energy production,” Shapiro said. “Today, that excuse is gone,” Shapiro continued, saying he looked forward to “aggressively” adding more clean energy to the grid. Won: Tax breaks for workers The creation of a refundable state earned income tax credit was a major factor in getting more Democrats on board. The maximum federal credit for a family with three children is now over $8,000, meaning that family would get $800 knocked off their Pennsylvania taxes, and get cash back from the state if their tax bill went negative as a result. “I think in Pittsburgh it’s around 90, 000 households, and as the governor said one million households across the commonwealth will be able to get a credit,” Costa said, giving every member of a legislature a significant home-town win. The appeal was bipartisan, with Sen. Lynda Schlegel Culver, R-Columbia County, describing the credit as “not a hand-out, it’s a hand up.” “These are the long-term investments that reduce pressures on social services and strengthen local economies,” she continued. The tax credit wasn’t in Shapiro’s initial budget pitch but has been tossed around by House Democrats for years, with Shapiro crediting Bradford and House Speaker Joanna McClinton, D-Philadelphia, for pushing its inclusion. Lost: The definition of ‘balanced’ In his remarks before signing the budget bills, Shapiro repeatedly referred to the budget as “balanced.” This is only true if one considers an existing cash surplus to be revenue. The $50. 1 billion spend will be offset by only about $47 billion in income this fiscal year, according to projections from the Independent Fiscal Office, meaning the state will likely have to balance the budget by using most of the existing surplus in the general fund, a one-time source of money. This operating deficit was the major concern for fiscal hawks, as Topper noted, and some hardline conservatives opposed the budget because of it. Sen. Dawn Keefer, R-York County, described the deal as “another round of unbridled spending without even a modicum of a policy win that would control this year-over-year break-neck-pace spending.” Won: The integrity of the ‘rainy day’ fund The new budget is not expected to require the state to dip into its “rainy day” reserve fund, currently $7. 4 billion, with several Republicans stressing that the deal while more than they want to spend ensures the reserve will stay untouched for another budget cycle. This point of fiscal restraint was a frequently rallying cry for the GOP during the impasse. “We held the line to keep our promise to the people of Pennsylvania by not raising their taxes and ensuring that our state savings account, also known as our rainy day fund, and the interest [it generates] were not affected,” Ward said, adding that doing so “was very, very important” to limit the possibility of tax hikes in the future. Won: Aid for school districts Along with the added cost to maintain Medicaid, boosting state aid to K-12 school districts was the biggest chunk of new spending. Basic education aid to supplement districts’ local property taxes went up $105 million to $8. 26 billion. More importantly, an extra $562 million was pumped into the budget line for the adequacy and equity formulas intended to make up for Pennsylvania’s unfair school funding system, as decided in the landmark court case. That allocation is now $1. 83 billion. Democrats have long signaled that they weren’t willing to come down much from Shapiro’s proposed numbers on education, which Republicans had criticized as being excessive and unnecessary given the declining student population in many districts. The fact that the final numbers were virtually the same as Shapiro had originally pitched was touted by Democrats as a major win. Lost: Federally-induced tax cuts The biggest single change to the state’s fiscal laws, by dollar value, is one that went virtually unmentioned. The budget package de-couples parts of Pennsylvania’s corporate tax code from that of the federal government, so the rules for things like expensing real estate purchases and amortizing research and development costs are no longer tied to federal law. Without this, the federal tax cut deal that passed in July dubbed the “One, Big, Beautiful Bill” by President Trump would’ve cost the state $1. 1 billion in revenue this fiscal year, according to calculations by Senate appropriations staff. On the flip side, the budget continues the scheduled decrease in Pennsylvania’s base corporate tax rate, bringing the rate down from 7. 99% to 7. 49% as of January 2026. Won: Permitting reform This was frequently cited by Republicans as a huge improvement to the state’s business environment. The new fiscal code puts strict timetables on the Department of Environmental Protection (DEP) to review permits, with applications being deemed approved if the timeline is not met. “We have, for the first time in my ten years in the legislature, real permit reform, said Sen. Greg Rothman, R-Cumberland County, reform that serves as “a message to the people who are willing to invest in this commonwealth” that they won’t be hampered by red tape. Shapiro also welcomed the permitting changes, characterizing them as an extension of some of the programs he has already started, such as putting a money-back guarantee in place for certain DEP permits. Won: Workforce development Many of the items Democrats championed were smaller budget lines that add up to something bigger, with many serving as both a social benefit and job training. Among these is a $25 million grant program to recruit and retain child care workers, and $21 million to raise the wages of care workers who are hired directly by Medicaid patients. The student-teacher stipend program was increased from $20 million to $30 million, and another $20 million each added to the Main Street Matters downtown development program and the minority-owned small business program. Won: Cyber reform The budget brokers a compromise on cybercharter schools albeit one that is still opposed by many cyber schools themselves. The first element of the reform deal focuses on oversight, with provisions requiring cybers to create and report attendance benchmarks to make sure students are actually doing their online lessons. Language on student wellness checks, as well as the requirement for cybers to communicate with students in real-time at least once per week, were also tightened. Some conservatives voted against the education code bill because of these items. The bill “would require parents of a quote-unquote ‘habitually truant’ child to go to court to obtain a judge’s order proving that the transferring of their child to a cyber charters school is in the best interest of the child,” said Rep. Charity Grimm Krupa, R-Fayette County, which she viewed as a violation of parental rights. Further, Shapiro and Democrats had supported putting a hard $8,000 limit on the tuition that school districts must remit to cyber charters for every student in the district who opts into the cyber program. What they ended up getting were major revisions to the existing formula that determines what each district pays, estimated to reduce districts’ cyber rates by an average of 14. 6%, which would’ve equated to $178 million last year. The new formula will go a long way, Shapiro said, in reducing excessive cyber payments that are draining school districts’ coffers. Won: Educational Improvement Tax Credits These credits are claimed by businesses who donate to school scholarship funds, and have been championed by Republicans as a way to support private schools taking on children from struggling districts. Democrats are generally more skeptical, viewing the credits as a subsidy to private and religious schools that could be used to fix public ones. Expanding the credits has long been used as a sweetener to get the GOP to agree to higher public education spending, and this budget was no different, raising the value of EITC from $540 million to $590 million. Won/Lost: Entitlement reform (depending on who you ask) The budget bills beef up laws around public benefits, including more stringent rules for checking the income of Medicaid and Supplemental Nutrition Assistance Program (SNAP) recipients and requiring the state Department of Human Services (DHS) to issue reports about recipients who also report lottery winnings and valuable automobiles. DHS is also required to begin studying how to reduce Medicaid transportation costs by using a third-party broker. Republican leaders called it a major step in cracking down on waste and fraud. “We have brought accountability to our public assistance programs through meaningful, comprehensive reforms to our Medicaid program,” said Senate Majority Leader Joe Pittman, R-Indiana County, Some Democrats were ambivalent toward the changes, given that they don’t make actual cuts to public assistance programs; some conservatives criticized the reforms as only token changes. Lost: New revenue sources When Shapiro rolled out his budget proposal, he included a number of new revenue-generators that would help to solve the deficit problem over time. These included legalizing recreational marijuana, reforming corporate taxes and regulating “skill games” that have skirted the state’s slot machine laws. Agreements failed to materialize, with Shapiro and Democrats blaming it on dissent within the Senate GOP, whose leaders have acknowledged their members have a vast diversity of views on those issues. Even through the end-game of the impasse, legislative leaders were still trying to come up with new recurring revenues. A proposal to add skill games revenue to the general fund, and use an increased tax on online gaming and sports betting to increase transit subsidies, was on the table for a while, according to those with knowledge of the talks. The deal fell apart a few days before the budget was finally passed. With the budget held up for months by the fundamental disagreement over the deficit, it begs the question of whether lawmakers are setting themselves up for the same problem next year. If significant economic growth isn’t realized, the state will find itself with less of a cash cushion and more need for new spending, necessitating cuts, even greater new revenues, or the use of the ‘rainy day’ fund. Asked if he planned to pitch new revenues in the next budget to avoid dipping into the fund, Shapiro joked “I’m signing this year’s budget, how about you give me a minute?” The governor, by law, must present his budget proposal to the legislature by the first week in February, giving Shapiro another 12 weeks to figure it out.

https://www.delcotimes.com/2025/11/19/with-pa-state-budget-signed-who-are-the-winners-and-losers-in-the-final-bargain/

Atos annonce la disponibilité d’Autonomous Data & AI Engineer, une solution d’IA agentique sur Microsoft Azure, optimisée par la plateforme Atos Polaris AI

Les solutions d’IA agentique seront en démonstration sur le stand d’Atos lors du salon Microsoft Ignite, qui se tiendra à San Francisco du 18 au 21 novembre Paris, France 18 novembre 2025 Atos, un leader mondial de la transformation digitale accélérée par l’IA et partenaire Microsoft Frontier pour les technologies d’IA, annonce aujourd’hui la disponibilité d’une solution d’IA agentique, Autonomous Data and AI Engineer, conçue pour augmenter les capacités et la vitesse des équipes d’ingénierie des données et de l’IA. Cette solution s’appuie sur la plateforme Atos Polaris AI lancée plus tôt cette année et aujourd’hui intégrée aux fonctionnalités avancées du cloud et de l’IA d’Azure, permettant l’implémentation de systèmes complets d’agents d’IA travaillant de manière autonome pour orchestrer des flux de travail complexes. Fondée sur les principes d’IA responsable de Microsoft, cette solution agentique est conçue pour gérer et automatiser des tâches d’ingénierie IA basées sur des données complexes nécessitant plusieurs étapes de traitement dans le cadre de processus métiers applicables à tout secteur. Elles est actuellement disponible pour Azure Databricks et Snowflake sur Azure, deux plateformes de données cloud de premier plan disponibles sur Microsoft Azure. Autonomous Data and AI Engineer peut intégrer, traiter et interagir de manière autonome avec des données structurées et non structurées. Après avoir chargé des fichiers à partir de plateformes de données externes, les agents appliquent des règles de qualité et de transformation des données afin de créer des visualisations de données servant de base à la prise de décision humaine. Une fois que les tâches typiques d’ingénierie des données sont exécutées avec succès, les spécialistes peuvent utiliser des agents IA et de visualisation supplémentaires pour interroger facilement les données et obtenir des informations exploitables. Les experts métiers techniques et non techniques peuvent utiliser le Atos Polaris AI Agent Studio no-code intégré pour associer et orchestrer plusieurs agents, les connecter à des LLMs (grands modèles de langage), à divers outils et autres agents à l’aide de normes ouvertes telles que les protocoles MCP (Model Context Protocol) et A2A (Agent-to-Agent). La solution d’IA agentique d’Atos réduit les efforts manuels, et accélère le développement et le déploiement des opérations de données d’environ 60 %. Elle accélère la mise sur le marché en réduisant la dépendance vis-à-vis des équipes centrales d’experts dans la génération d’informations à partir de nouvelles sources de données. La solution réduit également les coûts opérationnels jusqu’à 35 % en s’appuyant sur des agents DataOps qui permettent de réduire le temps moyen de traitement des tickets. Les entreprises peuvent donc s’adapter rapidement à l’évolution des sources de données, aux priorités changeantes et aux exigences de conformité, tout en libérant des capacités de R&D et d’innovation. Notre nouvelle solution agentique permet d’adopter le paradigme des « Service-as-Software » en exploitant l’IA pour gérer des tâches complexes à étapes multiples d’ingénierie de données », a déclaré Narendra Naidu, responsable mondial des données et de l’IA chez Atos. Depuis plus de 20 ans, Atos et Microsoft collaborent pour offrir des services cloud flexibles qui optimisent les ressources, rationalisent les processus et prennent en charge les centres de données mondiaux. Avec l’introduction de la plateforme Atos Polaris AI sur Microsoft Azure, les deux entreprises fournissent une fois encore des solutions de bout en bout à leurs clients pour les appuyer dans leur parcours de transformation numérique. La plateforme d’IA d’Atos Polaris sera en démonstration lors du salon Microsoft Ignite, qui se tiendra au Moscone Center, à San Francisco, du 18 au 21 novembre. Découvrez l’engagement d’Atos pour l’innovation et la croissance grâce aux données et à l’IA, la plateforme Atos Polaris AI, ainsi que nos solutions d’IA et de cloud de bout en bout et bien plus encore sur notre stand numéro 4335. *** À propos d’Atos Group Atos Group est un leader international de la transformation digitale avec près de 67 000 collaborateurs et un chiffre d’affaires annuel de près de 10 milliards d’euros. Présent commercialement dans 61 pays, il exerce ses activités sous deux marques : Atos pour les services et Eviden pour les produits. Numéro un européen de la cybersécurité, du cloud et des supercalculateurs, Atos Group s’engage pour un avenir sécurisé et décarboné. Il propose des solutions sur mesure et intégrées, accélérées par l’IA, pour tous les secteurs d’activité. Atos Group est la marque sous laquelle Atos SE (Societas Europaea) exerce ses activités. Atos SE est cotée sur Euronext Paris. La raison d’être d’Atos Group est de contribuer à façonner l’espace informationnel. Avec ses compétences et ses services, le Groupe supporte le développement de la connaissance, de l’éducation et de la recherche dans une approche pluriculturelle et contribue au développement de l’excellence scientifique et technologique. Partout dans le monde, le Groupe permet à ses clients et à ses collaborateurs, et plus généralement au plus grand nombre, de vivre, travailler et progresser durablement et en toute confiance dans l’espace informationnel. Contact presse : Laurent Massicot laurent. massicot@atos. net Pièce jointe CP Global Atos annonce la disponibilité d’Autonomous Data & AI Engineer, une solution d’IA agentique sur Microsoft Azure.

https://www.globenewswire.com/news-release/2025/11/19/3190623/0/fr/Atos-annonce-la-disponibilit%C3%A9-d-Autonomous-Data-AI-Engineer-une-solution-d-IA-agentique-sur-Microsoft-Azure-optimis%C3%A9e-par-la-plateforme-Atos-Polaris-AI.html

Canaan Inc. Surpasses Revenue Expectations in Q3 2025

Canaan Inc. a new quarterly record and a 37. 7% increase year-over-year. This achievement was fueled by strong demand in Asia and a strategic rebound in North America. Additionally, Canaan’s cryptocurrency treasury expanded to 1, 581. 9 BTC and 2, 830 ETH by the end of Q3 2025. Operational Highlights Nangeng Zhang, Canaan’s Chairman and CEO, noted the company’s strategic advancements, including the introduction of the next-generation air-cooled A16XP model, offering 300 TH/s with energy efficiency of 12. 8 J/TH. Canaan also launched pilot initiatives exploring the synergy between bitcoin mining and energy management, such as grid balancing and stranded natural gas utilization. Financial Metrics Gross profit surged to $16. 6 million from a gross loss of $21. 5 million in the same period last year. The company also reported a net loss of $27. 7 million, a significant improvement from the $75. 6 million loss in Q3 2024. The cash position strengthened to $119. 2 million by the end of the quarter, supported by record-high crypto treasuries. Business Developments Recent developments include a landmark U. S. order for over 50, 000 Avalon® A15 Pro mining machines and the launch of a gas-to-computing pilot project in Canada. Canaan also regained compliance with Nasdaq’s minimum bid-price requirement and completed a $72 million strategic investment from institutional investors. Future Outlook Looking ahead, Canaan anticipates total revenues for Q4 2025 to range between $175 million and $205 million, reflecting ongoing market conditions and customer dynamics. The company remains committed to monitoring global policy environments and market developments to adjust its business strategies accordingly. Image source: Shutterstock.

https://Blockchain.News/news/canaan-inc-surpasses-revenue-expectations-q3-2025

Bybit Opens ‘Vault of Legends’ With 500,000 USDT in Exclusive VIP Rewards

Dubai, UAE, November 18th, 2025, Chainwire Bybit, the world’s second-largest cryptocurrency exchange by trading volume, is thrilled to announce its final and most prestigious event of the year, the Vault of Legends, offering 500, 000 USDT in rewards for elite traders. The event, which runs from Nov. 18, 2025, at 10 a. m. UTC to Dec. 26, 2025, at 10 a. m. UTC, invites top-performing users to earn and redeem points for premium rewards through Bybit’s VIP program. Points can be redeemed until Dec. 31, 2025, at 11: 59 p. m. UTC. Paths to Prestige Participants can choose between two trading paths, each designed to reflect distinct trading styles. The Path of Precision caters to strategic spot traders who prioritize consistency and measured decision-making, while the Path of Momentum rewards derivatives traders who thrive on volatility and quick execution. Each trade contributes to a participant’s point total, allowing users to progress toward the event’s exclusive rewards. Legendary Rewards The Vault of Legends contains four categories of rewards curated specifically for VIP participants: Solid Gold (USDT Airdrops) Symbolizing stability and consistent performance. Everbright Crystal (MNT Airdrops) Representing shared growth within the Bybit ecosystem. Rare Relic (Bybit Mystery Boxes) Collectible items available only to exceptional traders. Golden Compass (Nansen Pro Subscriptions) Advanced analytical tools designed to enhance trading decisions. Each reward highlights an aspect of trading excellence, from reliability and insight to rarity and growth potential. Traders accumulate points through market activity and can redeem them directly within the vault. Points may also be used for Vault Scratch Cards, offering additional opportunities to win during the event period. The more consistent a trader’s engagement, the greater their share of the 500, 000 USDT prize pool. The Vault of Legends marks Bybit’s closing chapter of 2025’s VIP campaigns, underscoring its focus on rewarding consistent performance, trading expertise, and commitment within its global VIP community. Disclaimer: Participation is limited to verified individual and business accounts outside restricted regions, including the European Economic Area. Subaccounts, market makers, institutional users, and Pro users are ineligible. Trading activity generated by bots or 0-fee structures will not contribute to event volume. #Bybit / #CryptoArk / #IMakeIt About Bybit Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 70 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open, and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit. com. For more details about Bybit, please visit Bybit Press For media inquiries, please contact: [email protected] For updates, please follow: Bybit’s Communities and Social Media Contact Head of PR Tony Au Bybit [email protected] Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

https://bitcoinethereumnews.com/tech/bybit-opens-vault-of-legends-with-500000-usdt-in-exclusive-vip-rewards/

ADA Price Prediction: Cardano Eyes $0.70 Recovery Despite Oversold Bounce Setup

Cardano (ADA) finds itself at a critical juncture as technical indicators flash oversold signals while the cryptocurrency trades near multi-month lows. With RSI hitting 29. 64 and ADA testing its 52-week low of $0. 47, our comprehensive ADA price prediction analysis reveals a mixed but cautiously optimistic outlook for the coming weeks. ADA Price Prediction Summary • ADA short-term target (1 week): $0. 52 (+10. 6%) bounce from oversold conditions • Cardano medium-term forecast (1 month): $0. 65-$0. 70 range (+38-49%) • Key level to break for bullish continuation: $0. 824 (analyst consensus breakout level) • Critical support if bearish: $0. 46 (immediate) and $0. 27 (major support) Recent Cardano Price Predictions from Analysts The latest analyst predictions for ADA paint a cautiously optimistic picture despite current bearish momentum. InvestingHaven presents the most bullish ADA price prediction with targets ranging from $0. 66 to $1. 88 long-term, contingent on breaking the crucial $0. 824 resistance level. This Cardano forecast aligns with a potential W-reversal pattern formation. Short-term predictions show more conservative expectations, with CoinCodex projecting stability around $0. 51 while their medium-term outlook suggests a 33% increase to $0. 68. The Price Forecast Bot’s technical analysis points to $0. 69 as a realistic ADA price target within the next month. Notably, Journee-Mondiale stands out with an ambitious $1. 00 price prediction citing Q4 seasonal strength, whale accumulation patterns, and potential ETF approval catalysts. However, Changelly’s bearish assessment warns of continued weakness based on declining moving averages. ADA Technical Analysis: Setting Up for Oversold Bounce Current Cardano technical analysis reveals ADA in deeply oversold territory with RSI at 29. 64, traditionally signaling potential bounce conditions. The MACD histogram at -0. 0045 confirms bearish momentum, but the severity suggests exhaustion selling may be near completion. ADA’s position at 0. 07 within the Bollinger Bands indicates the price is hugging the lower band at $0. 46, often a precursor to mean reversion toward the middle band at $0. 55. The 24-hour trading range of $0. 46-$0. 50 shows sellers struggling to push below the psychological support level. Volume analysis from Binance spot market shows $121. 9 million in 24-hour turnover, suggesting institutional interest remains despite the -4. 78% daily decline. The Average True Range of $0. 04 indicates moderate volatility, providing opportunities for swing traders. Cardano Price Targets: Bull and Bear Scenarios Bullish Case for ADA Our bullish ADA price prediction centers on a recovery to $0. 65-$0. 70 within 30 days. This scenario requires ADA to first reclaim the immediate resistance at $0. 52 (EMA 12), followed by a push toward $0. 55 (SMA 20 and Bollinger Band middle). The critical ADA price target for sustained bullish momentum lies at $0. 824, as identified by multiple analysts. Breaking this level could trigger the W-reversal pattern, potentially targeting the $1. 00 psychological level supported by Q4 seasonal trends and whale accumulation. Technical confirmation would come from RSI moving above 50 and MACD turning positive, with volume expansion above $150 million daily average supporting the breakout. Bearish Risk for Cardano The bearish scenario for our Cardano forecast involves a breakdown below the immediate support at $0. 46. This would expose ADA to a test of the major support zone at $0. 27, representing a potential 43% decline from current levels. Warning signs include sustained trading below the 200-day SMA at $0. 73 and failure to generate a meaningful bounce from oversold conditions. A break below $0. 45 would invalidate the near-term bullish thesis and suggest further distribution. Should You Buy ADA Now? Entry Strategy Based on our Cardano technical analysis, a layered approach offers the best risk-reward setup. Consider initial positions at current levels ($0. 47) with stop-loss at $0. 44, targeting the first resistance at $0. 52. For conservative investors, wait for confirmation above $0. 52 before entering, with targets at $0. 65. Aggressive traders might consider the oversold bounce play but should limit position size to 2-3% of portfolio given the bearish momentum. The buy or sell ADA decision ultimately depends on time horizon short-term traders can capitalize on oversold conditions, while long-term investors should wait for confirmation above $0. 55 to ensure trend reversal. ADA Price Prediction Conclusion Our comprehensive ADA price prediction suggests a cautiously optimistic outlook with medium confidence. The combination of oversold technical conditions and analyst consensus around $0. 65-$0. 70 targets supports a recovery scenario within 30 days. Key indicators to monitor for confirmation include RSI breaking above 35, MACD histogram turning positive, and volume expansion above $150 million. For invalidation, watch for breaks below $0. 45 which would signal continued bearish pressure. The timeline for this Cardano forecast extends through December 2025, with the critical $0. 824 breakout level determining whether ADA can achieve the more ambitious $1. 00 targets suggested by bullish analysts.

https://bitcoinethereumnews.com/tech/ada-price-prediction-cardano-eyes-0-70-recovery-despite-oversold-bounce-setup/

Northern Arizona secures 108-79 victory against Embry-Riddle (AZ)

FLAGSTAFF, Ariz. (AP) Isaiah Shaw had 20 points in Northern Arizona’s 108-79 victory against Embry-Riddle (AZ) on Tuesday. Shaw shot 5 for 7 (4 for 5 from 3-point range) and 6 of 7 from the free-throw line for the Lumberjacks (2-2). Traivar Jackson added 16 points while shooting 6 of 7 from the field and 4 for 6 from the line, and also grabbed eight rebounds. Karl Markus Poom had 16 points and shot 5 for 8 (3 for 6 from 3-point range) and 3 of 5 from the free-throw line. Jacey Canalin led the way for the Eagles with 16 points and two steals. Christian Wells added 11 points for Embry-Riddle (AZ), and Noah Gifft added nine points. ___ The Associated Press created this story using technology provided by Data Skrive and data from Sportradar. By The Associated Press.

https://mymotherlode.com/sports/college-sports-game-stories/10203834/northern-arizona-secures-108-79-victory-against-embry-riddle-az.html

XRP Price Prediction: $2.70 Target Within 30 Days as Technical Oversold Conditions Emerge

XRP Price Prediction Summary • XRP short-term target and signal line (-0. 0733) suggests momentum deceleration. This technical divergence often precedes trend reversals, particularly when combined with oversold RSI conditions. Volume analysis from Binance spot trading shows $552. 2 million in 24-hour activity, indicating sustained institutional interest despite the -3. 37% daily decline. The Stochastic oscillator readings (%K: 17. 63, %D: 21. 79) confirm oversold conditions, with both indicators well below the 20 threshold that typically marks extreme selling pressure. Ripple Price Targets: Bull and Bear Scenarios Bullish Case for XRP The primary XRP price target for the bullish scenario centers on the $2. 70-$3. 15 range, supported by multiple technical confluences. Breaking above the immediate resistance at $2. 59 would trigger the first leg of this move, targeting the upper Bollinger Band at $2. 57 initially. The 50-day SMA at $2. 51 represents the first major resistance hurdle, followed by the 20-day SMA at $2. 33. Successfully reclaiming these moving averages would confirm the bullish Ripple forecast and open the path toward the strong resistance zone at $3. 10. Technical requirements for this scenario include RSI climbing above 50, MACD histogram turning positive, and volume confirmation above the recent average. The Daily ATR of $0. 16 suggests that moves of $0. 30-$0. 50 are well within normal volatility parameters, making the $2. 70 target achievable within the 30-day timeframe. Bearish Risk for Ripple The bearish scenario activates if XRP fails to hold the immediate support at $2. 07. This level coincides with the lower Bollinger Band at $2. 10, creating a critical support cluster. A decisive break below this zone would target the strong support at $1. 25, representing a potential 43% decline from current levels. Risk factors include continued regulatory uncertainty, broader crypto market weakness, and failure to generate sufficient buying volume above the 20-day moving average. The bearish XRP price prediction scenario would see RSI dropping below 30 into deeply oversold territory and MACD histogram extending negative momentum. Should You Buy XRP Now? Entry Strategy Based on current Ripple technical analysis, the answer to “buy or sell XRP” depends on risk tolerance and timeframe. For aggressive traders, the current level near $2. 19 offers an attractive risk-reward setup with tight stop-loss placement below $2. 07. Conservative investors should wait for confirmation above $2. 40 (pivot point) before entering positions. This approach sacrifices some upside potential but reduces the risk of catching a falling knife. The ideal entry strategy involves scaling into positions between $2. 15-$2. 25 with stop-losses below $2. 00. Position sizing should account for the 14-day ATR of $0. 16, suggesting maximum position risk of 2-3% of portfolio value given the volatility profile. Target allocation should not exceed 5% of total cryptocurrency holdings until the XRP price target of $2. 70 is achieved. XRP Price Prediction Conclusion Our XRP price prediction maintains a medium confidence level for the $2. 70-$3. 15 target within 30 days, contingent on breaking above $2. 40 resistance. The technical setup favors oversold bounces, but broader market conditions and regulatory developments remain key variables. The Ripple forecast hinges on three critical indicators: RSI recovery above 45, MACD histogram turning positive, and sustained volume above 500 million daily. Failure to achieve these technical milestones within 7-10 days would invalidate the bullish scenario and suggest extended consolidation or downside risk toward $1. 25 support. Timeline expectations center on initial movement within 5-7 days, with the primary XRP price target achievable by mid-December 2025 if technical conditions align with regulatory clarity catalysts.

https://bitcoinethereumnews.com/tech/xrp-price-prediction-2-70-target-within-30-days-as-technical-oversold-conditions-emerge/

Saif Ali Khan makes major real estate move; buys commercial offices worth Rs. 30.75 Crore in Mumbai

Bollywood actor Saif Ali Khan has added yet another prime asset to his real estate portfolio, this time in Mumbai’s thriving commercial district of Andheri East. According to property registration documents, the actor has purchased two office units in the Kanakia Wallstreet building for a total consideration of Rs. 30. 75 crore. Saif Ali Khan makes major real estate move; buys commercial offices worth Rs. 30. 75 Crore in Mumbai The combined area of the newly acquired offices measures 5, 681 sq ft and includes six dedicated parking spaces. The seller of the property is Apiore Pharmaceutical, a US-based pharma company, as reflected in the registration filings. The deal was arranged by Volney, a real estate advisory and investor network firm. The transaction was officially registered on November 18, 2025, with a stamp duty of Rs. 1. 84 crore and a registration fee of Rs. 60, 000. Industry experts note that Andheri East has rapidly emerged as one of Mumbai’s busiest commercial corridors, attracting corporates, global enterprises, and creative firms due to its improved connectivity and infrastructure. Volney’s founder, Rohan Sheth, described the area as a market that combines accessibility with strong rental prospects, adding that it continues to draw long-term investors. Saif’s new commercial investment also places him among several high-profile names who have recently secured space in the vicinity. Elon Musk’s satellite internet company, Starlink Satellite Communications Private Limited, recently leased a 1, 294 sq. ft. office in the nearby Chandivali area for a five-year period, with total rent valued at Rs. 2. 33 crore. Additionally, the same building previously housed leased offices where Hrithik Roshan and Rakesh Roshan acquired three commercial units earlier this year for about Rs. 31 crores through HRX Digitech LLP. Beyond his latest acquisition, Saif Ali Khan is already known for his premium residential and commercial holdings across Mumbai. He currently resides in a high-end apartment in Bandra West, a property he purchased nearly a decade ago for Rs. 24 crores. Records also show that he bought a sprawling 6, 500 sq. ft. apartment in April 2012 for Rs. 23. 50 crore from Satguru Builders, further cementing his presence in the city’s luxury real estate landscape. With his latest investment, the actor continues to strengthen his position not just in cinema but also in Mumbai’s top-tier property market. Also Read: Dining with the Kapoors Trailer: Netflix brings together Bollywood’s first family for a grand tribute to Raj Kapoor BOLLYWOOD NEWS LIVE UPDATES.

https://www.bollywoodhungama.com/news/bollywood/saif-ali-khan-makes-major-real-estate-move-buys-commercial-offices-worth-rs-30-75-crore-mumbai/

Breaking: John Day city council votes to increase water and sewer rates

2026 rate increase is the second of five proposed rate increases JOHN DAY The John Day city council at its Nov. 18 meeting voted unanimously in increase water and sewer service fees. The increased rates will take effect in the first billing in January 2026. More to come.

https://bluemountaineagle.com/2025/11/18/breaking-john-day-city-council-votes-to-increase-water-sewer-rates/